China’s stock market selloff in 2018 is serious. The index lost 25% in 2018, large cap stocks in China also lost 25% and China internet stocks lost 22% in 3 weeks time. InvestingHaven takes a step back from the frenziness, and zooms out to stay focused on the longer term trends. This article contains 3 must see charts on China’s stock market selloff in 2018.

We take a classic top-down approach in looking at China’s stock market selloff. First, China’s index SSEC on the monthly chart on 20 years, followed by the large cap stock index FXI ETF (FXI) on the monthly, and finally the internet stocks ETF KWEB (KWEB) on the weekly.

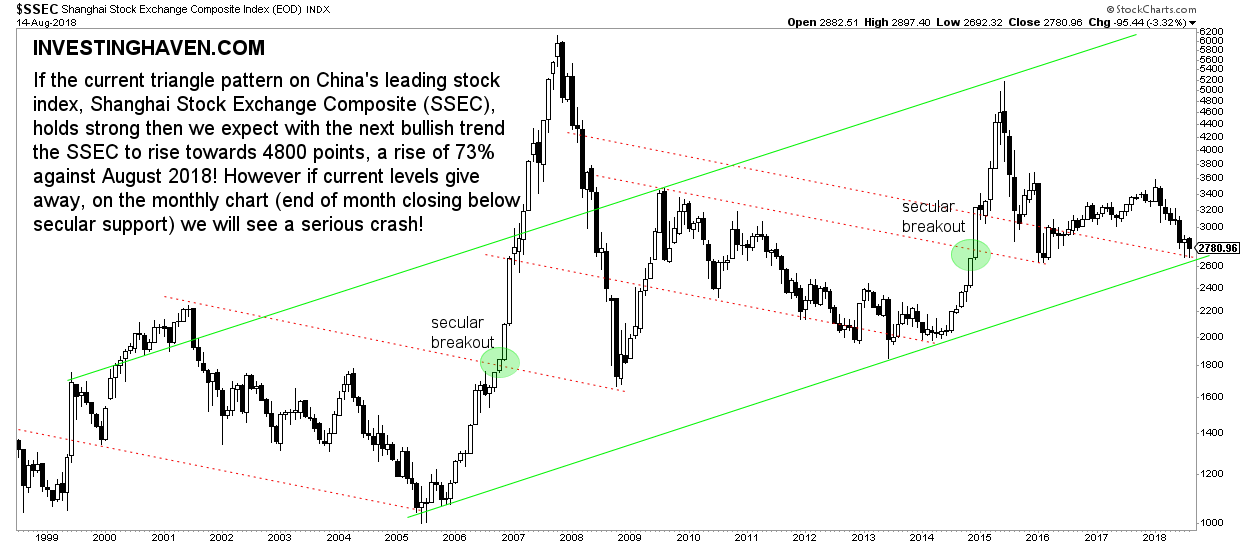

China Stock Market Selloff Of 2018: Chart #1 SSEC monthly

The monthly chart of SSEC (SSEC) was as discussed many times before on this blog: China Stock Market At Make-Or-Break Level (July 2018) and China Stock Market Has 10 Pct More Downside, Major Buy Opportunity Setting Up (June 2018).

In previous articles we identified current levels as great entry points.

What makes today’s situation somehow stressful is the unknown factor of Turkey’s stock market crash. It’s a wildcard, led by Turkish PM. If that situation gets worse we can see a true crash of epic proportions, not only in Turkey but also in other emerging markets, primarily China.

That is because China trades at secular support. The monthly chart speaks for itself. In no way do stock market bulls want to see the SSEC close below 2700 points at the end of the coming months, starting August 2018!

It may not be visible on this chart but the lowest support line on the first chart goes back almost 30 years. It really is an important trend.

In case the stock market panic eases, and Turkey gets its act together with its Lira, then China is at a very enticing entry point, in other words a BUY signal with lots of upside potential in 2018 and beyond.

