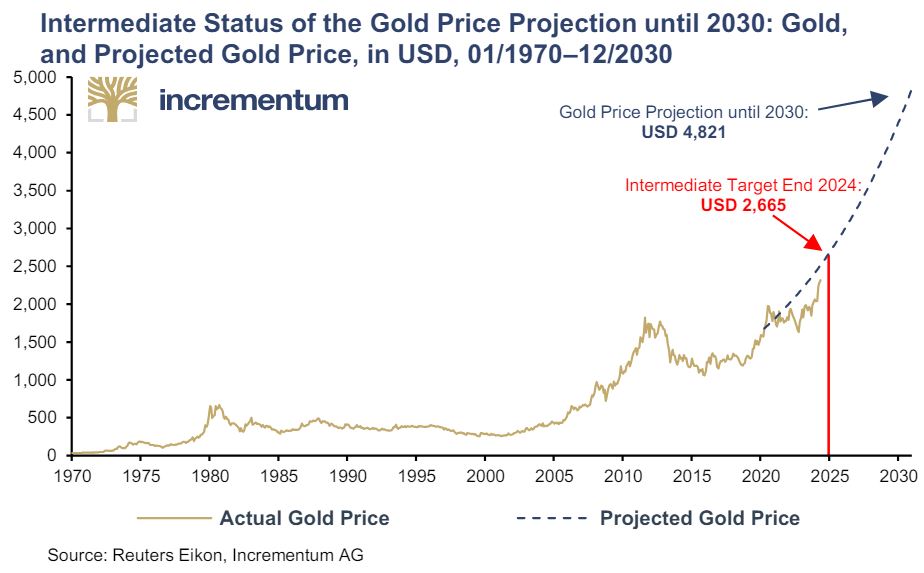

In the latest edition of his study, released on May 17th, 2024, Stoeferle re-iterates his method and data used to derive his gold price target of $4,821 for 2030.

RELATED – In Gold We Trust 2024

Ronald Stoeferle is the lead analyst of the respected In Gold We Trust, the most comprehensive and detailed gold market study available on the market.

Long term gold price target of $4,821 an Ounce

He sticks to his gold price forecast of USD $4,821 by the end of 2030, which he initially introduced in 2020.

Achieving this price target requires an annualized return of just under 12%. By way of comparison, the return in the 2000s was over 14% p.a., compared with around 27% p.a. in the 1970s.

He continues:

Loyal readers will remember our gold price forecast model that we published in the In Gold We Trust report 2020. At that time, we calculated a price target of just above USD 4,800 by the end of 2030, using the gold coverage ratio as a key input factor.

This is the chart that appeared on page 410 of In Gold We Trust 2024:

Fundamental drivers of Stoeferle’s gold target

The gold study looks at the fundamental shifts that are playing out, in recent years, in the gold market. That’s why the key theme of this year’s edition of In Gold We Trust is the new playbook in the gold market. The chessboard on the cover of the study visualizes the concept of the new dynamics, the new playbook, dominating the gold market.

In particular, the Federal Reserve’s rigorous interest rate hikes and the temporary slowdown in inflation have kept the rise in the gold price in check over the past two years. The recent surge in the gold price is probably a harbinger of the imminent turnaround in interest rates and possibly also of an increasingly stagflationary environment in the US. We feel that the recent price action confirms our price target, and we continue to adhere to the target of around USD 4,800 for 2030 that we postulated at the beginning of the decade.

The gold price target of $4,821 is based on dynamics that are dominating the current landscape of markets (including decisions and policies of market participants like policy makers).

Is the $4,821 gold target too bold?

Stoeferle asks the question whether his gold target is too too bold. Some critics may argue that a rise of 100% in the gold price, over 6 years, is not realistic.

We would like to put the return derived from this target into historical perspective. Based on a current gold price of USD 2,300, this would mean a price increase of just under 12% p.a. by the end of the decade. By comparison, the gold price rose by over 14% p.a. in the 2000s and over 27% p.a. in the 1970s.

So, the conclusion is that a compounded rise of roughly 12% per year, over a period of 6 to 7 years, is not ambitious at all. It might even be conservative, considering historical benchmarks.

We strongly recommend to follow the work of Ronald Stoeferle, a superb gold analyst:

- X – Ronald Stoeferle

- Linkedin – Incrementum

- Website – In Gold We Trust

Quotes and charts in this article: courtesy of In Gold We Trust 2024.