China’s stock market (SSEC) is clearly in a corrective period, short term. Since February of this year the Shanghai Stock Exchange (SSEC) retraced from 3600 points to 2815 at the time of writing. Is this a buy opportunity or this the start of a new long term bear market?

Before looking into the current state we quickly revise our recent thoughts. Some 3 months ago we observed that China’s Stock Market Was Close To Being Bullish In 2018 right at a time when the SSEC was testing 3300 points. Somehow later the SSEC corrected again to the 3000 level, but held strong, which is when we said that China’s Stock Market Did Something Important.

However, since then it went downhill, and the China stock market exchange SSEC declined to the 2880 level at the start of this week (at the time of writing it trades at 2816 points).

How big is the damage? Is this the end of the bull market in China?

First of all, we refer to the following we repeated a couple of times so far:

What are the odds China will do good in 2018? We believe the odds are very high, because Emerging Markets Are Very Bullish In 2018 and 2019. As emerging markets are expected to outperform, China is likely to get influenced by this.

The point in this is that emerging markets have been increasingly bullish in the last 24 months, at least up until a month ago. Most emerging markets have been struggling in recent weeks.

So the first question to solve is whether we believe that emerging markets as a group will continue to remain weak or even crash. Based on the dollar and commodities correlations we do see weakness but not more than that. There are no signs of an upcoming crash, or a raging dollar which may cause commodities and emerging markets to crash.

That said, it is clear that some continued weakness may occur in emerging markets. As said earlier this week emerging markets have some 10 pct downside left before a major support level kicks in.

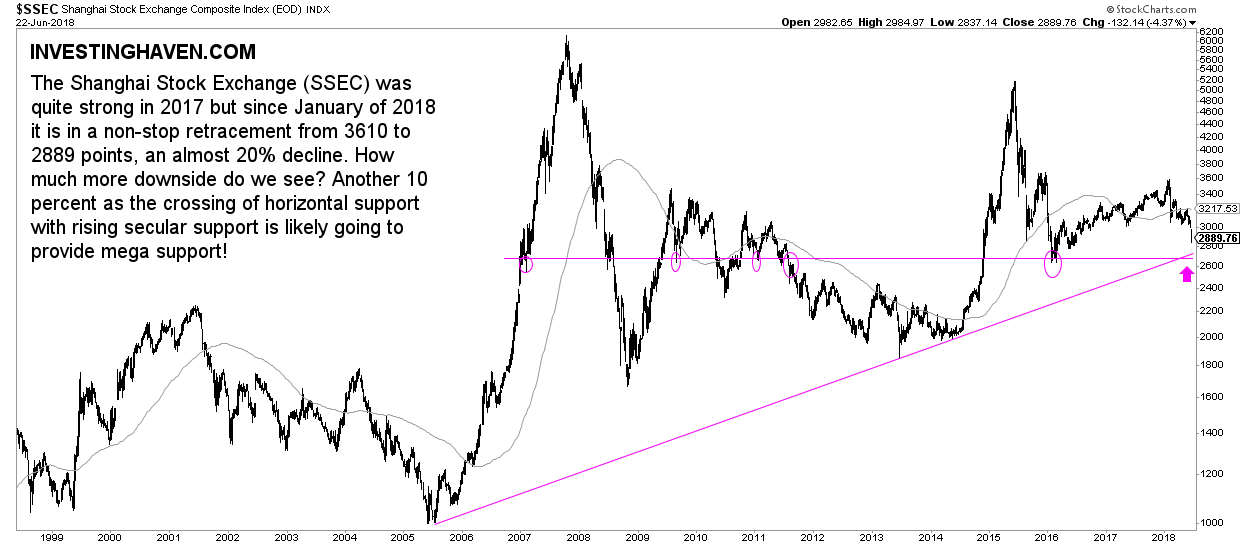

Specifically China seems to be close to a very important support level as well. The chart of the SSEC shows that, uncoincidentally, also 10 pct downside is left before secular support kicks in.

Do not underestimate the importance of ‘secular support’. As seen on this chart the support line goes back to 2005, and got tested in 2013 and 2014, in a ‘pixel perfect’ way. The trendline shown on the chart is incredibly sharp and amazingly concise.

Note how horizontal support comes in at almost the same price point.

In other words, China’s stock market at 2600 points will provide very, very strong support. The odds favor that China, after correcting another 10 pct, will stop declining. If not, it will be extremely bearish which we do not anticipate.

If the corrective action stops at 2600 points investors may check this article: 5 China Stocks To Consider In 2018 Listed On US Stock Markets written by InvestingHaven’s research team. Moreover, the more generic FXI ETF (FXI), a selection of large caps in China, has held very strong, and, as always, assets showing relative strength during a correction must be considered when a correction ends.