Gold prices continue to climb even as Treasury yields rise, driven by fiscal concerns, central bank demand, and shifting monetary policy expectations.

Gold prices typically fall when Treasury yields rise. After all, rising yields increase the appeal of interest-bearing assets, making gold, which pays no yield, relatively less attractive. But in May 2025, gold has defied that logic.

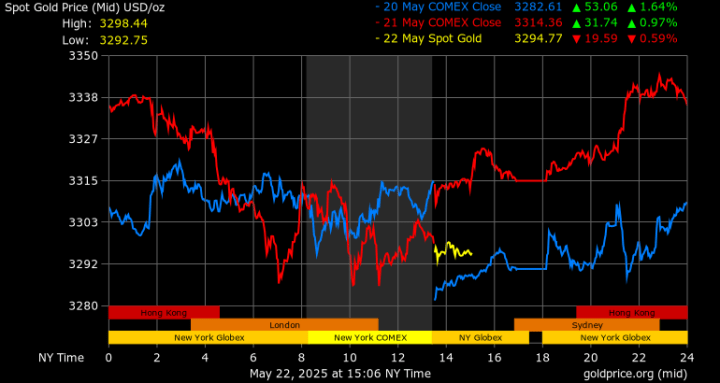

Spot gold prices surged to $3,336.43 per ounce on May 21, up 0.7% in spot transactions, marking the highest level since May 9. U.S. gold futures also rose 0.7% to $3,337.60.

This marks four consecutive days of gains, part of a 4% rise this week and more than 25% since the beginning of the year.

Safe-Haven Demand Amid Fiscal Fears

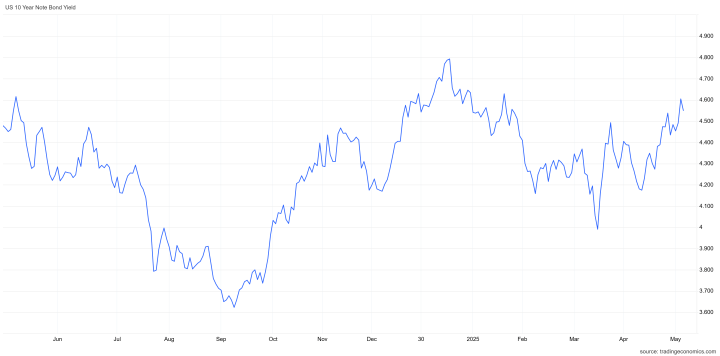

A major driver behind this divergence is growing investor unease over U.S. fiscal policy. The Treasury’s recent $16 billion 20-year bond auction saw weak demand, triggering a broader sell-off in bonds and pushing the yield on 30-year Treasurys to 5.1%.

Yields on 20- and 30-year notes were last seen at 5.136% and 5.128%, respectively. The benchmark 10-year Treasury yield rose to 4.593%.

These surging borrowing costs, following Moody’s downgrade of the U.S. credit rating and ahead of the passage of a major tax-and-spending bill likely to add trillions to the national debt (now at $36.2 trillion), have prompted some investors to rethink Treasurys as a safe-haven asset.

In this environment, gold has gained favor as a hedge against fiscal instability and geopolitical tension.

Central Banks Are Buying

Central banks, especially in emerging markets, are increasing their gold reserves aggressively. China, for instance, has tripled the share of gold in its foreign exchange reserves since 2022, importing over 700 metric tons from the UK alone.

This strategic accumulation is part of a broader move to de-dollarize and diversify reserve holdings, particularly as geopolitical tensions and the threat of sanctions make reliance on U.S. assets riskier.

Inflation and Rate Cut Expectations

Despite high yields, expectations are growing that the Federal Reserve could pivot to rate cuts later this year. Inflation remains stubbornly above the Fed’s 2% target, but slowing economic growth is adding pressure on policymakers.

Market pricing as of mid-May suggests traders expect at least two rate cuts by the end of 2025.

Analysts like Ilia Spivak expect gold to remain elevated, projecting prices around $3,450–3,500, while Commonwealth Bank of Australia sees potential highs near $3,750 by Q4, driven by demand for safe havens and a weaker dollar.

Conclusion

Gold’s rise in the face of elevated Treasury yields reflects deeper macroeconomic anxieties: fiscal instability, central bank repositioning, and shifting expectations for monetary policy.

With traditional safe-haven assets under scrutiny, gold has reasserted its role as a reliable store of value amid growing uncertainty.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)

- A Divergence In The Precious Metals Universe (May 10)

- Gold Retracing, Silver and Miners at a Critical Level (May 4)

- The Precious Metals Charts That Bring Clarity Through Noise (April 27)

- Highly Unusual Readings In Gold & Silver Markets (April 20)