There is one raging bull market that started very recently: Canadian cannabis stocks are literally on fire. It is fundamentally important to choose the right stocks because, as in any bull market, all stocks go up but on the very long run only a handful of stocks survive the bubble. You really want to have the outperforming ones, similar to investing in Amazon in 1996.

Admittedely, there is a moral aspect to cannabis investing. As an investor you can bring up the point of how ethical is it to invest in something that is illegal. Well, here is the point: cannabis will be legalized as of summer 2018 by the Canadian government.

Carefully choosing the right cannabis stock is not only important from a long term value creation perspective but also from an ethical perspective and a risk management perspective.

Investors need to act fast now. Now is the time to get in, waiting does not make sense. Seizing the positions and choosing the right stocks is key, but waiting is not an option.

Here is InvestingHaven’s 5 top.

The once-in-a-lifetime opportunity

Why are we so bullish on the Canadian cannabis market? Because of two reasons!

First, as said, the Canadian government is legalizing the usage of cannabis, including recreational cannabis, on July 1st 2018.

Second, more importantly, because the recent news, the total market size seems to be much bigger than initially estimated. Two studies suggested that the total market size in Canada would be around 4 to 6 billion CAD. One was conducted by the government in 2012, the other one by Deloitte in 2016. However, there is a new estimate of the Canadian recreational-marijuana market, particularly Colin Firth partnered with market research firm Oraclepoll Research and found out that the number of recreational users could be more than 11 million. That is twice as much as the other studies found. This is of course not set in stone but it clearly indicates the previous estimates could be largely underestimated.

Here is another recent study: PI Financial Corp. analysts estimate that with current production, funded capacity expansion, and potential yield improvements, projected for 2019 a total demand of 610,000 kilograms vs supply of just 422,115 kilograms.

The market is clearly reacting on this, and the key in all this is that there is an imbalance between projected demand vs supply. In other words, the producers of cannabis in Canada are the ones that will profit most out of this situation.

What we are saying is that investors stay away from high risk cannabis researchers, health providers, cigarette producers, etc. The safest path to success is to pick out the cannabis producers that have the largest production capacity as well as outlook for growth.

The stocks we listed below are carefully chosen based on current production capacity as well as projected growth in their capacity (with the exception of the last stock).

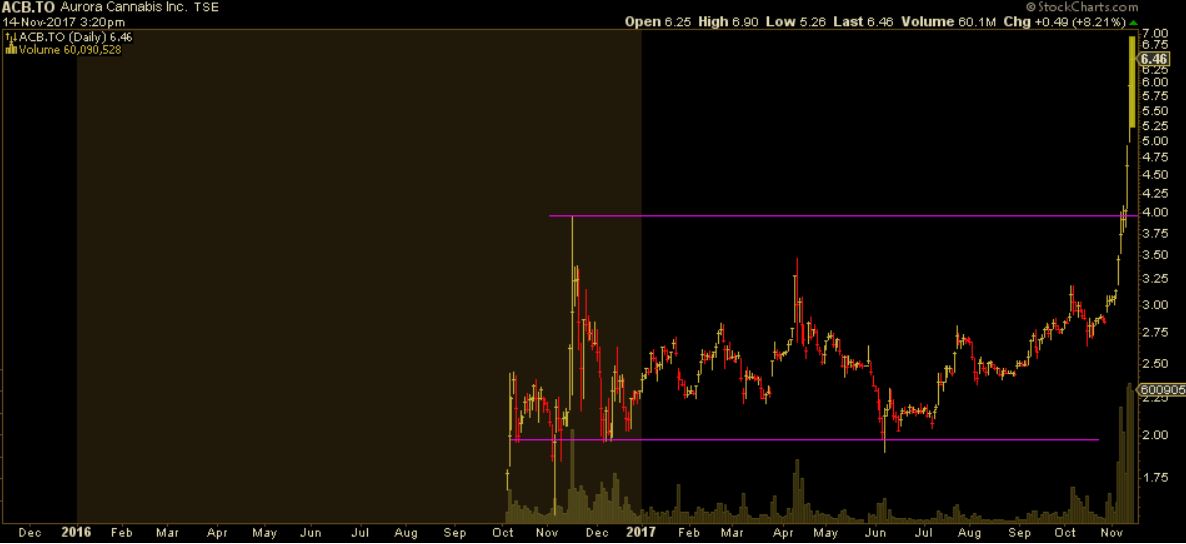

Stock #1: Aurora Cannabis (ACB.TO)

Aurora has a market cap of $2.5B which makes it the second largest producer in Canada. What we like about the company:

- Strong revenue growth (+160%) in recent quarter out of cannabis sales. Another strong growth expected in the next quarter (imagine what it will give once this market gets legalized).

