Gold has long been the go-to safe haven during economic turmoil—but with rising interest in Bitcoin, booming stock markets, and shifting global power dynamics, is gold losing its shine?

For more than a century, gold has stood the test of time as the best hedge against inflation, economic uncertainty, and currency collapse. Over the last 10 years, however, new and more lucrative assets like Bitcoin and stocks like Tesla have stolen its spotlight.

In light of these, investors are questioning gold’s appeal as an investment of the future. To understand whether Gold is still worth buying today, we need to look at its past and expected future price action.

What Gold’s Past Says About its Future Price Action

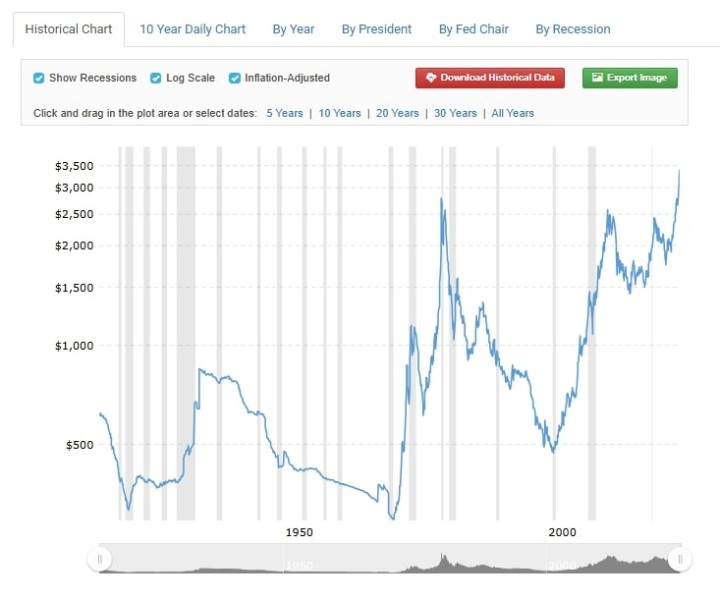

Gold’s greatest feature has been its resilience. Over last century, the yellow metal has survived some of the most devastating news – from world wars to global recessions.

It also survived a period of extended economic boom when stock markets and interest rates soared to new heights. These include during the shift to Brenton woods system in 1970 and during the stock market boom in 2000.

The proven resilience has most analysts convinced that gold will continue surviving even the highest interest rates.

What Makes Gold a Good Long Term Investment

Several factors make it one of the best long-term investments. For starters, the barrage of prevailing macro factors support a bullish uptrend for gold prices.

These include the heightened geopolitical conflicts in Europe between Russia and Ukraine, Israel-Ukraine in the Middle East, and the emerging India-Pakistan skirmishes in Asia.

Not forgetting the aggressive tariff policy adopted by the Trump administration, which threatens to thrust the US and, by extension, the global economy into a hyperinflation and recession.

All these are bullish catalysts that support a continued uptrend of gold prices into the foreseeable future.

It is also worth noting that even though Bitcoin is more lucrative to gold, it is unpredictably volatile. This explains why major emerging economies, especially the one affiliated with BRICS have resorted to amassing gold in place of Bitcoin in their de-dollarization plan.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- A Divergence In The Precious Metals Universe (May 10)

- Gold Retracing, Silver and Miners at a Critical Level (May 4)

- The Precious Metals Charts That Bring Clarity Through Noise (April 27)

- Highly Unusual Readings In Gold & Silver Markets (April 20)

- Gold Miners Breaking Out, Here Are A Few Gold Stock Tips. What About Silver & Miners? (April 13)