Bank of America raised its six-year gold forecast and set a $4,000 target. The bank highlights Fed independence risks.

Bank of America raised its six-year average gold forecast 6% to $3,049 and kept short-term calls at $3,356 for 2025 and $3,659 for 2026. Lead analyst Jason Fairclough told clients threats to Federal Reserve independence will raise safe-haven demand, and raised silver to $38.

RELATED: UBS Sees Macro Forces Driving Gold Prices To $3,700 By Mid 2026

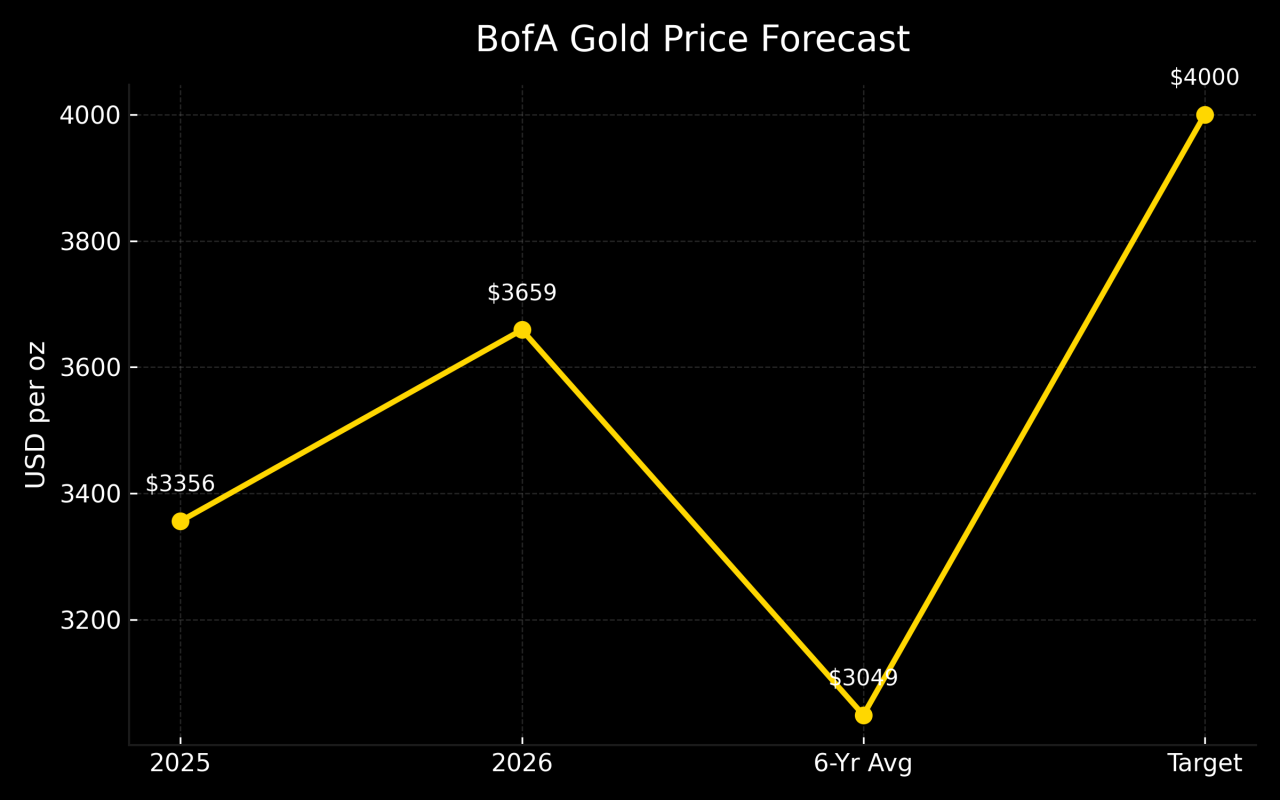

BofA Gold Forecasts And Near Term Calls

Fairclough kept BofA’s short-term calls at $3,356 for 2025 and $3,659 for 2026, while lifting the six-year average forecast 6% to $3,049 and setting a short-to-medium target of $4,000.

He described the bank as bullish on gold and raised the silver average to $38, a 7.5% increase. Fairclough told clients that gold has recorded strong gains this year, 31% YTD, futures and spot markets were trading in the $3,400s.

He said the change reflects sustained flows into bullion and higher central bank physical holdings. BofA kept tactical allocation unchanged for clients.

RECOMMENDED: Gold Price Rally: Safe-Haven Strength or Overheating Risk?

The Four Drivers Fairclough Cited

Fairclough enumerated four drivers for the call. First, he pointed to the U.S. structural deficit and persistent fiscal gaps, which he said increase long-term demand for non-yielding assets.

Second, he highlighted inflationary pressure from deglobalization and higher input costs that can sustain real price support for bullion.

Third, he identified perceived threats to Federal Reserve independence, citing President Trump’s removal attempt of Governor Lisa Cook as a catalyst for safe-haven flows into gold.

Fourth, he referenced elevated geopolitical tensions and global policy uncertainty as compounding elements. He told clients these forces overlap and can persist years ahead.

READ ALSO: Gold’s Record-Breaking Momentum: Can It Climb Further?

Immediate Catalysts And Market Context

Fairclough pointed to immediate catalysts, specifically political events touching Fed governance, including the dispute over Governor Lisa Cook’s removal. And stronger safe-haven flows into bullion.

He noted that recent spot and futures trades, trading in the $3,500s, signal heightened investor interest and provide a backdrop for his $4,000 short-to-medium target.

Fairclough says risks to Fed independence constitute a material driver likely to push gold toward the bank’s $4,000 target now.

Conclusion

BofA says threats to Federal Reserve independence, fiscal strain and supply shocks are a catalyst that will sustain safe haven flows and drive gold toward the bank’s $4,000 target level.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service — delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Must-See Monthly Gold & Silver Charts (Aug 31)

- The 5 Most Important Silver Charts For H2/2025 (Hint: Very Bullish) (Aug 23)

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean?(Aug 16)

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)