The most interesting aspect of investing in financial markets is the continuous trend changes. It is also the most challenging concept for investors to grasp. The fact that just 1% of investors is really successful as per our 1/99 Investing Principles is a proof of this. As 2020 kicks off there is another trend change underway, one that will be confirmed soon. We have taken this trend change into account in our 2020 forecasts, and our annual market forecasts reflect this. Which trend change exactly are we talking about?

Here is a hint: we have a bullish gold forecast and silver forecast for 2020.

Here is another hint: one of the leading indicators for both gold and silver is the positive correlation between the Euro and precious metals.

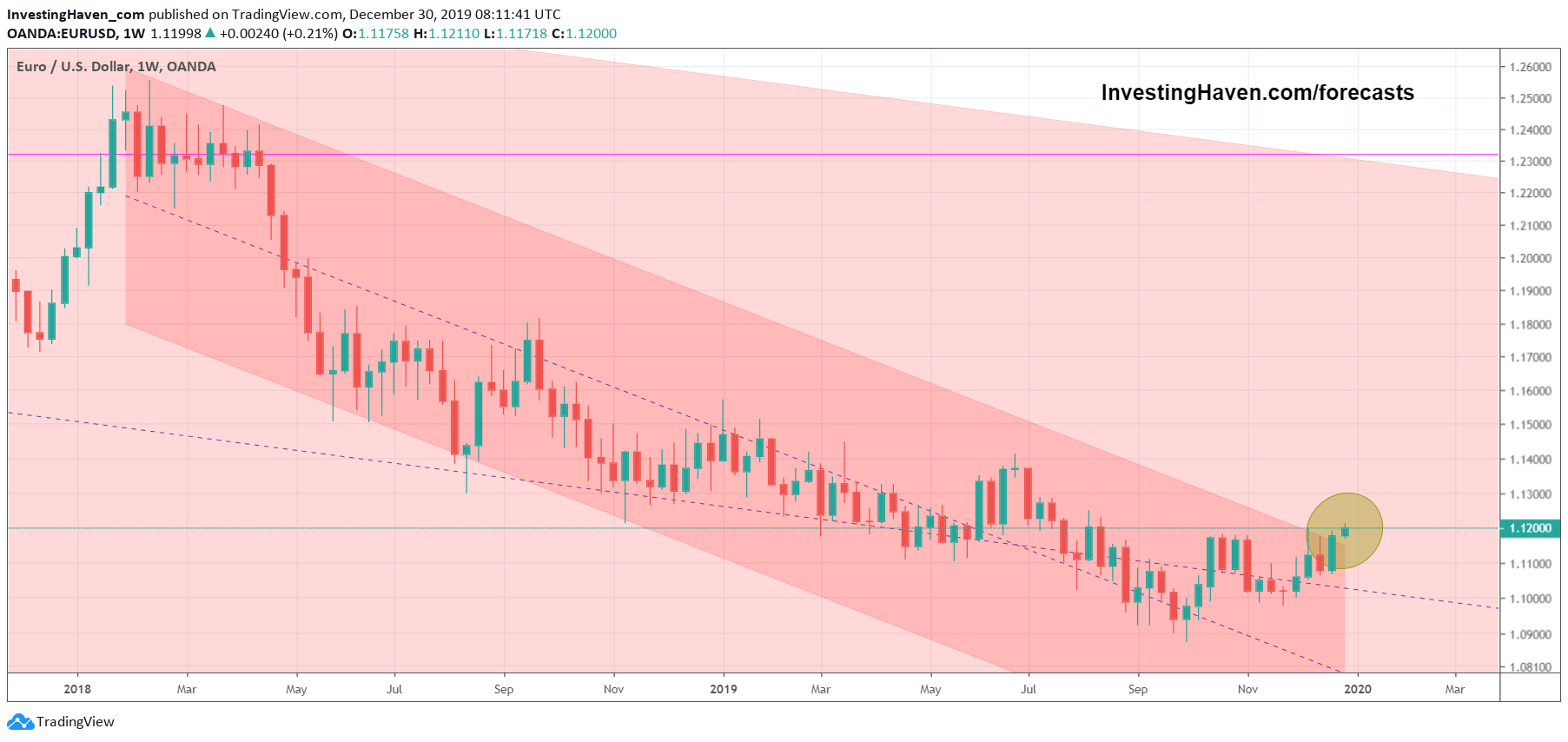

The chart below makes our point. The Euro is breaking out from a tactical bearish trend. This is big news, this is THE news. Forget financial news articles, forget the typical gold-trades-higher-today-because-of-trade-war-tensions. It’s nonsense, pure nonsense, of the highest degree.

If there is one, and only one, financial news item for December 2019 as well as January 2020 it is the Euro turning from bearish to bullish. Period.

In our ‘Momentum Investing’ premium service which will launch in exactly one week we go all-in on this trend with a specific play. With that we expect a kick start of our Mission 2026 which is designed to turn 10k into 1M before December 2026.

There are 2 reasons why most investors have a hard time dealing with trend changes.

First, you really need to take a drastically different view to looking at markets and reading markets. Forget news, forget newsletters, forget premium services, they all look at markets from their personal perspective. They are not designed to bring you the truth. Nobody talks about the underlying principles that define capital flows, so investors are left in the dark.

Second, investors are emotional. Once they score a hit with a trade they always associate those conditions with that trade. For instance, if an investor made a big profit taking a position in the gold market in 2016 when stocks were selling off he/she will always remember the positive correlation between volatility and gold. So gold is a safe haven asset, is the perception.

Nothing is further from the truth. Correlations change frequently, but the underlying principles do not change.