In Gold We Trust 2024 explains the paradigm shift in the gold market. “The New Gold Playbook” highlights structural changes in the gold market.

DOWNLOAD – the 2024 edition (pdf) of “In Gold We Trust” report >>

This year has been remarkable for gold, with prices soaring to new all-time highs in almost every currency. The title of this year’s report is “The New Gold Playbook,” which highlights significant changes in the gold market and offers strategic advice for prudent investors aiming to protect and grow their wealth in the years to come.

Gold – Reflecting on the Past Year

Before diving into the highlights of this year’s report, we extend our heartfelt thanks to our dedicated team and premium partners. Over the last 18 years, our report has grown to be the most comprehensive and widely recognized analysis of the gold market. This year’s report is the result of more than 20,000 hours of work by a team of 20 people across four continents.

Gold in 2024 & beyond – The New Gold Playbook

In last year’s report titled “Showdown,” we discussed the intense confrontations in monetary policy, geopolitical tensions between the East and the West, and dynamics within the gold market. This year, we focus on the permanent impact of structural changes that have reshaped not only the gold market but also the financial system and geopolitical landscape.

The cover of this year’s report features a chessboard, symbolizing strategic shifts. Just as a significant rule change in chess transformed the queen into the most powerful piece, recent global shifts necessitate a new gold playbook for investors.

Video introduction of In Gold We Trust by gold analyst Ronald Stoeferle:

Key Points of the New Gold Playbook

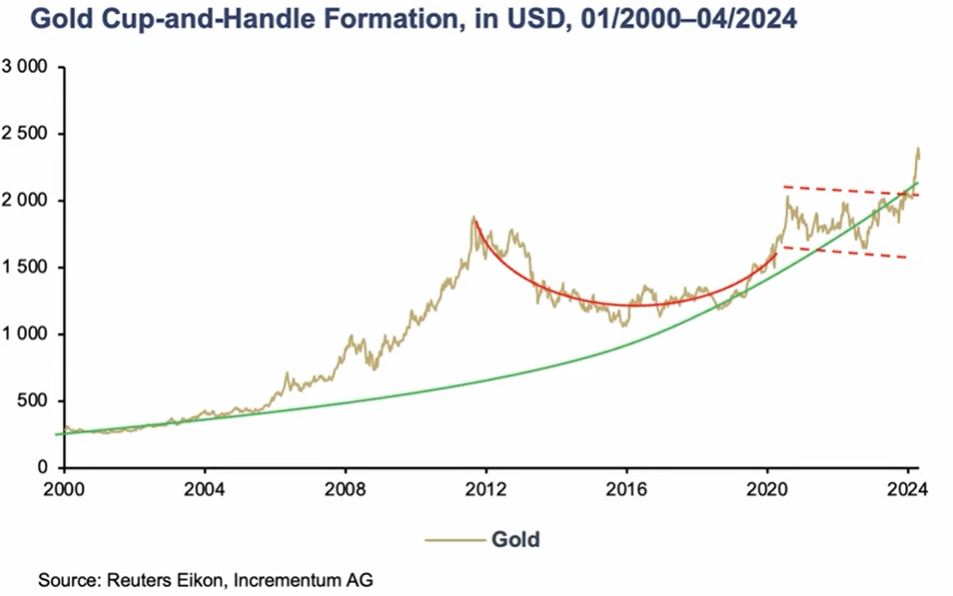

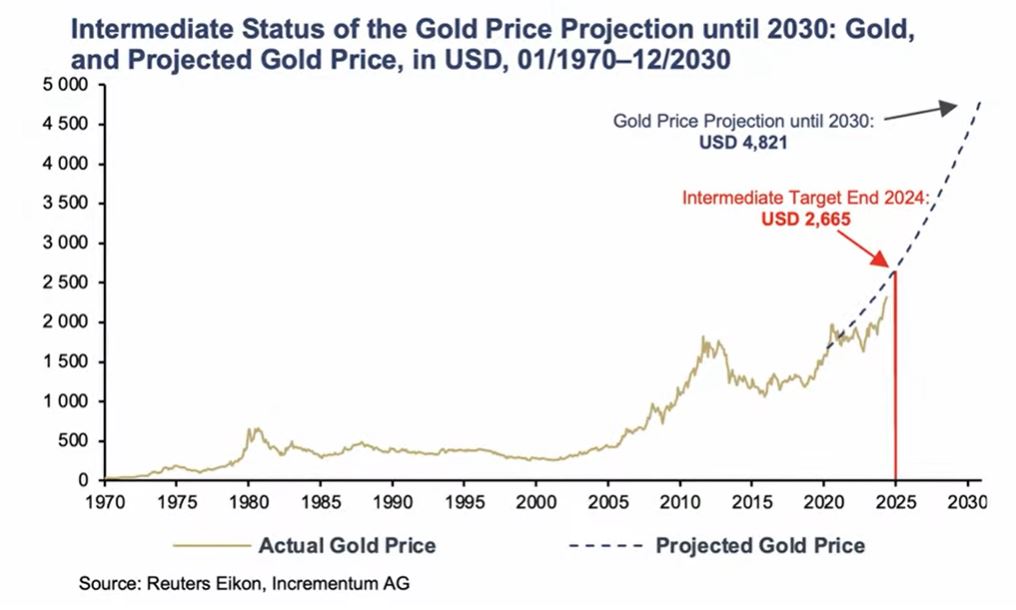

Gold Price Breakout: In the first quarter of 2024, gold prices broke through all resistance levels, setting new all-time highs despite rising real interest rates—a phenomenon contrary to traditional expectations.

Shifts in Demand: Western financial investors are no longer the marginal buyers of gold. Central banks and emerging markets, particularly China, are now the dominant forces driving demand, marking a significant shift in the gold market dynamics.

Eastward Gold Flows: Central banks in emerging markets have placed a floor under the gold price. In 2023, gold jewelry demand in Asia reached 2,000 tons, with 65% of this demand coming from China, India, and the Middle East.

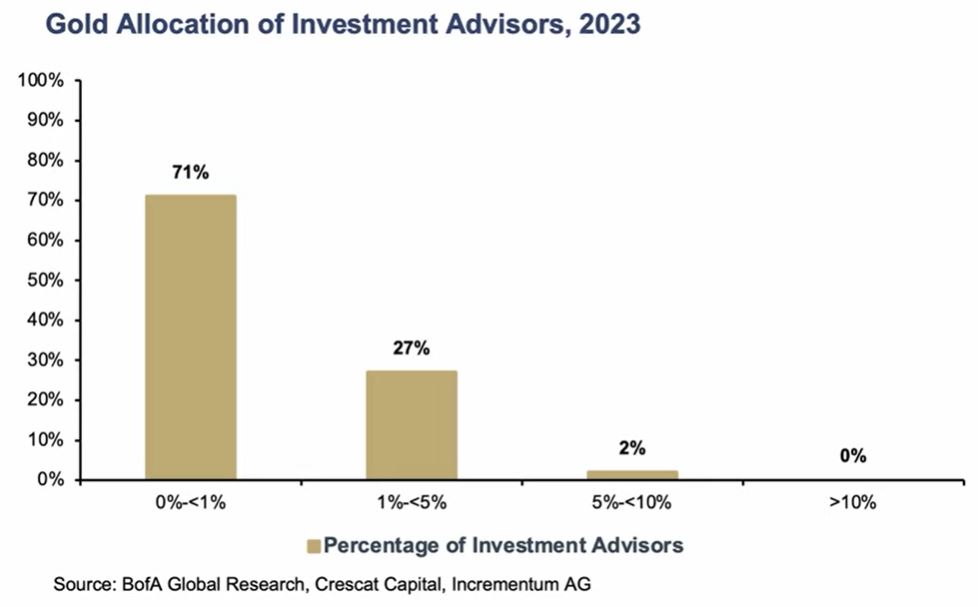

Western Investors Lagging: Despite the changing landscape, Western financial investors remain underexposed to gold, with 71% of US advisers allocating little to no gold in their portfolios. This is expected to change with rising inflation and potential recessions.

