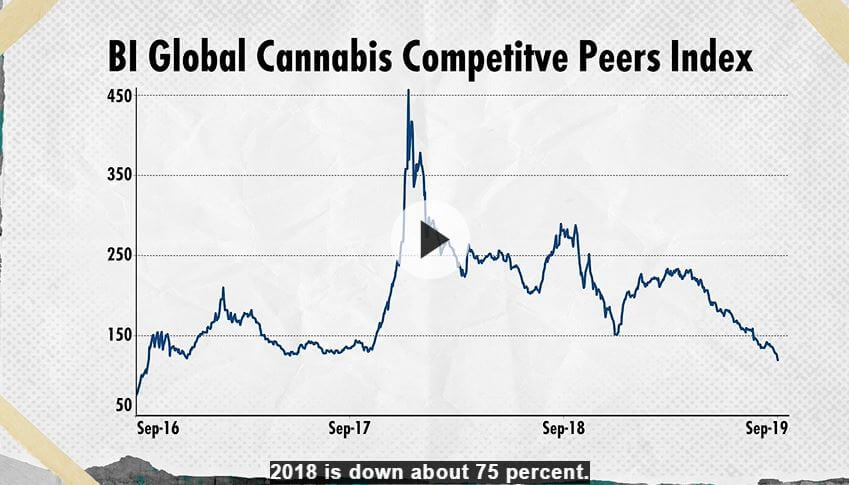

It has been a crazy ride in the cannabis stock market in the last 16 months. After the September 2018 peak the BI global cannabis competitive peers index lost more than 60 pct. Since the highs of April 2019 it lost some 40 pct. The index is back to levels of 2016. What does this mean, and what to expect going forward?

It all started last summer with a big rally which got stopped cold in October last year. Starting January of this year the whole cannabis space went up like crazy, but got stopped cold again in May of this year.

Since May of 2019 the cannabis space is going downhill, aggressively, for 6 straight months.

Things were made worse once the precious metals sector started rising: capital was flowing out of cannabis into another volatile sector being precious metals. We even calculated the flow with a back-of-the-envelop calculation: How Long Will Bearish Momentum Continue In Cannabis Stocks?

Let’s face it, our cannabis forecasts published last year did well until April of this year. That’s when things started falling apart.

What we have noticed is a very strong correlation between cannabis stocks and 10 year Treasury Yields. The aggressive sell offs in cannabis in the last 12 months coincided with the strong sell offs in Treasury Yields.

This does not solve our problem, but at least it helps explain what’s happening from an intermarket perspective (where is capital flowing).

From a fundamental perspective the sector is facing some challenges:

- Concerns about the health issues with vape pens have surfaced in recent weeks.

- Growing competition in the space is putting pressure, especially with lots of companies getting access to equity capital.

- The CannTrust scandal was a shocking revelation a few months ago.

- The very disappointing costs of Canopy Growth, early July, the market leader, made things worse.

- Overall regulatory uncertainty did not help.

Moreover, from a financial perspective, investors are getting fed up with the combination of continuously high costs with very often disappointing revenue as well as capital raising through equity offerings.

This led to what we called a hybrid market: Cannabis Market Breaks Down As High Beta Conditions Improve.

The two important quotes from that article:

In the light of improving broad stock conditions, and consequently a great set of conditions for high beta stocks, we believe a select group of cannabis stocks will outperform later in 2019 and going into 2020! We believe select top cannabis stocks offer a buy opportunity right now, not a sell. We believe we are near a major bottom for select cannabis stocks.

And we continued with this one:

Canopy Growth’s breakdown is not representative for the sector, is what we conclude. And this is a very high risk call as we will be criticized if this call appears to be wrong. Still we feel strong about this.

As an illustration we refer to this article: “Quarterly revenue of Aurora Cannabis (ACT.BO) was the largest ever reported for a pot company, and net cannabis revenue of $94.6 million was at the high end of Aurora’s guided range. It also sold 94 per cent more pot than in the previous quarter.”

There is continuous confirmation of the great long term outlook of the sector. However, the ongoing crisis is probably washing out lots of stocks.

So the cannabis market is falling apart into a hybrid market. Consequently we believe that fundamentally and financially strong companies vs the rest that will die.

With such a strong decline we believe a major bottom is near.

However, as we have learned, Treasury Rates should stop falling. The stock market should turn to RISK ON in order for the cannabis decline to come to an end. We explained in great detail the 3 indicators to watch in today’s article Investors Should Watch These 3 Charts In 2020 And 2021

So here is the verdict of the cannabis sector:

- The sector has fallen a lot, and it probably is near a major bottom.

- We will see several stocks continue to fall, while the financially promising stocks turn positive again.

- The turnaround will be there once broad markets turn back to RISK ON. The leading indicator is 10 year Treasury yields.

- We are interested in the cannabis stocks that have proven to grow revenue and control costs with limited shareholder dilution. They will outperform in the future!

We continue to follow this sector closely!