Gold leads with record-breaking domestic prices, silver gains industrial strength, and platinum rises on persistent deficits in clean energy-hungry markets.

Emerging markets like India are struggling with inflation, currency pressure, and geopolitical instability. That said, precious metals in India and beyond are gaining attention as strategic assets.

Gold is hitting record highs, silver is rising on industrial demand, and platinum is tightening on clean energy demand. Together, these metals offer investors a smart way to hedge risk and capture long-term value.

1. Gold: Stability in Uncertain Times

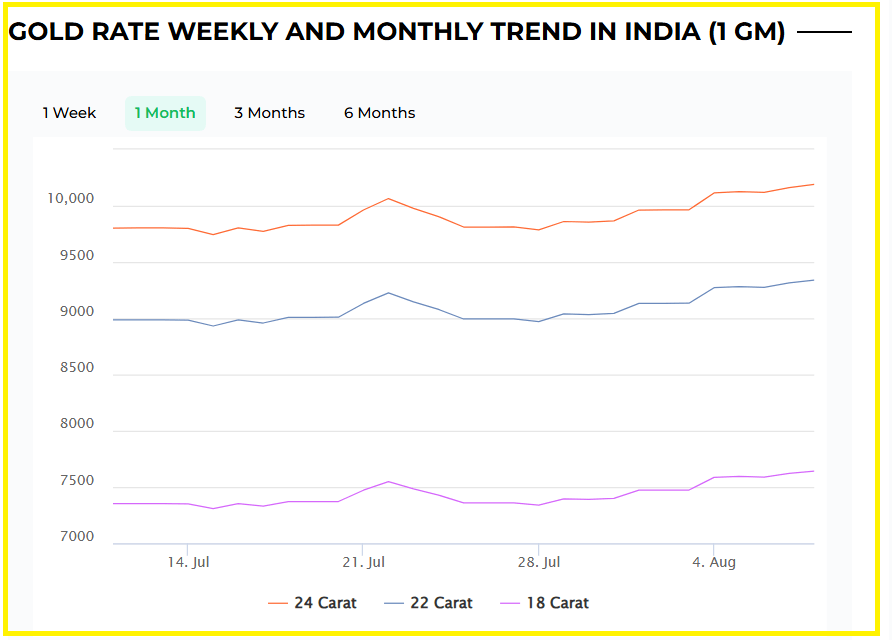

Gold remains the most trusted store of value in uncertain markets. On August 8, 2025, domestic gold prices in India soared past ₹1.02 lakh per 10 grams, a record high.

The growth was fuelled by rising tariffs, global instability, and a weakening rupee. Gold futures also climbed near $3,380 per ounce as markets brace for potential U.S. rate cuts.

While high prices are slowing jewellery demand, investment demand rose 7%, a clear sign that investors are looking to invest in gold in 2025 as a defensive move. In the current environment, gold continues to be one of the best metals for inflation hedge, particularly in volatile emerging economies.

