China’s stock market was wildly bullish two weeks ago, with a giant breakout. The breakout was so fast and furious that, logically, it had to come down. That’s what happened last week. What’s next, can we add China to our successful forecasts for the medium term? Is our China stock market outlook for 2020 still in play?

We’ll be very brief about China’s stock market outlook, and we’ll use the Shanghai Composite index (SSEC) for our analysis.

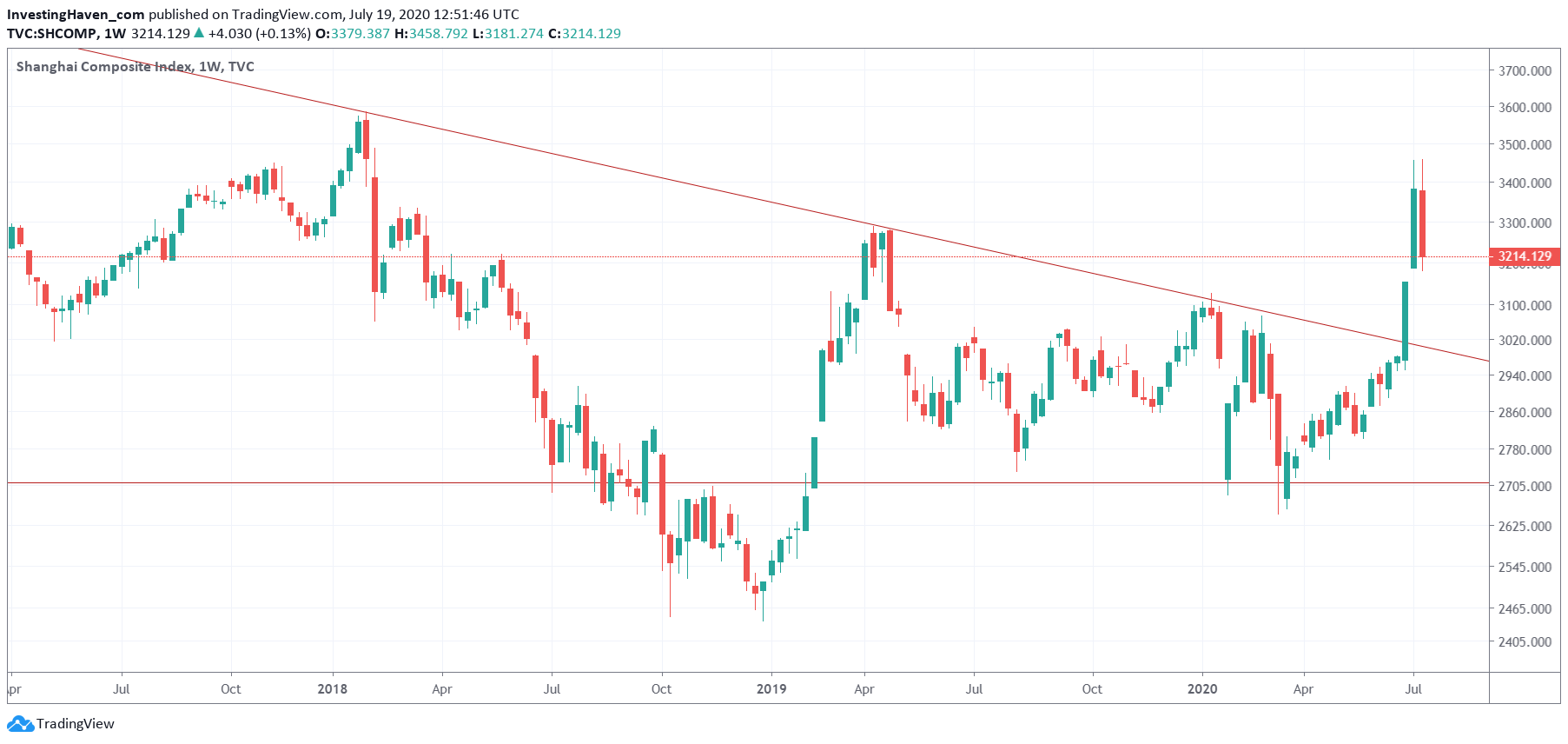

The long term chart (weekly, on 3 years) shows a clear breakout once the SSEC crossed 3,000 points which was 2 weeks and 1 day ago.

The probability of this breakout invalidating (which can happen until the 4th week after the breakout) is now rather small. Anything can happen, but it’s not likely.

Why?

First, because of the ferocity of the breakout.

Second, because last week’s red candle came down to close the week above the opening of the week before.

So the most likely path is one more week of a consolidation, ultimately two, before the uptrend resumes.

Next week will be telling, and we will need the daily chart to ‘sniff’ for bullish (or bearish) signals.

This is the one rule of the thumb: if SSEC will close the next 3 weeks above 3200 points it will rise to 4,500 points (at a minimum).

In our Momentum Investing portfolio we hold one China tech stock which we expect to do very well if the SSEC continues to rise. In fact, we even think that the highest target could be some 70% above current levels. This stock has shown relative strength in the last 9 months against its peers, we are confident it is the right stock pick. All we need is the SSEC and the Nasdaq to continue their bullish trend.