Our Aurora Cannabis stock forecast for 2019 may not seem realistic but it really is a very rational forecast. It is based on the chart of Aurora Cannabis (ACB.TO) combined with industry strength. We derive a major top of $75. It might come in 2019 or 2020. Our Aurora Cannabis stock forecast for 2019 or 2020 is $75 which would mark a major top.

[Ed. note: This article about our Aurora Cannabis stock forecast for 2019 was originally published on February 8th, 2019. Readers can verify this by checking the dates on the charts. We will frequently update our initial Aurora Cannabis stock forecast in 2019 and even beyond. The new updates will appear at the bottom of the current forecast. Followers can track how our initial forecast will perform. Last update of our Aurora Cannabis stock forecast: March 16th, 2019.]

Note that we consistently published bullish forecasts on top cannabis stocks: Canopy Growth stock forecast for 2019, Aurora Cannabis stock forecast for 2019, Canadian cannabis stocks forecast. These are not meant to exaggerate in any way even though the forecasted prices may look exaggerated at first glance. This is just meant to identify reasonable price targets in a market that is set to become ultra hot in 2019 and 2020.

Aurora Cannabis: Very Popular in Financial Media

Every financial site that covers cannabis stocks has Aurora Cannabis listed.

More interestingly, though, what we continuously see is Aurora Cannabis being top of the favorites in the cannabis stock sector. This quote illustrates what we are saying, and there must be a reason why Aurora Cannabis is so popular among analysts.

Azer was upbeat on Aurora before the news, calling it not only her No. 1 pick in cannabis, but also her third favorite idea in all her coverage. Yet she thinks the alliance will bear even more fruit. She reiterated an Outperform rating and $14 price target on the Canadian shares.

In this article we will look for factual evidence why Aurora Cannabis deserves a top spot among favorite cannabis stocks. We should not rely on what others say, we always have to verify the facts ourselves.

Aurora Cannabis Stock Forecast Based on Momentum in the Sector

Moreover, and more importantly, we will use the charts to tell us what a realistic price target is. In the same exercise we want to find out what a (very) bullish price target may be.

The reason being that cannabis stocks are ultra volatile, they tend to rise strongly once every 12 to 18 months. During periods of momentum there is mostly a blow-off top which smart investors try to catch. We as well want to catch the next blow-off top especially if Aurora Cannabis turns out to be a top favorite stock in the cannabis space.

As per our 100 investing tips for successful investing:

For peace of mind investors should have a handful of price points that they track in the big picture market trend. Moreover, it is monthly closes that are important to determine dominant trends. This allows for more controlled investing decisions.

Let’s match the financials and fundamentals with those critical price points on the chart of Aurora Cannabis.

Is A Bullish Aurora Cannabis Stock Forecast Justified?

It of course all starts with the legalization of cannabis in Canada. On October 17th, 2018, Canada legalized the usage of cannabis. This led to a major boom in Canadian cannabis stocks prior to the event.

The next phase in this boom market is the Hemp Farming Act of 2018. As per Wikipedia this is an act that was a proposed law to remove hemp (defined as cannabis with less than 0.3% THC) from Schedule I controlled substances and making it an ordinary agricultural commodity. Its provisions were incorporated in the 2018 United States farm bill that became law on December 20, 2018.

Forbes wrote a good piece about this, and it is worth reading. The conclusion from this article:

This bill offers a legal new path to growth for cannabis producers in the US. By some estimates, the CBD market is already a billion-dollar industry in the US. Passage of this bill opens the door for that market to greatly expand, offering revenue growth, funding for R&D and new products for consumers. And for the first time in a long time, I can say that (some) cannabis is legal in the US.

Financials for our Aurora Cannabis Stock Forecast 2019

This a list of top level financials for Aurora Cannabis:

- Market cap: $10.2B

- P/E: 85.8x

- Price/Sales: 134x

- Diluted EPS: 0.29

- Cash: $494M

- Short % of shares outstanding: 3.7%

- Long term debt of $200M maturing in 2021

What stands out is the very high readings in P/E and Price/Sales, the high cash level as well as the high debt level.

Year-on-year, the revenue is rising very fast while with the recent earnings losses rose too fast as well.

On the first point (high P/E and Price/Sales) this is typical in very fast growing companies where revenue rises and earnings cannot keep track with it. We remember Amazon with similar readings a couple of years ago. We are not too concerned about this given the highly unusual and disruptive state of this market.

On the second point (high cash level) this of course is great. It offsets the debt and creates a buffer to support the fast growth.

On the third point (high debt level) we believe it is justified in case the money is well spent. If a loan results in a decent revenue stream it is a good thing from an economic perspective.

Capacity Growth as a Key Metric for Aurora’s Cannabis Stock Forecast

Given the above items we believe revenue growth is one of the most important metrics to consider for our Aurora Cannabis stock forecast for 2019 and beyond.

Related to this is the production capacity and production capacity growth. That’s because in the first place the revenue will be created by selling quality cannabis to international markets.

