In our China stock forecast 2019 we said that the Chinese stock index SSEC (SSEC) was trading right at secular support. Our assumption was that it would trade there until the end of this year, after which improvement should start, if not it would be a bearish sign. China internet stocks specifically might be an amazing buy in case the bullish scenario unfolds. Can we find any useful insight for this from the China internet stocks vs Nasdaq index correlation?

Let’s first look at this article which was published by Forbes recently. This is a quote from this article which triggered us to look into the China internet stocks vs Nasdaq correlation:

“We definitely like China tech right now because the valuations are attractive when comparing them price-wise to the FANG stocks: Facebook, Amazon, Netflix, and Google. Chinese tech companies are into more things and not total pure-plays so it is not always easy to compare. They’ve all been beaten up because of the trade war.”

So from a valuation perspective China internet stocks have fallen much lower relative to U.S. tech stocks which is one of the two take-aways from below chart.

Now intuitively this makes sense of course as China internet stocks, represented by KWEB ETF (KWEB), started falling in March, and lost 38% top to bottom. So that’s an easy call.

However, does this mean, by default, that China internet stocks are a buy right now? Let’s turn to below chart for this question as well.

The other take-away is related to the question whether China internet stocks are a buy at current levels. That’s where it becomes a bit more tricky to come with a straightforward answer.

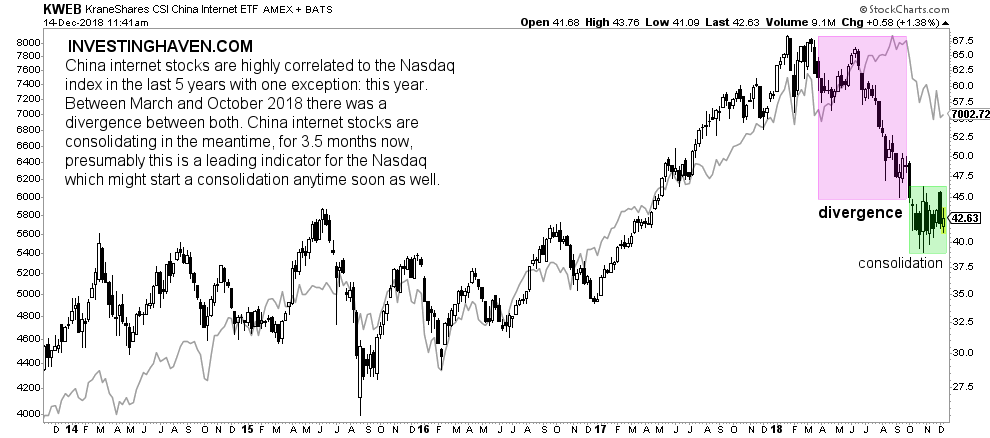

China internet stocks are highly correlated to the Nasdaq index in the last 5 years with one exception: this year. Between March and October 2018 there was a divergence between both. China internet stocks are consolidating in the meantime, for 3.5 months now, presumably this is a leading indicator for the Nasdaq which might start a consolidation anytime soon as well.

In other words, if, and that’s a big IF, both the China stock market index SSEC stabilizes around current levels, and starts showing a first sign of higher lows, it will be very bullish for China internet stocks. However, the Nasdaq index needs to stabilize as well, anytime soon, because of the long term correlation between both. If both conditions are met investors may become very aggressive in buying China internet stocks.