Every investor has a watchlist. We often get the question as the year starts which stocks or markets are highest on our watchlist. In this article we reveal the 5 stocks highest on our watchlist for 2019. Readers may consider this to be InvestingHaven’s 5 stock tips for 2019. These 5 stock tips should not be looked at in isolation, but together with the findings from our 15 leading indicators and dominant market trends.

Note that this article which contains 5 stocks tips for 2019 has a somehow different objective compare to the 5 top stocks with their forecasts for 2019 which we wrote several months ago. The biggest difference is that we identified top stocks in U.S. markets, and forecasted what may happen for them in 2019 in our previous article. The current article though takes a much broader scope, it is fair to say that has a global scope across all sectors. More importantly, though, each stock represents a market or an asset or covers a ‘strategic’ meaning in markets.

Our point made above will become clear once readers go through thse 5 stock tips on our watchlist for 2019, please continue reading.

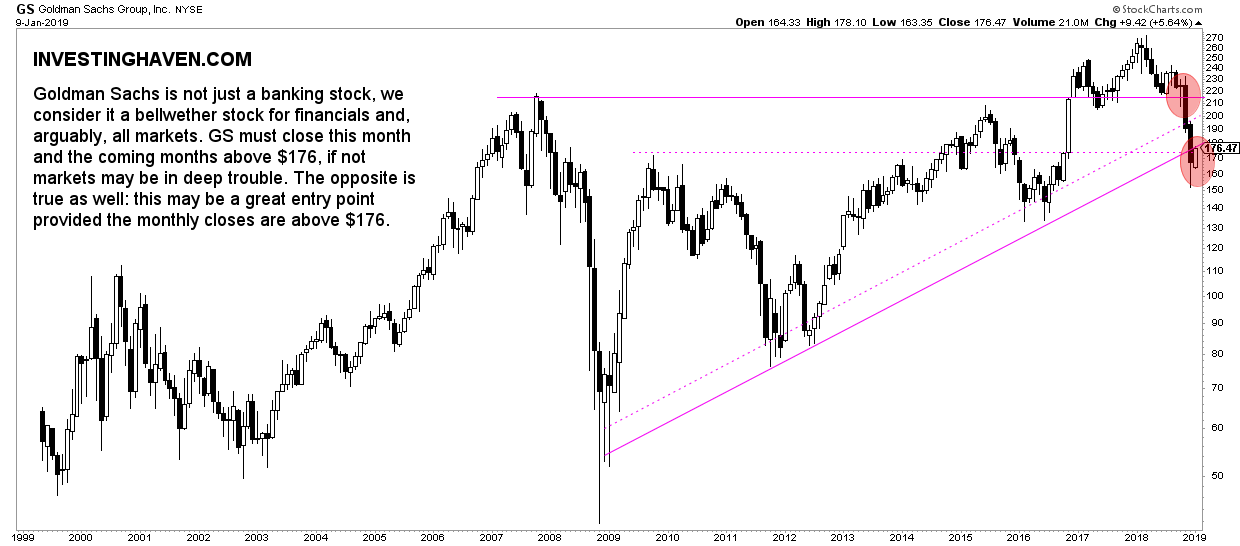

Stock Tips for 2019: Goldman Sachs (GS)

First in the list of our 5 stock tips for 2019 is Goldman Sachs, a giant financial services stock.

Goldman Sachs is not just a banking stock, we consider it a bellwether stock for financials and, arguably, all markets. That’s why we continuously watch GS in conjunction with leading stock market indices, first and foremost the Russell 2000 but also long term charts like the Dow Jones Long Term Chart on 20 Years.

GS must close this month and the coming months above $176, if not markets may be in deep trouble.

The opposite is true as well: this may be a great entry point provided the monthly closes are above $176.

