It is getting tight in the cannabis sector. Our Cannabis Stocks in Canada forecast for 2019 was very bullish but in recent weeks the market went against our forecast. No harm done yet, but this sector has to recover otherwise it might invalidate our forecast. The cannabis sector is now trading at a major point of support.

On the day of the cannabis legalization in Canada, i.e. October 17th 2018, there was a rush in the country, and it came with a big sell-off in the stock prices of most cannabis stocks.

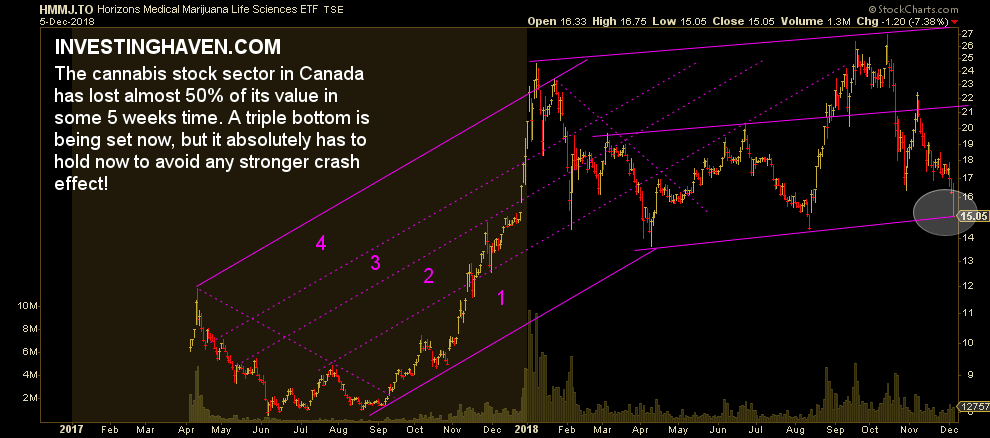

That’s the day when we wrote that the HMMJ ETF representing cannabis stocks in North America had a consolidation at the breakout point of its January 2018 highs. We considered it a very normal process, and said it to be a classic buy-the-dip opportunity unless prices would fall below support which came in at $21.50.

The sector did fall below support, even if we did not anticipate this to happen.

We wrote: “Only a sustained break below $21.50 would make us reconsider our thoughts.”

We also wrote: “For now, InvestingHaven sits in the bullish camp.”

So, that said, what do we make out of it, and is it justified to continue to be bullish?

Right now, we see a triple bottom being set. This one absolutely has to hold now to avoid any stronger crash effect! This is decision time in the sector.

What certainly will not help, from an intermarket dynamics point of view, is continued selling in the broad indexes. The fact that the cannabis sector sold off is really largely related to the risk-off sentiment in broad markets. Cannabis tends to thrive during risk-on cycles in markets.

So we continue to look at the HMMJ ETF, and especially the 15 point level, combined with the broad indexes, especially S&P 500 at 2600 points. Both will determine if this is a major buy opportunity in cannabis or start of something worse.