- On track to expand production capacity and produce 100,000 kg annually as of mid-2018, which makes it a top producer in Canada.

- $159M in cash and equivalents on their balance sheet.

- Completed a bought deal and a private placement for gross proceeds of $75 million.

- Apart from cannabis production Aurora also has a health business in which they treat +2000 patients.

- In preparation for the anticipated mid-2018 Canadian federal legalization of adult consumer use of cannabis, the Company is building organizational and production capacity to capture a share of the adult use market.

The chart looks awesome, but clearly this stock got ahead of itself. Given the forecasted super growth in demand there is still plenty of upside in this stock.

In order to manage risk it is best to be prudent, and not go all in. Instead of taking a position investors can think of taking a first slice at current levels. The second slice can be taken in case the breakout point at $4.00 gets tested.

Selling 50% once this stock doubles seems a very reasonable tactic in order to keep 50% of the initially bought shares for free.

Stock #2: Emerald Health Therapeutics (EMH.V)

This is a much smaller stock with a market cap of $218M. Their focus on production is the reason why this stock is exploding in recent days. There is still lots of upside potential.

Emerald has a strategic partnership with Pure Sunfarm in which a 50/50 revenue split was agreed on cannabis sold. Their production capacity has a strong growth outlook:

- annual production of 46,000 kg by 2020 with a possibility to scale this up to 75,000 kg with the current plants

- possible to expand to achieve a production of 225,000 kg annually !

Moreover, Emerald has several years of expertise, and it also has a clean cap structure, no debt.

Same strategy as Aurora: a first slice of 50% can be considered a current prices but the breakout point (which is indicated with the horizontal line on the chart, it coincides with $2.00) is certainly worth considering the second slice.

Exit 50% of shares once prices have doubled against the entry point.

Stock #3: Aphria (ticker APH on TSX)

Aphria is a company with a market cap of $1.2B , one of the lowest cost producers in the Canadian industry.

It is making profits with an eps of $0.14.

The company is expanding its production plant though the growht is spread between May 2018 and January 2019:

- Currently: 1,700 kg annually

- May 2018: 21,000 kg annually (on top of the 1,700)

- January 2019: 70,000 kg annually (on top of the 1,700 + 21,000)

So all in all, in a little bit over a year this will be one of the top producers in Canada.

We see this stock growing a bit slower, but it is certainly a good long term play, less risky than Emerald. Between 8 and 9 dollar is a good entry. Exit once this stock has doubled.

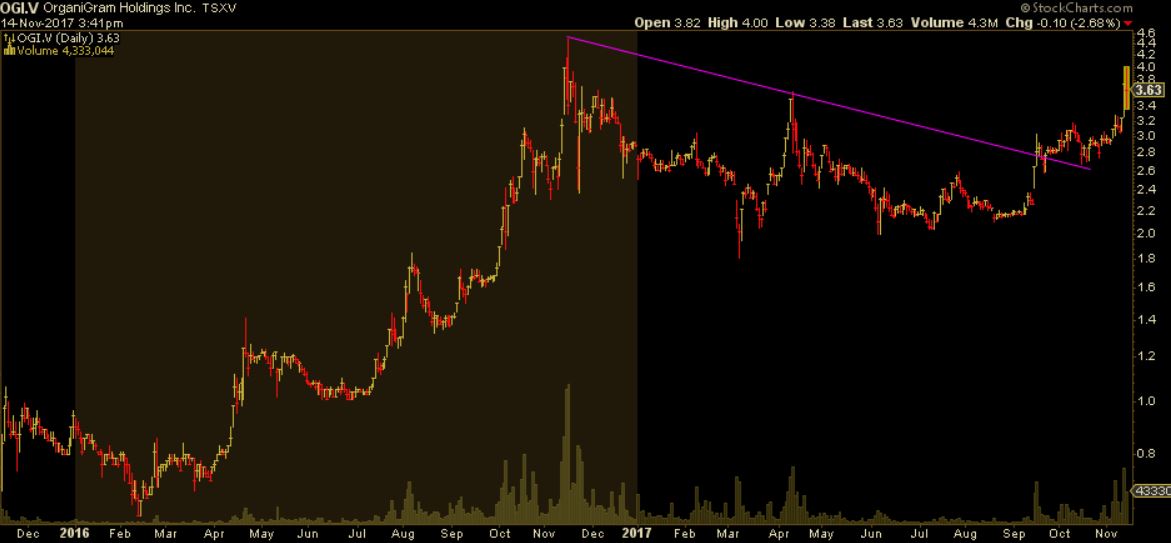

Stock #4: Organigram Holdings (ticker OGI.V on TSXV)

Organigram has a market cap of $380M, a cash position of $48M and just 3M of debt.