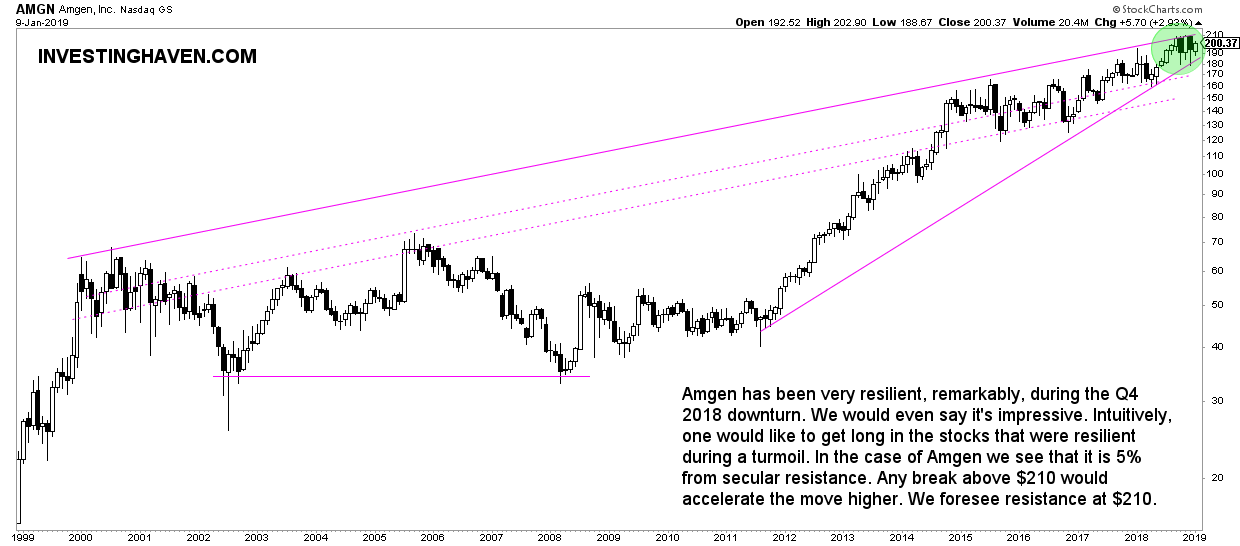

Stock Tips for 2019: Amgen (AMGN)

Second, Amgen is one of the top stocks in the biotech space.

Essentially biotech has gone nowhere since it peaked in summer 2014. Amgen, specifically, peaked at $160 and now treades at $200, that’s not very impressive.

Two things may happen in the biotech space: they either go seriously higher as they start a new leg higher in 2019, or they continue to consolidate in a wide range.

Amgen is for us the bellwether biotech stock, so it ranks very high on our watchlist for top stocks in 2019.

Amgen has been very resilient, remarkably, during the Q4 2018 downturn. We would even say it’s impressive. Intuitively, one would like to get long in the stocks that were resilient during a turmoil. In the case of Amgen we see that it is 5% from secular resistance. Any break above $210 would accelerate the move higher, and generate a new uptrend for biotech. We foresee resistance at $210 though.

Stock Tips for 2019: Canopy Growth (WEED.TO)

We continue to believe that cannabis will be among the outperformers in 2019, as said in great detail in our cannabis forecast for Canadian stocks in 2019.

We consider Canopy Growth, symbol WEED.TO, as the bellwether cannabis stock or the leading indicator in this space. It crashed in October but we said its long term uptrend was intact. Just two weeks ago we said it was decision time in this sector. We identified the $35 level as the line in the sand.

We start seeing evidence that Canopy Growth is decisively going higher. With this we believe the cannabis space will do very well in 2019.

