As part of our never-ending mission to identify the TOP 3 investing opportunities per year which deliver mega returns we identified China stocks as a potential candidate. Our China stock market outlook for 2019 was very bullish. But is there much upside potential after the recent rally, especially in China large cap stocks (FXI)?

We vividly remember the time when literally everyone was so bearish on China’s stock market. It was all about trade wars, and financial media was full of it.

Some illustrations from the past:

Trade War Escalates. Stock Markets Shrug. Here’s Why. (New York Times)

China retaliates against new US tariffs as trade war escalates (Financial Times)

Trade war: Trump accuses Beijing of election meddling amid flurry of tariffs (The Guardian)

As said many times news is a lagging indicator. As per our investing tips for successful investing:

News is a lagging indicator, charts patterns are leading indicators!

The chart pattern of China’s stock market suggested a rock solid bottom was in the making. However, a bottom is only rock solid after the facts. So a confirmation is needed, and it requires time. Nobody, including ourselves, can never be 100% sure during a downturn that a bottom is in.

There are leading indicators, and the ones we used was the emerging markets ‘asset class’. The emerging markets outlook based on the leading indicators emerging markets currencies as well as the Euro we suggesting the bottom we mentioned before.

This forecast did prove to be right!

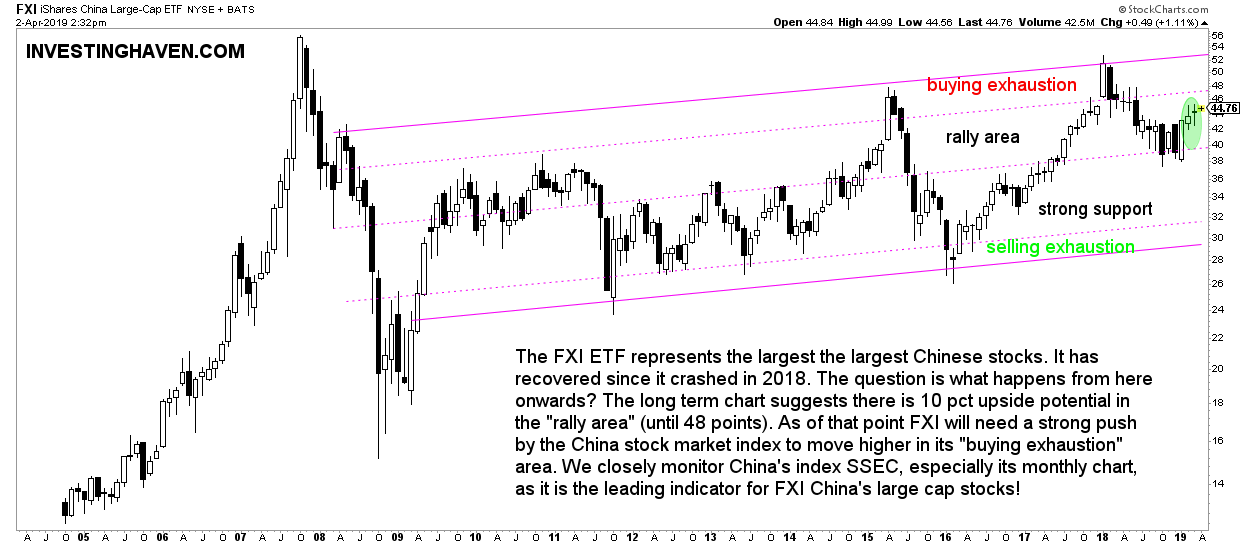

If we look at the current state of things, especially the large cap China stocks, we see the following picture.

The FXI ETF representing the largest the largest Chinese stocks has recovered since it crashed in 2018. The question is what happens from here onwards?

Short term, the monthly chart suggests there is 10 pct upside potential in the “rally area” (until 48 points).

However, as of that point, the FXI will need a strong push by the China stock market index to move higher in its “buying exhaustion” area. We need to closely monitor China’s index SSEC (SSEC), especially its monthly chart, as it is the leading indicator for FXI China’s large cap stocks!

If emerging markets confirm their secular breakout as described in the forecast mentioned above, we expect China’s stock market to go much higher. In that case the FXI ETF will do extremely well. It will certainly move above its 52 secular resistance level. These are the conditions that should not be ignored though.

If and when this situation materializes we will know for sure that China’s large cap stocks will be a strong candidate for a top 3 investing opportunity!