ALSO READ: 5 Reasons to Buy Gold in 2025

2. Silver: Industrial Growth Meets Safe-Haven Demand

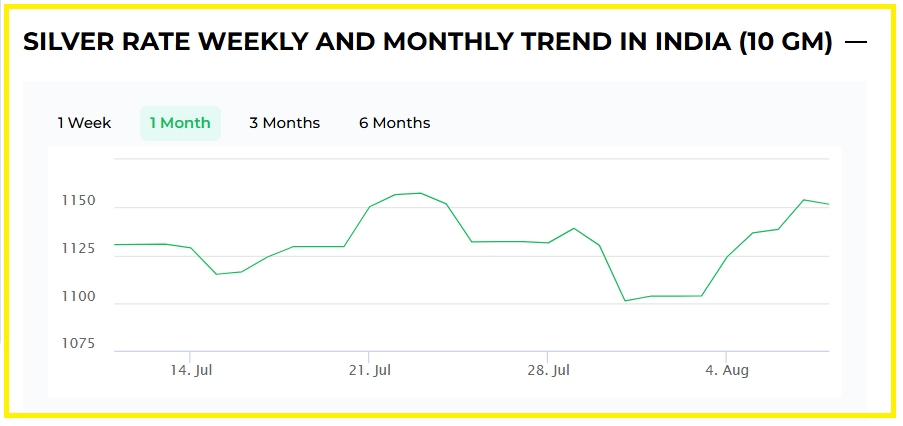

Silver is up 24% year-to-date, likely due to strong industrial use of silver in solar energy and electronics. The metal is now facing its fifth consecutive year of supply deficit, creating strong upward price pressure.

In India, silver is seeing a retail surge. Imports jumped 431% in May, and silver ETF investments are rising. As silver demand in emerging markets grows, the metal is becoming a key player in both industrial expansion and portfolio diversification.

For those comparing gold vs silver investment, silver offers higher growth potential with dual-use appeal.

RELATED: Silver’s Surge: Outshining Gold in 2025

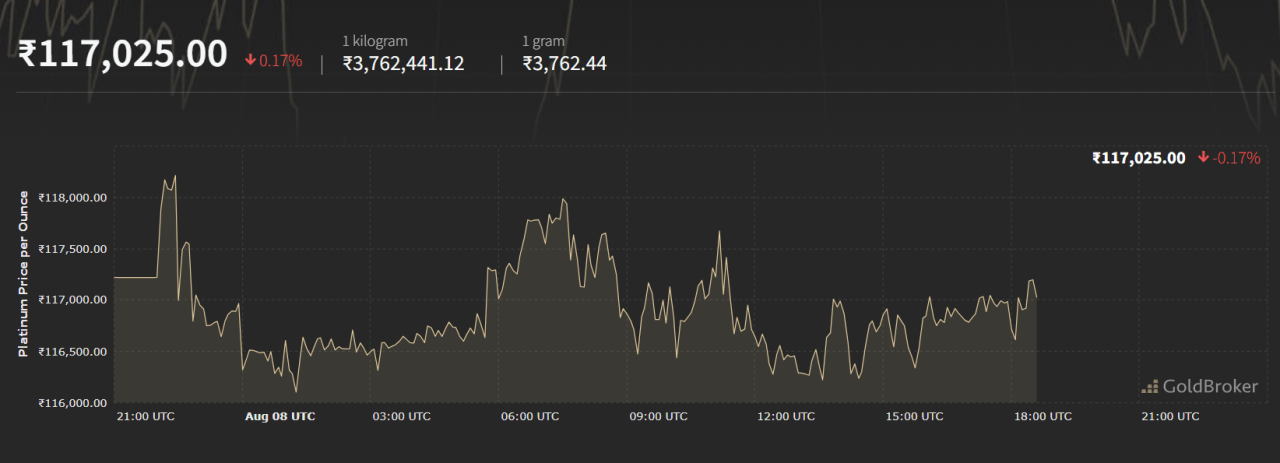

3. Platinum: Clean Energy Metal with Supply Constraints

Platinum has gained over 40% this year, outpacing both gold and silver. The platinum price trend in 2025 reflects tightening supply, now in its third straight year of deficit, with a shortfall of 966,000 ounces expected; about 12% of global demand.

As recycling slows and mining struggles, platinum’s role in green hydrogen production and auto emissions control is drawing strong interest. In emerging economies pushing clean energy, the industrial use of platinum adds real upside potential.

RELATED: Platinum’s Breakout: Is Platinum the Next Major Precious Metals Rally?

Conclusion

In fast-changing markets, precious metals remain a core strategic asset. Gold offers financial safety, silver delivers industrial and investment strength, and platinum capitalizes on clean-tech growth.

For investors seeking diversification, real value, and protection, these are the best metals for inflation hedge in 2025 and beyond.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

Our most recent alerts – instantly accessible

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)

- The Two Only Silver Charts That Matter In 2025 (July 6)