Gold nears record highs amid weak jobs data and tariff-induced stagflation fears; silver extends gains toward $40 with strong deficits, but both face key tests ahead.

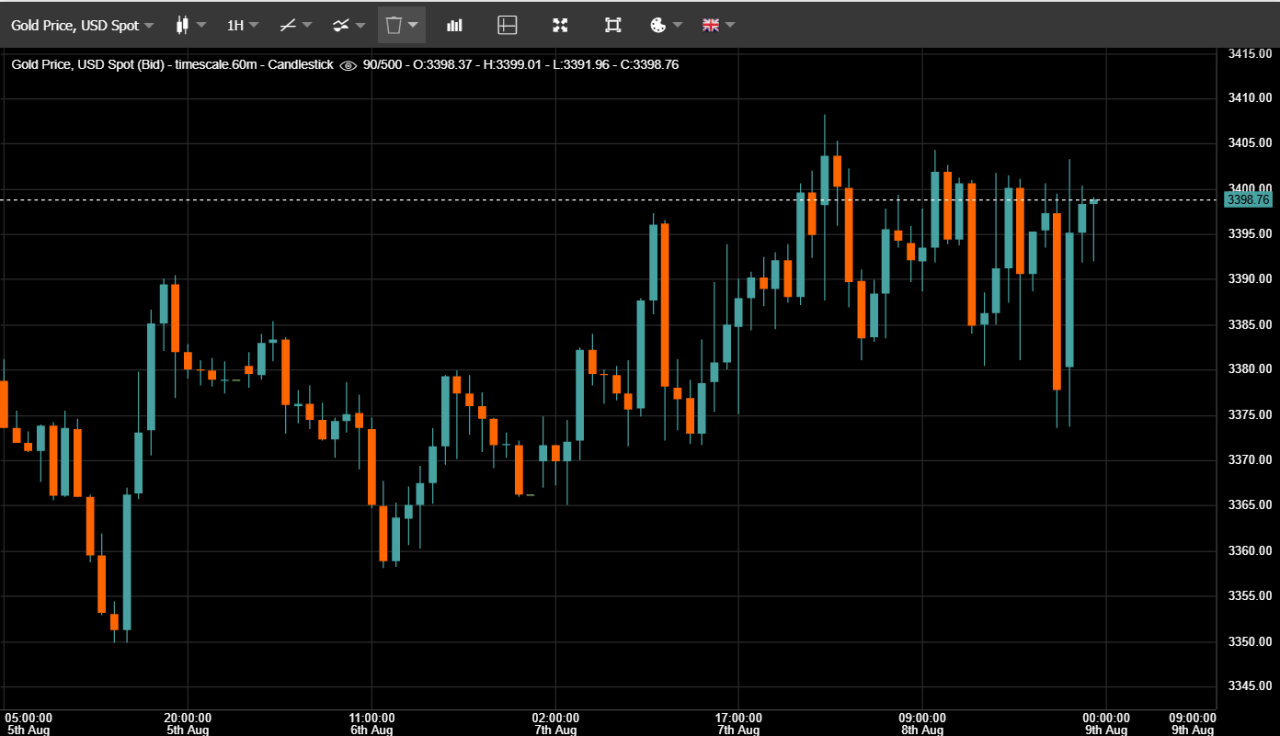

Gold trades near $3,400/oz, close to its June 2025 peak of about $3,449, on the back of softer U.S. jobs data that pushed September Fed rate-cut expectations above 90 %.

