Photon Control is a small cap stock with a market cap of $160M. It trades on the Toronto Ventures stock exchange under the symbol PHO.V. The company has a positive EPS and a PE ratio of (only) 24.

The company manufactures optical sensors and instruments to measure temperature, pressure, flow. Photon Control’s products provide high accuracy and reliability in extreme conditions.

Photon Control was awarded last week with a top 10 listing on the TSX Venture 50™ which recognizes the top companies in the TSX Venture Exchange. Recipients are ranked based with equal weighting given to return on investment, market cap growth, trading volume, and analyst coverage. Read about Photon Control’s nomination.

Moreover, Photon Control published preliminary Q4 financial results:

- Total revenue of approximately $8 .5 million, an increase of 47% from $5.8 million in Q4 2015

- Gross margins of approximately 50.3% compared to 50.0% in Q4 2015

- Cash and cash equivalents of approximately $32.5 million at December 31, 2016 , an increase of 24% from $26.2 million as at the end of Q4 2015

- Order backlog was $8.8 million at the end of Q4 2016, an increase of 57% compared to $5.6 million at December 31, 2015

Photon Control breaks out, 10-bagger potential

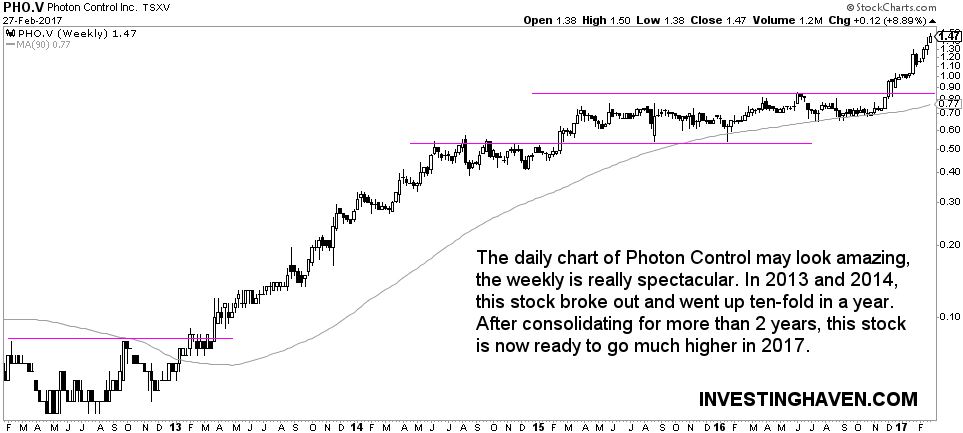

Those great accomplishments are reflected in the stock price of Photon Control. The daily chart shows how the stock broke out in December, at $0.85 on strong volume. Since then, the stock has marched higher on increasing trading volume. That is a great sign of strength.

If the daily chart looks strong, then the weekly chart looks truly spectacular. Photon Control broke out from a 2-year consolidation period. Note how the stock price of Photon Control has a track record to rise very sharply once it breaks out, as seen in the 2013 – 2014 time period.

Based on the financials of this company, we do not exclude it could become a 10-bagger in 2017 – 2018.