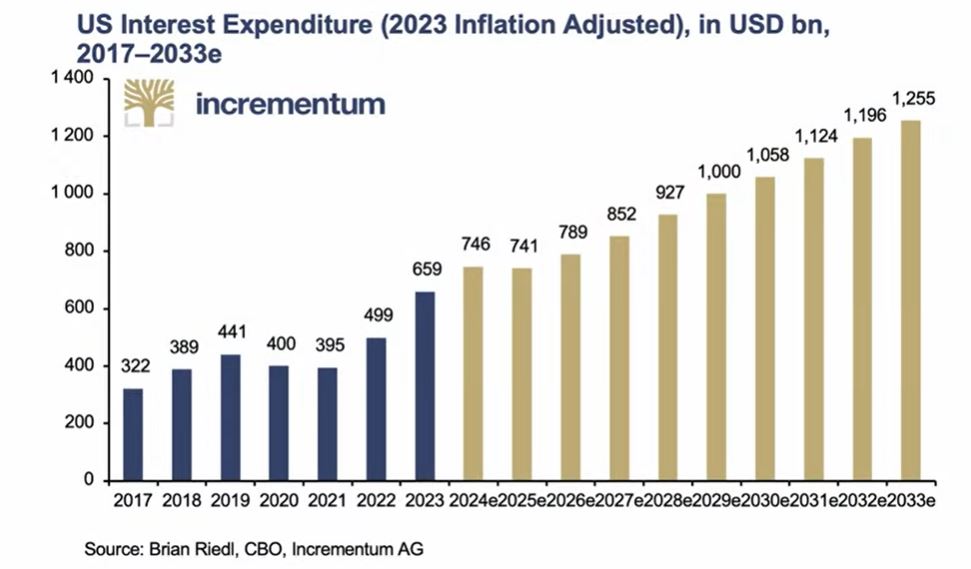

Unsustainable Debt Levels: Global debt levels have surged, with US debt increasing by over $11 trillion since January 2020. Interest payments are projected to become the largest federal budget category by 2029, highlighting the need for alternative investment strategies.

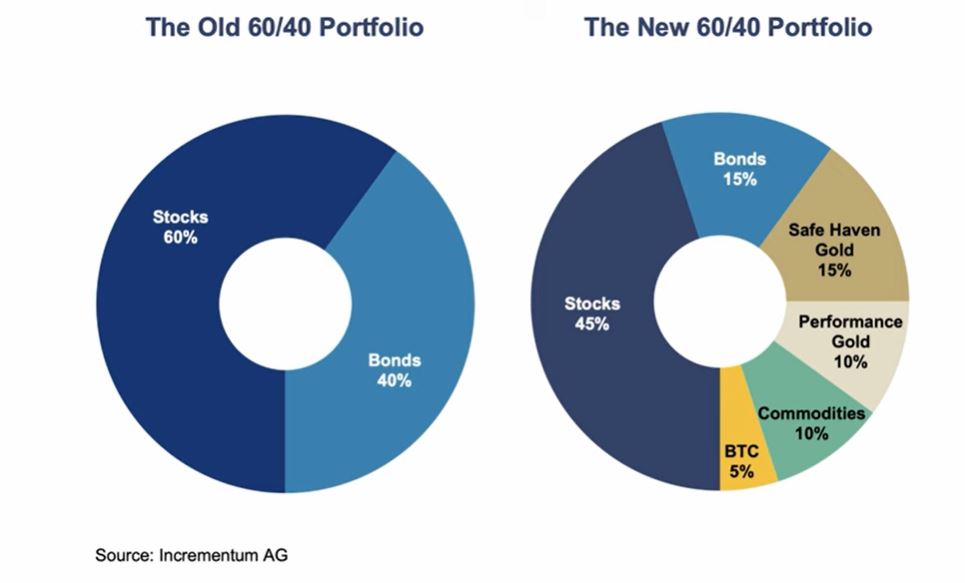

The Decline of the 60/40 Portfolio: Traditional 60/40 portfolios are no longer effective due to rising inflation and volatility. We propose a modified portfolio consisting of 60% equities and bonds, and 40% alternative assets including gold, silver, mining stocks, commodities, and Bitcoin.

Gold-Backed Currencies: With efforts by China, Russia, and allies to de-dollarize bilateral trade, the possibility of a gold-backed currency is being explored. This geopolitical chess game could have far-reaching implications for the global financial system.

Digital Gold and Bitcoin: We explore the role of digital gold and Bitcoin in modern investment strategies, highlighting their potential alongside traditional gold assets.

