It is easy to get caught up on short term price trends. Amazon, for instance, rose from $480 in February last year to $945 today. That is almost exactly a rise of 100% in 15 months time.

Amazon’s stock price is trading 0.23 percent lower today, after a strong rise of 2.5 percent yesterday, as it closed at all-time highs at $948.

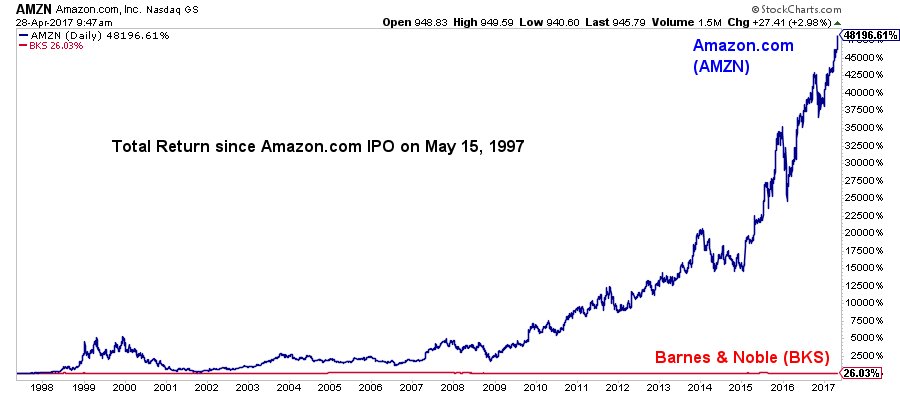

Looking at the big picture, Amazon started to trade publicly in May of 1997 which is exactly 20 years ago. At that time, nobody could imagine how much value Amazon would create in this world. Amazon truly disrupted e-commerce, not only when launching but, more importantly, the company continued to disrupt.

The first chart makes a very important point. Investing in disruptive companies can be extremely profitable. Choosing the right company is obviously key.

Amazon started off selling books and CD’s on the internet. It was the start of a new large trend. Comparing Amazon with a traditional book selling company, on the chart Barnes & Noble, shows how different it is to invest in traditional vs disruptive companies.

Many investors are looking for ‘the next Amazon’. In doing so, it is important to understand what the next big trend will be.

According to McKinsey & Company, a consultancy among corporates, the odds are high that Blockchain is going to disrupt the world. Blockchain is basically ‘the internet of value’, and it can improve the way transactions are done, something the internet has not really done in the past.

