Gold holds steady as traders eye Fed signals, inflation data, and looming U.S. tariffs for potential breakout or pullback cues.

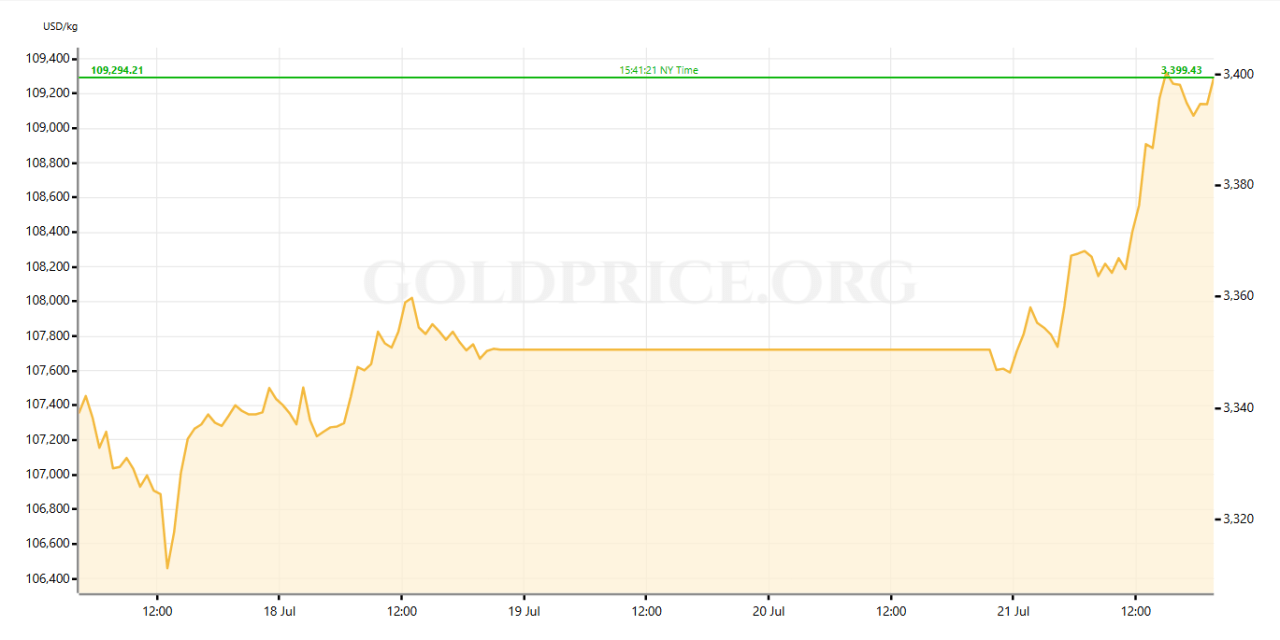

Gold is currently holding firm in the $3,340–$4,000 per ounce range having gained around 1.42% in the last 24 hours.

The strong price is supported by a softer U.S. dollar and declining Treasury yields, both easing pressure on gold’s opportunity cost.

With the Federal Reserve increasingly expected to signal rate cuts, and the August 1 U.S. tariffs deadline looming, this coming week will be pivotal for gold’s next move.

Weekly Gold Price Analysis

Our public blog posts typically share high level insights that are not actionable. For actionable insights, we recommend considering our detailed gold & silver price analysis. It is a premium service, covering leading indicators of the gold price and silver price. Premium service: Gold & silver price analysis >>

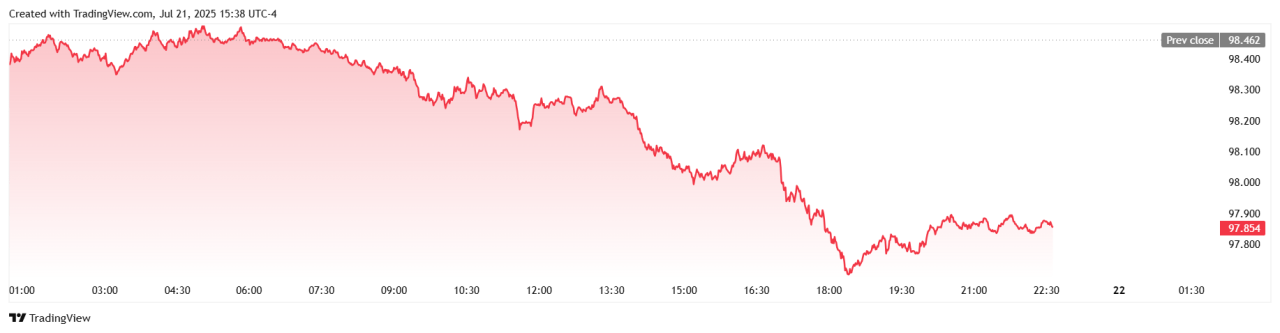

Dollar & Yield Landscape

The U.S. dollar index (DXY) has softened, sliding roughly 0.7%, making gold more attractive for non-dollar buyers. Concurrently, 10‑year Treasury yields have edged lower, hovering near one‑week lows, which adds to gold’s appeal.

These moves come amid signs the Fed might cut rates in September, with markets pricing in around a 59% chance. If the dollar and yields continue easing, it could ease gold through the upper bound of its current technical range.

Tariff Tension & Inflation Watch

Investor focus intensifies as the August 1 tariff deadline nears. President Trump’s threat of up to 30% tariffs on EU and Mexico imports is injecting uncertainty. Slower trade progress, or new tariff actions, would be bullish for gold.

Inflation data adds another layer: June CPI rose 0.3% month-over-month, with core CPI near 2.9%, supporting the Fed’s cautious stance. Upcoming PPI and CPI releases will be key in determining whether inflation sticks and if tariffs are feeding through.

Technical Range & Key Catalysts

Technically, gold is range-bound between support near $3,315 and resistance around $3,400. A consolidation appears alongside contracting volatility.

Key catalysts this week will include: FOMC guidance on rate cuts, fresh U.S. tariff headlines, ETF flows, and central bank updates – especially from the ECB and BoJ meetings. A breakout above $3,400 could trigger renewed momentum, while a dip below $3,315 may mark a pullback.

Conclusion

With gold sitting at a technical inflection and macro forces in flux, this week’s dollar moves, Fed commentary, inflation readings, and tariff developments will determine if prices break higher or retest support.

If you are looking to invest in gold, you should closely monitor DXY, yield trends, and trade headlines to stay ahead.

Our most recent alerts – instantly accessible

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)

- The Two Only Silver Charts That Matter In 2025 (July 6)

- Quarterly Gold & Silver Charts Are In, Here’s the Big Picture (June 29)

- Gold & Silver – The Big Picture Charts That Matter (June 21)