This is what we see in the latest earnings release:

Based on preliminary (unaudited) results, the Company anticipates revenues for Q2 2019 of between $50 million and $55 million (net of excise taxes), compared to $11.7 million for the same quarter in the prior year, and compared to $29.7 million for the previous quarter ended September 30, 2018 . The results reflect an anticipated revenue growth rate in excess of 327% compared to Q2 2018 and in excess of 68% compared to the previous quarter.

Aurora Cannabis continues to ramp its production capacity up from 70,000 kg / annum as reported in November 2018, to approximately 100,000 kg / annum in January 2019. It reaffirms its expectation to achieve at least 150,000 kg / annum of production capacity within the first 3 months of 2019.

What stands out is the second paragraph, especially the info indicated in bold. The growth of the capacity is exactly what we want to see to justify a bullish Aurora Cannabis stock forecast. Their production capacity more than doubles in less than 5 months.

Moreover, as per Wiki, Aurora Cannabis has a strong focus on expansion.

Aurora Cannabis vs other cannabis stocks

To put this into perspective we picked out two other promising producers, and compare their production capacity:

- Organigram (OGI.V), with a market cap of $1B => capacity grows from from 36k kg / year in January of 2019 to 113k/year in Oct 2019. This is a very promising growth rate. It also shows how much larger the one from Aurora Cannabis is.

- Cronos Group, with a market cap of $5B => capacity grows from 40k kg / year currently to 77k kg /year later in 2019.

Both the volume of the capacity as well as the growth rate justifies a bullish Aurora Cannabis stock forecast for 2019 and beyond.

We absolutely want to see continued confirmation of Aurora Cannabis executing on their plan, in their press releases and quarterly earnings reports.

Aurora Cannabis Stock Forecast for 2019: The chart structure

Because of the above mentioned items we believe that a bullish outcome on Aurora’s chart will be justified.

The long term chart of Aurora Cannabis has a very clear and certainly interesting chart structure. It has a rising support line as well as a double top pattern. Moreover, it has a clear trend to make it a triple top.

The current trend in the cannabis market points to a structural underlying deficit in the market. This is based on both the U.S. Hemp act of 2018 as well as the continued supply/demand deficit in Canada. We will know for sure that a breakout on Aurora’s chart is in the making.

Interestingly, the current setup reminds us of the situation in 2016/2017. After the triple top breakout we saw price rising 5x in a matter of 3 months.

Do we anticipate that exactly the same thing will happen? As always, history does not repeat, but it may rhyme. We believe a giant breakout on Aurora’s chart is in the making. It will likely send the stock price many multiples higher.

We set our price target for a major top at $75 in 2020 (the latest 2021). This not an average price for 2019 or 2020, it is more of a blow off top we expect to see. It is based on the 5-fold rise after its breakout similar to the previous 2 instances.

Depending on the market conditions and evolution we may adjust this forecast.

Aurora Cannabis Stock Forecast ased on Relative Strength (update March 16h, 2019)

This last section was update on March 16th, 2019.

We are pleased to see relative strength in Aurora Cannabis compared to its peers. This is exactly what we wanted to see for our Aurora Cannabis stock forecast to materialize in 2019 or 2020. The reason is the triple top breakout which we expect, being the main thesis for our investing opportunity and forecast.

First, the latest-and-greatest stock chart which shows the current situation at the time of writing vs. the setup 6 weeks ago (original post above).

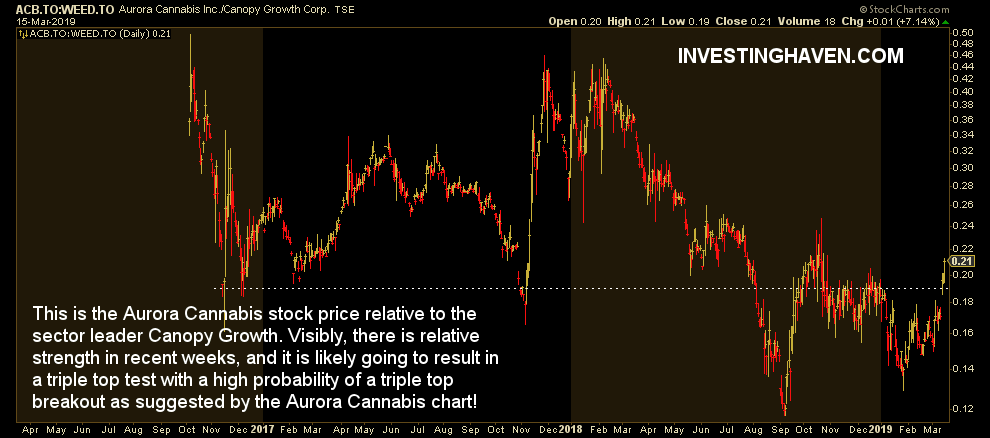

Below is the Aurora Cannabis stock price relative to the sector leader Canopy Growth (WEED.TO).

There is relative strength in recent weeks. This is likely going to result in the triple top test with a high probability of a triple top breakout as explained on the chart above.