In this insightful blog post, we will explore the current state of the lithium market using the leading indicators we’ve established. Our lithium investing leading indicators confirm when the lithium market turns decisively bullish again in the long-term green battery metals mega cycle, which is not now, not yet. Furthermore, we’ll dissect the BATT ETF chart to uncover a potential epic entry opportunity for long-term positions in the high-growth and high-potential lithium and EV sectors. So, let’s review the data with the intention to address the question: When is the right time to buy lithium technology & EV stocks?

Related readings: Lithium Market: A New Booming Trend In 2023 And 2024 and One Lithium Stock To Buy In August Of 2023. Note that the lithium stock to buy went up nearly 50% since we tipped it to our Momentum Investing members, however it came down this week which makes it for a ‘juicy’ re-entry opportunity. Details of the best lithium stocks to buy in this weekend update sent with Momentum Investing members earlier today.

Long-term lithium cycle with lithium’s leading indicators

To navigate the lithium market’s long-term cycle, let’s examine the key leading indicators:

- Spot Lithium Price in China: 217,500 CNY/t

- Lithium Futures Price: 35.12

- BATT ETF Turning Point: 15.01

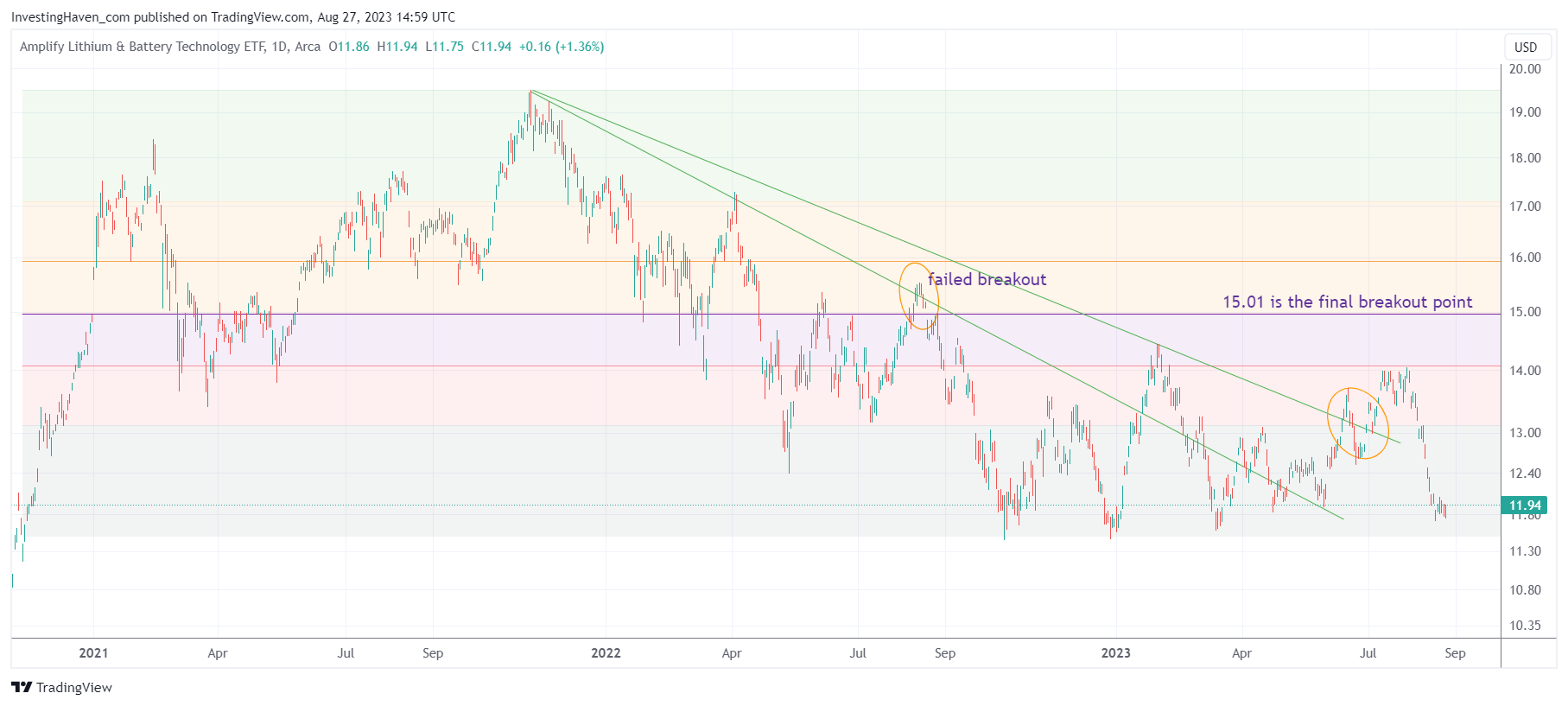

Spot lithium prices have experienced a moderate decrease from the summer highs. Lithium futures prices rest at a level that indicates a market recalibration. Now, focusing on the BATT ETF, the bullish turning point at 15.01 offers insight into a potential pivot in market sentiment. Combined, these indicators provide a comprehensive view of our position in the long-term cycle.

Charting a potential entry opportunity

The BATT ETF chart unfolds a narrative of potential opportunity. The emphasis is on its 2022 lows—a critical juncture. If history is a guide, these lows have acted as robust support levels. The chart’s movement around this point suggests the market’s recognition of its significance. This juncture sets the stage for an epic entry opportunity for investors who believe in the sustained potential of lithium and EV stocks.

Decoding the Chart

Analyzing Future Potential The BATT ETF chart speaks volumes not just about its past but also its future potential. The respect shown to the 2022 lows is a testament to market sentiment and the forces shaping it. This behavior creates the foundation for a bounce or a reversal, unveiling an entry point that aligns with the upward trajectory of the lithium and EV sectors. Invalidation: if the 2022 lows give up, on a 3 to 8 day closing basis.

Seizing the Strategic Opportunity

or investors with a long-term perspective, the potential epic entry opportunity warrants careful consideration. The BATT ETF’s respect for its 2022 lows signals sentiment and a possible bullish shift. As the world marches towards sustainability and electrification, positioning oneself within these transformative sectors becomes imperative.

Conclusion

A Glimpse into the Future In conclusion, the current state of the lithium market, guided by our leading indicators, provides insight into the long-term cycle. As we analyze the BATT ETF chart, a potential epic entry opportunity emerges—an opportunity that resonates with the broader sentiment in high-growth lithium and EV stocks.

While the road to investing success is multifaceted, the alignment of indicators and charts presents a strategic window. Yet, remember that individual circumstances and risk tolerance should always guide your investment decisions. As you contemplate the right time to invest in lithium technology & EV stocks, consider the synergy between indicators and opportunities that align with your financial goals.

Interested in more insightful explorations, as well as our top picks in the lithium tech & lithium mining & EV space? Please sign up to Momentum Investing, and get instant access to our latest alert posted today in which we feature incredibly ‘juicy’ setups in a few hidden gems in the lithium space & our top EV picks: Broad Market Direction & 15 Stock Charts Across Our Watchlists.