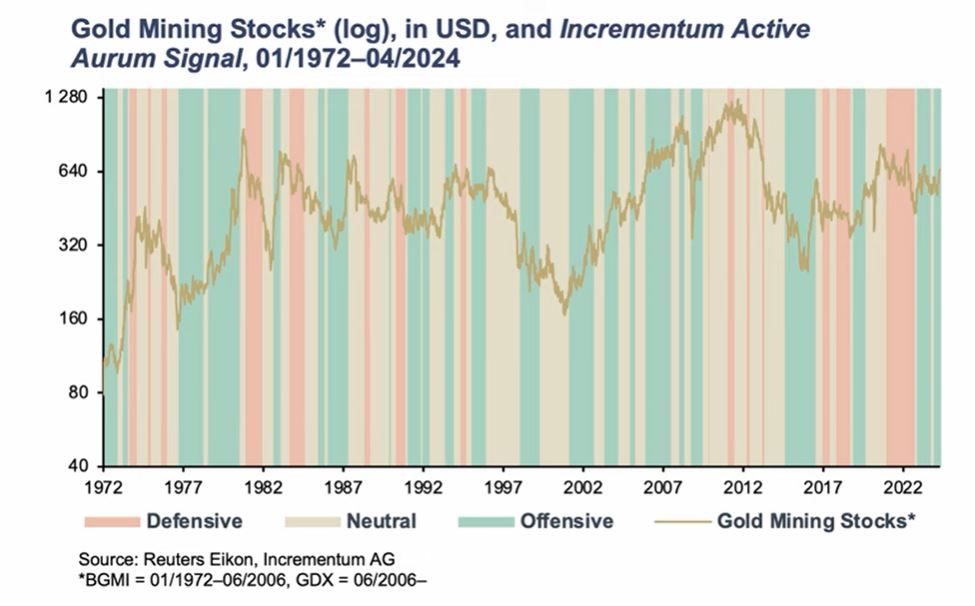

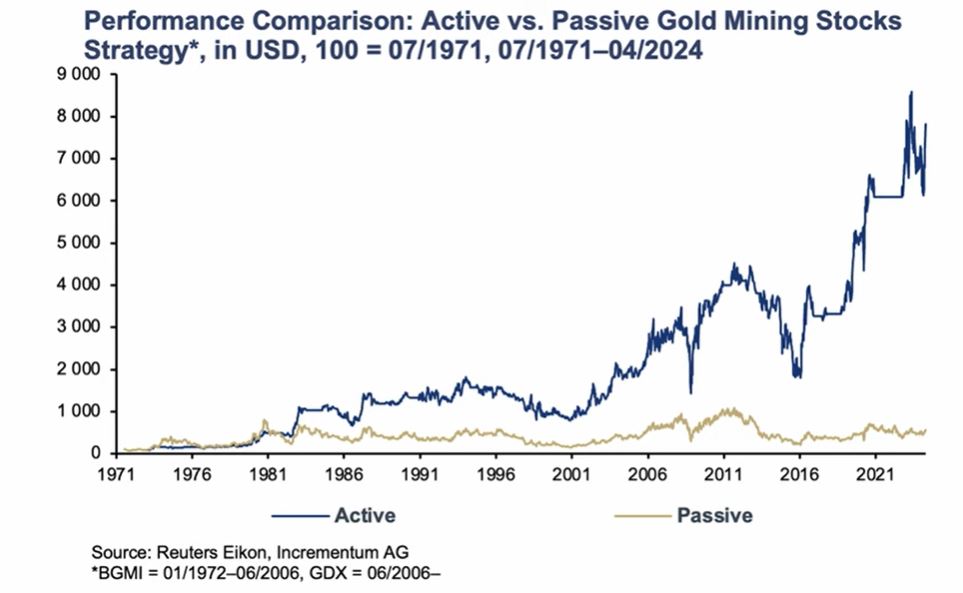

Innovative Investment Strategies: Our new Incrementum Active Aurum Signal is designed to optimize gold exposure in investment portfolios, achieving superior performance in backtesting.

Gold Price Forecast: We maintain our gold price forecast of $4,800 by the end of 2030, requiring an annualized return of just under 12%.

In Gold We Trust 2024 – Conclusion

As the global geopolitical chess game continues, the new gold playbook suggests that investors should allocate a higher percentage of their portfolios to precious metals and real assets.

Incrementum AG invites you to explore our comprehensive 18th “In Gold We Trust” report >>