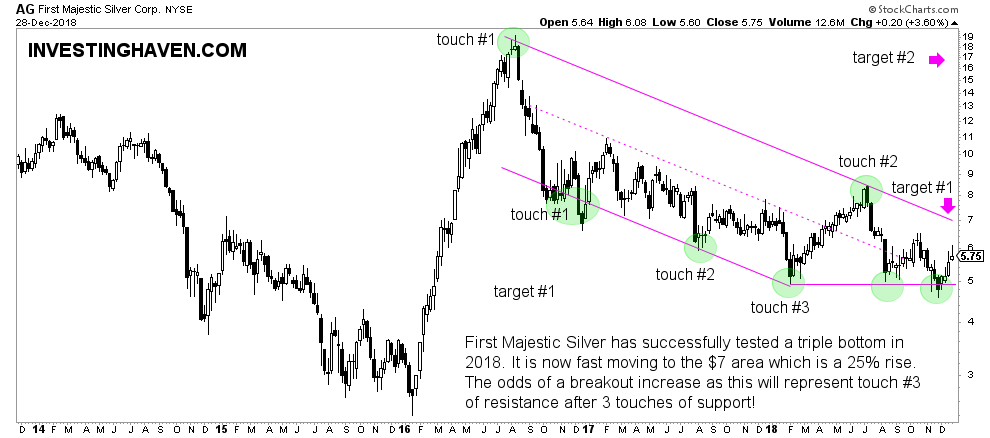

Stock Tips for 2019: First Majestic Silver (AG.TO)

Fourth, the gold and silver mining space, with First Majestic Silver as our bellwether stock for this sector.

Our silver stocks forecast for 2019 featured a very informative chart: the silver stocks to S&P 500 ratio, and an amazing breakout which we spotted last week. Driven by a great precious metals outlook which we have detailed in our gold forecast 2019 as well as silver forecast 2019 we see silver miners go much higher in 2019.

The fundamentals and financials confirm, fundamentally, our vision that First Majestic Silver’s stock price will provide serious leverage with every cent that the silver price goes up in 2019. Moreover, as we expect silver to move towards $17 as a base case and $20 as a bullish case we believe returns on First Majestic Silver will be enormous. Read more in our First Majestic Silver Stock Forecast for 2019.

Note that we include the weekly chart, as opposed to the monthly which we choose in the previous stock tips, because First Majestic does not have such a long history.

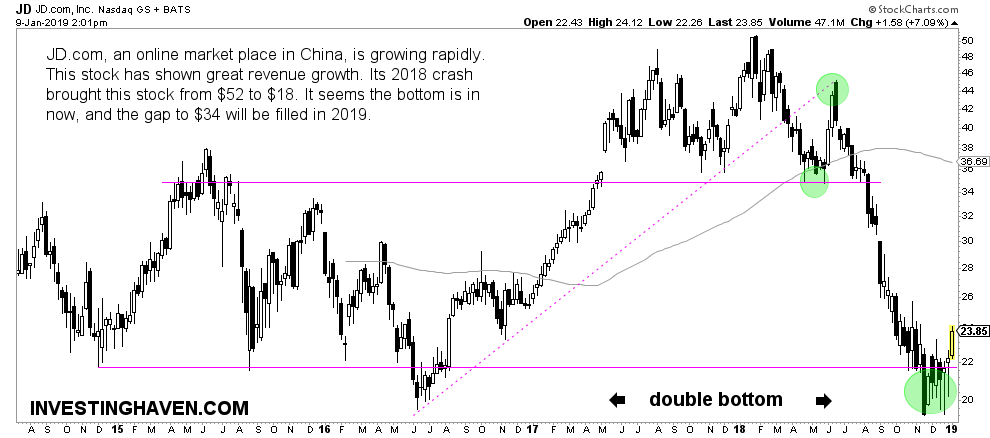

Stock Tips for 2019: JD.com (JD)

Last but not least, China tech stocks are very high on our watchlist as they crashed so hard that they must recover significantly in 2019. This is in line with our China Stock Market Forecast 2019.

Many may argue that JD is a stock to avoid, we say the opposite. Because of the fact that it crashed in 2018 from $52 to $18, a 52% decline, with solid fundamentals, it is oversold. That’s the type of enticing opportunity we are looking for!

Chart-wise, we now see a major double bottom. This may suggest that a long lasting bottom is in. If that’s the case we expect the gap to $34 to be filled in 2019.