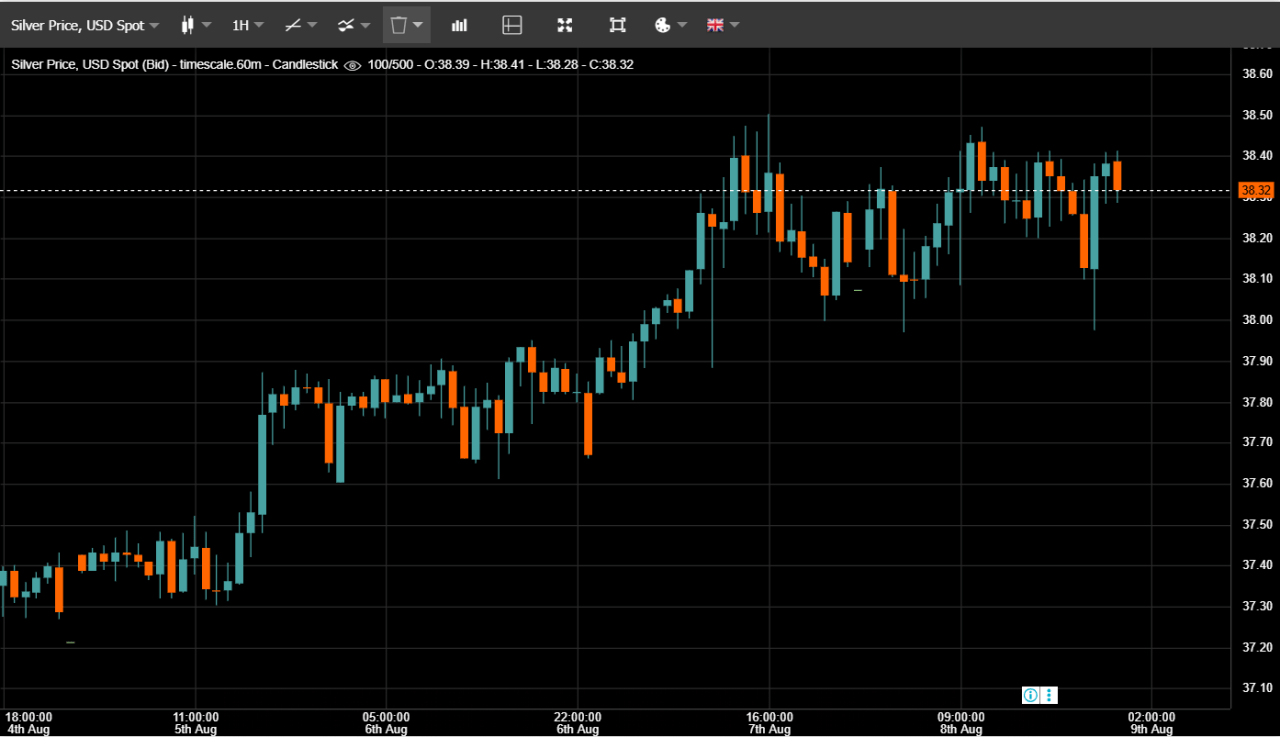

Silver climbs to roughly $39.40/oz, its highest level since 2011, outpacing gold’s 31 % YTD gain with a 36 % surge so far in 2025. But can these early-week gains hold under shifting fundamentals?

Let’s find out.

Gold’s Safe-Haven Surge and Its Limits

The weak July jobs report raised the U.S. unemployment rate to around 4.2 %, raising expectations of a Fed rate cut by September and lifting gold’s appeal.

Gold price forecasts in 2025 from analysts like Citi see continued upside toward $3,500–$3,600/oz as inflation pressures from tariffs linger and growth slows.

Still, gold pulled back from intraday highs, resisting a sustained break above $3,420/oz, as traders locked in gains. If upcoming economic data or central bank commentary shifts hawkish, that could cap further moves.

RELATED: 5 Reasons to Buy Gold in 2025

Silver’s Breakout: Structural Support Meets Technical Stress

Silver’s rise to $39.40/oz reflects tight physical markets, tariff distortions, and elevated investor interest. HSBC now forecasts an average of $35.14/oz in 2025, up from $30.28, citing continued deficits north of 206 million ounces, albeit easing in 2026.

Technical setups also point to a breakout: the gold-silver ratio has compressed from 105 to about 87, a potential mean reversion. That said, silver remains highly volatile; any industrial slowdown or profit-taking could force a pullback toward $35/oz.

RELATED: Is Silver A Good Investment Right Now?

Conclusion

Gold and silver show early momentum due to macro uncertainty and dovish expectations. Gold needs continued dovish Fed sentiment and weak data to hold above $3,400/oz.

Silver benefits from structural deficits and technical setups, but its path toward $40+/oz hinges on sustained industrial demand and investor conviction.

Watch upcoming jobs figures, Fed commentary, and technical levels to gauge whether the bounce can turn into firm support, or fade under pressure.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

Our most recent alerts – instantly accessible

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)

- The Two Only Silver Charts That Matter In 2025 (July 6)