They have a fully funded facility expansion with a 250,000 sq. ft. on 14 acres and a 690% increase in 4 years. Their production capacity is currently 5,200 kg per year, by Q4 2017 16,000 kg per year (a 208% increase) and by December 2018 a capacity of 26,000 kg per year (63% increase).

Next to that, Organigram sells cannabis oil, an activity that is growing though will not make the difference in the bigger scheme of things.

Given that the production capacity is not as big as the first two stocks listed above, we are more prudent here: the breakout level between $2.60 and $2.80 seems to be the point to enter, and this stock is not as attractive as the previous two.

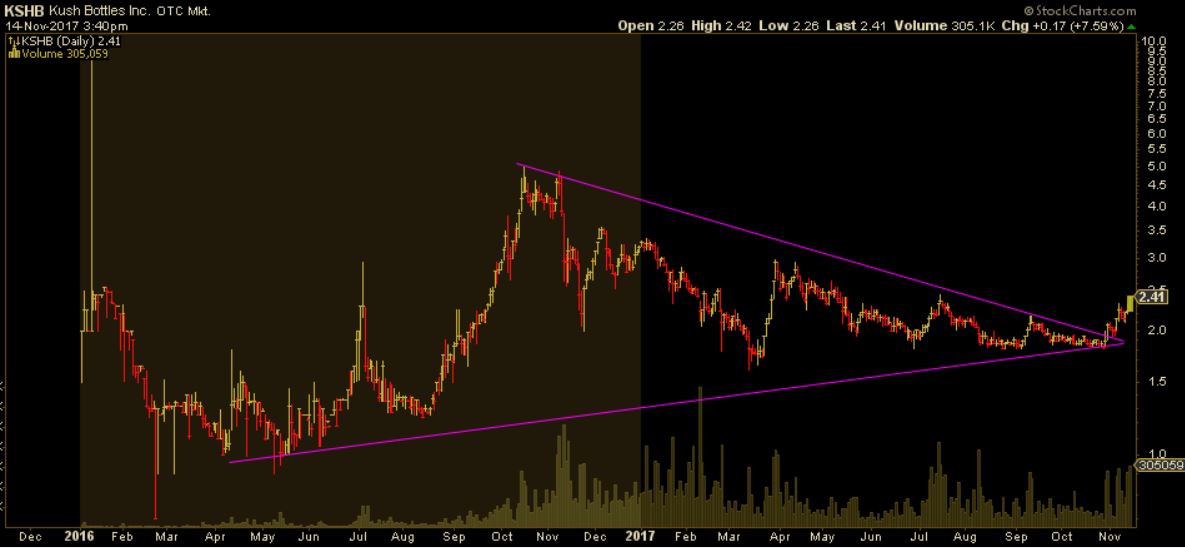

Bonus: Kush Bottles (ticker KSHB on OTC)

Kush Bottles is a company with a $139M market cap. It is a high risk as it still trades on the OTC market, also not available with every broker. We believe though that Kush Bottles is one of those few exceptions trading on OTC that is worth considering, and a serious candidate to move to a more advanced exchange like the Nasdaq.

The investor presentation is not publicly available, but we received it from the company, and have to say growth figures are impressive.

We particularly like this stock because it is a low risk to play the booming cannabis market: it offers bottles and packaging to the cannabis market.

The chart looks awesome. Kush Bottles is now breaking out of a long term triangle pattern. It is doing so on rising volume. In addition, it has been consolidating since early this year, a 9 month period.

An entry point is enticing at current levels. There will be resistance once this doubles, around $4.4, so that seems a point to take profits and sell 50%.

Disclaimer: please do your own dilliegence before undertaking any action. InvestingHaven cannot be held responsible for any action undertaken by readers according to the general disclaimer.