BlackBerry (BB), a forgotten tech stock has transformed itself into a hidden gem. It is now a cybersecurity stock. A year ago we wrote this piece BlackBerry: Hidden Gem Stock With Bullish Outlook For 2018 And 2019 and it certainly is still relevant, even more relevant than ever. In fact our forecast from last year is now being confirmed in the last quarterly earnings report. BlackBerry, a hidden gem, is about to a fast growing tech stock, and certainly deserves a spot in our top tech stocks of 2019.

BlackBerry Tech Stock: From Forgotten Mobile Stock To Fast Growing Cybersecurity Stock

Under Chief Executive Officer John Chen, BlackBerry left its phone-making days behind, pegging its new identity to security software. The company offers a range of different product lines, such as systems to manage an entire stable of mobile phones, or to let cars securely update their entertainment systems.

This is how Reuters start its piece on BlackBerry’s quarterly results published on Thursday: BlackBerry Ltd beat estimates for quarterly profit and forecast fiscal 2020 revenue above analysts’ expectations on Friday as its focus on fast-growing markets like autonomous cars and cybersecurity pays off, sending its shares up as much as 15 percent on Friday.

Revenue from BlackBerry’s technology and solutions segment rose nearly 20 percent in the quarter, supported by the company’s focus on QNX, a software used by carmakers to provide infotainment and other services to customers. QNX is used in more than 120 million cars worldwide.“We are winning the lion’s share of the deals” in the market for embedded software in auto, CEO John Chen told Reuters.

These are 2 interesting nuggets about BlackBerry which characterizes how the company has evolved from a mobile device maker into a cybersecurity company:

- BlackBerry currently has over 100 patents in application, with more from Cylance, a cybersecurity company it bought for $1.4 billion in February.

- Licensing and intellectual property revenue was $99 million in the quarter.

BlackBerry’s Quarterly Results

- Net income was $51 million, or 8 cents a share, in the quarter to Feb. 28. This compares to a loss of $10 million, or 6 cents a share, in the same period a year ago.

- Adjusted EPS was 11 cents, above the FactSet consensus of 6 cents.

- Revenue rose to $255 million from $233 million, above the FactSet consensus of $241.1 million, as a 15% decline in enterprise software and services revenue to $92 million was offset by a 71% jump in licensing, IP and other revenue to $99 million and 20% growth in technology solutions revenue to $55 million.

As per Bloomberg which summarized the data points from the quarterly announcement: BlackBerry expects revenue to grow between 23 percent and 27 percent in fiscal year 2020, driven by a double-digit increase in billings.

- BlackBerry’s BTS segment, which includes its autonomous vehicle technology, is set to grow faster than the company’s content management software business.

- “Everybody’s interested in creating connected vehicles or autonomous vehicles or self-driving vehicles — and it’s not only cars. It parallels efforts going on in trucks and planes and drones,” he said in an interview. So while content management is a more stable market, with “the autonomous side of the equation, the market is just taking off.”

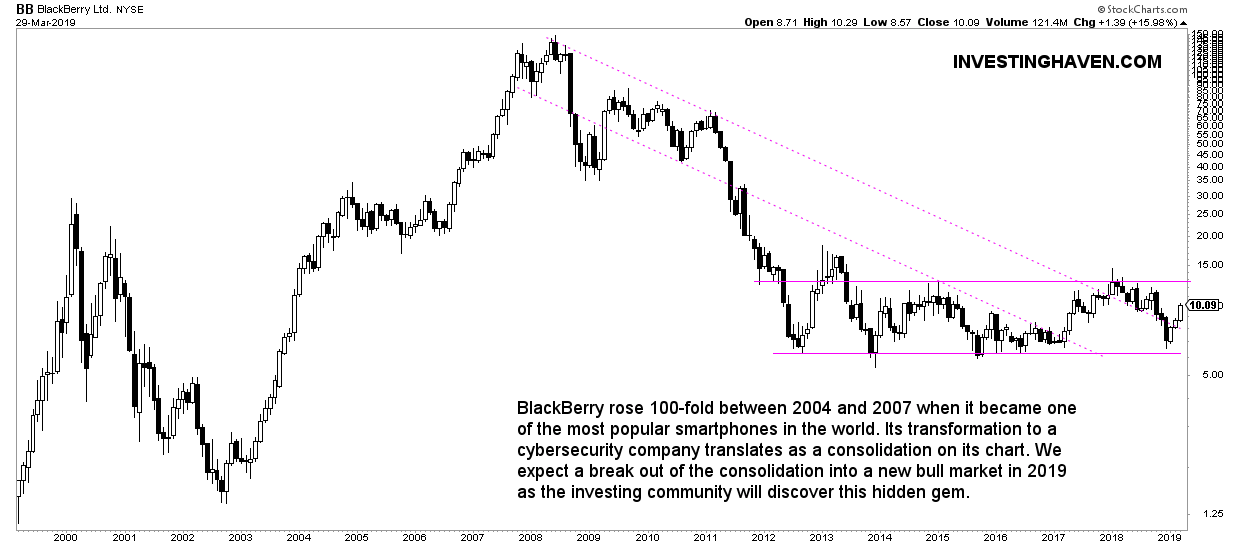

BlackBerry: Great Chart Setup, Pressure Cooker

BlackBerry rose 100-fold between 2004 and 2007 when it became one of the most popular smartphones in the world. Its transformation to a cybersecurity company translates as a consolidation on its chart. We expect a break out of the consolidation into a new bull market in 2019 as the investing community will discover this hidden gem.