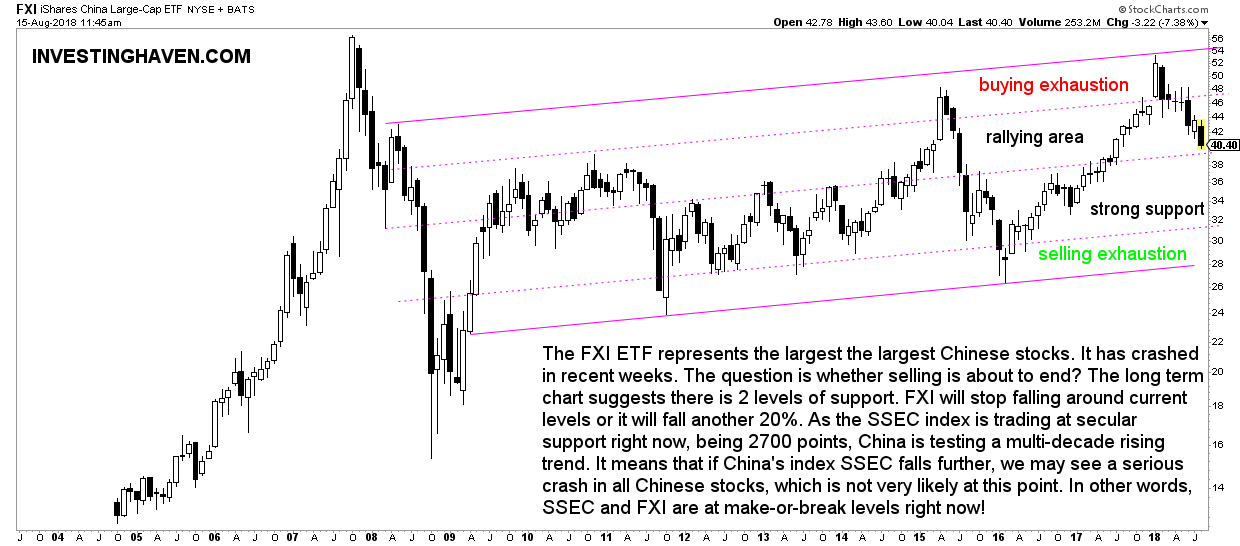

China Stock Market Selloff Of 2018: Chart #2 FXI monthly

The largest stocks in China are represented by the FXI ETF.

Its chart is truly beautiful, a clear trend that has respected its pattern.

It also shows that large cap stocks in China were a very interesting place to be since 2016, as said many times on our blog.

China’s stock market selloff in 2018 is also visible on the FXI ETF monthly chart. Note how the 25% decline since January 2018 brought the FXI to an important support area. We tend to believe that current levels will provide support. If not, the support that is visible on this chart is a wide area from 32 to 39 points.

Provided the SSEC shown above holds strong we are looking at an amazing buy opportunity in FXI ETF. However, in case SSEC gives away then FXI will fall lower.

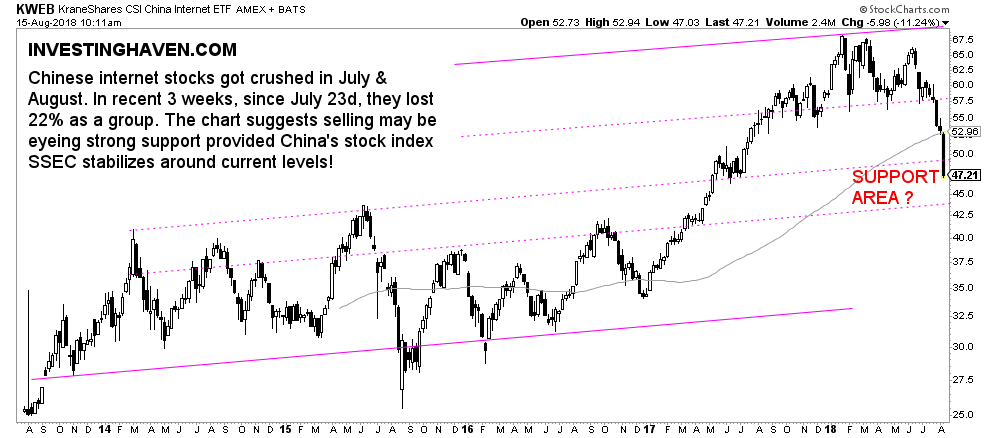

China Stock Market Selloff Of 2018: Chart #3 KWEB weekly

The last chart showing China’s stock market selloff in 2018 is China’s internet stocks. It is KWEB ETF that represents China internet stocks.

Note how this selloff accelerated 3 weeks ago, specifically on July 23d, with a 22% decline in a matter of 3 weeks.

Visibly, KWEB has entered a strong support area. Although there is some downside to the 43 level, which is just 7% below current levels, we strongly believe this selloff is about to decelerate.