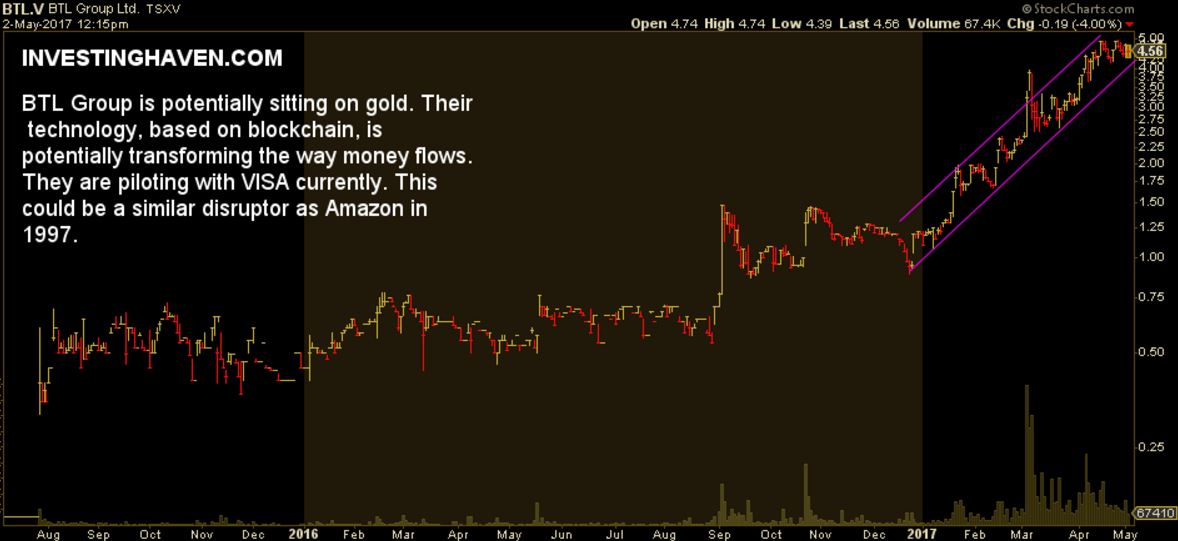

One such company active in the Blockchain space is BTL Group, a small cap technology company. The chart of BTL Group looks incredibly strong, and it really reflects its technology and product roadmap. Note on the chart how trading volume has risen significantly in 2017.

BTL Group is trading at $4.56 while it was trading $1.25 in the first week of this year.

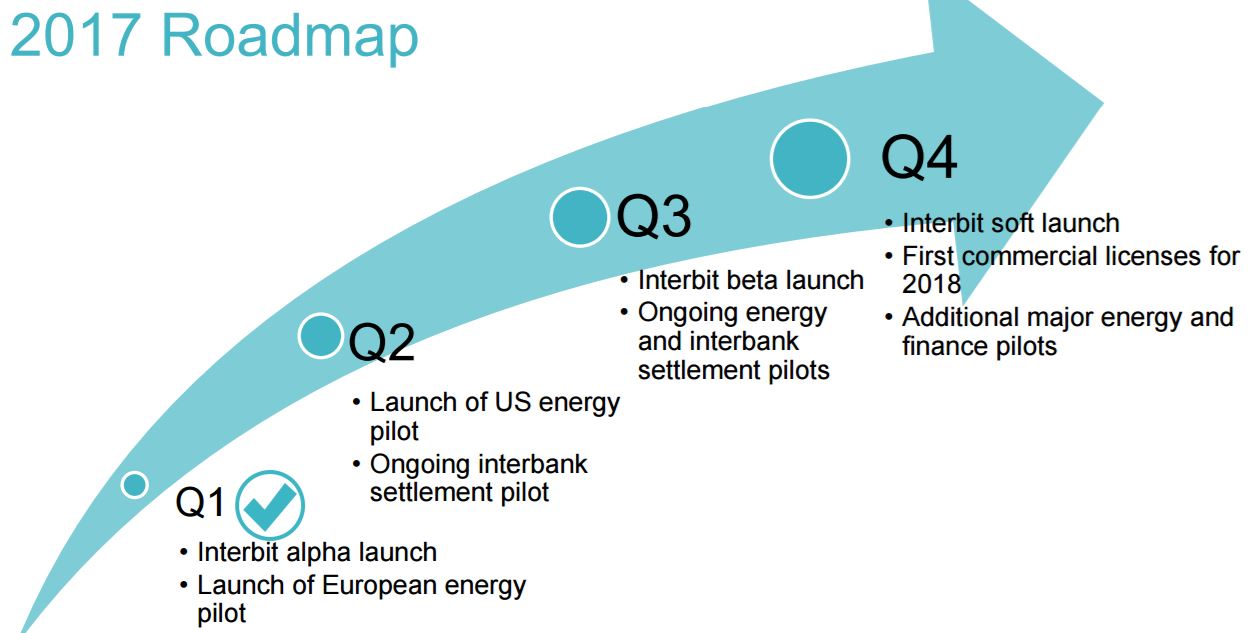

BTL Group’s roadmap looks fantastic from a disruption potential. Although the company is still in alpha and beta phases on their product roadmap. The activities and companies it is working with demonstrate the enormous potential. Visa is serving many trillions of payment flows, the energy market is one of the largest markets, and innovation is finance is still a blue ocean.

InvestingHaven’s research team would not be surprised if BTL Group would be a large cap company in ten or twenty years from now.

Do you want to know how BTL Group ranks against all other blockchain stocks out there? Subscribe to InvestingHaven’s Blockchain Stock Investing Research Service to get a full list of blockchain stocks >>