The crypto bull market is set to accelerate going into 2020! Bitcoin may have reached our price target of $11.7k which we communicated to premium crypto members already many weeks ago (through our weekly crypto alerts). The million dollar question is whether this is an important top, and the previous crypto bear market will continue or not. InvestingHaven is on record that the crypto bull market will not only continue, but even accelerate going into 2020. Not just because we flashed on Feb 25th our crypto alert on the new crypto bull market but more importantly because intermarket dynamics give green light for a continuation and acceleration of the crypto bull market into 2020. Yes, this implies we may need to revise our Bitcoin price forecast of $25k upward! It also implies our upcoming cryptocurrency predictions for 2020 may contain some outrageous points.

The focus of InvestingHaven and its research team is forecasting global markets based on solid leading indicators and based on the principle ‘start with the chart’.

What this really means for Bitcoin, and the crypto bull market we anticipate in 2020 need to have some leading indicators that have bullish signals.

Crypto bull market 2020 driven by intermarket dynamics

As explained in our investing methodology we look at financial markets through the lens of intermarket dynamics. Simply said, this is how capital flows from one key asset to another one (with 5 key assets in our view: stocks, commodities, gold, currencies, Treasuries).

In the end financial markets are one big closed loop area in which large investors move capital from risk-on assets like stocks and some currencies to risk-off assets like Treasuries and cash.

So where does Bitcoin and crypto fit in this picture?

It did NOT … until now.

We are sure that capital has really not been flowing out of those 5 key assets into Bitcoin in the past. Why? Do you really see a hedge fund getting a few millions out of a currency position and sending it into their Coinbase account?

The point is this: there was no way for institutional investors to participate in the grand crypto bull market … but this is changing now.

The long-awaited new services that are designed for institutional investors to invest in Bitcoin (BTC), Ethereum (ETH) and XRP (XRP) will start moving significant amounts of capital into and out of crypto markets.

This is new, and is an important fundamental shift in markets, not just crypto markets but all markets.

Note that we are preparing another Medium.com article (similar to this one about BTC futures) in which we will make the point that this new trend will help central bankers create the inflation that they are desperately waiting for so many years!

Leading indicator for the ongoing crypto bull market

That said which is the leading indicator for Bitcoin and the cryptocurrency market in general?

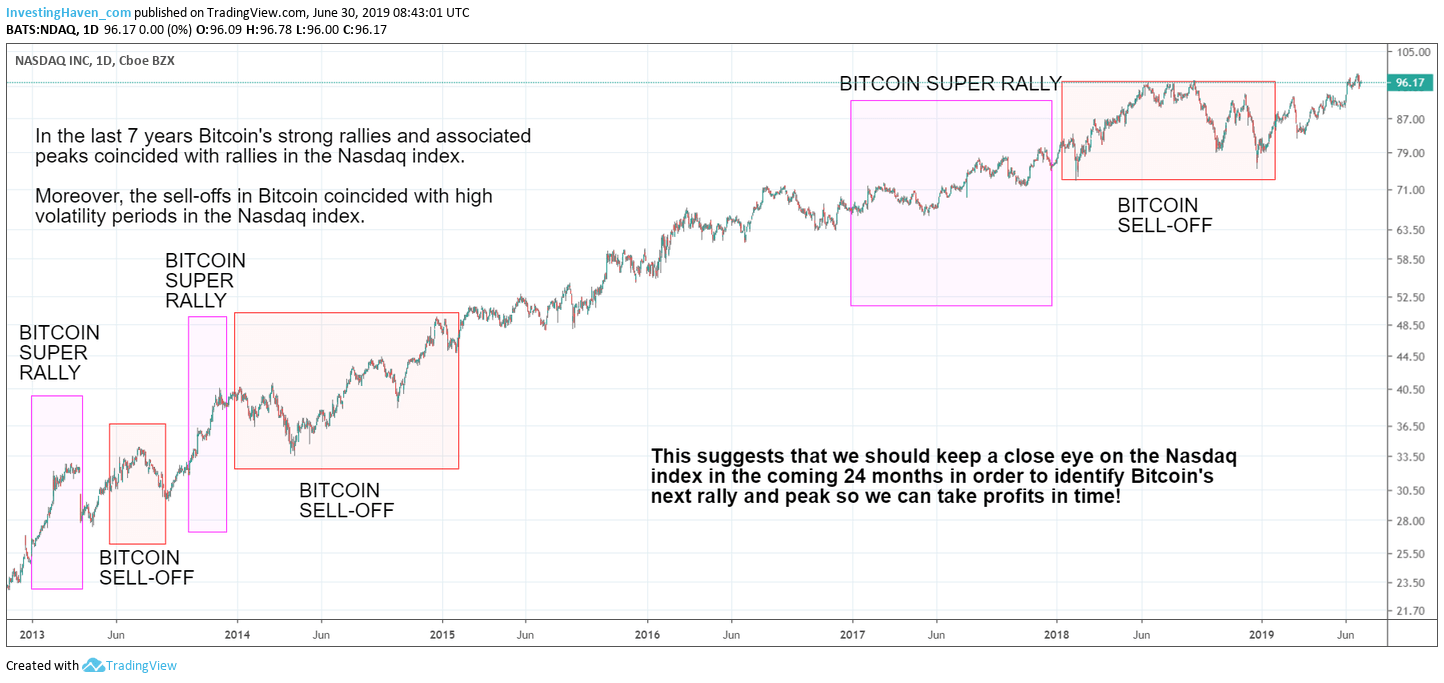

We believe the Nasdaq will play a crucial role, and there has already been signs of this in the last 7 years. Our point of view is that this trend is set to accelerate!

If we look at this long term Nasdaq chart with our proprietary annotations we see the alternating Bitcoin up vs Bitcoin down cycle reflected on the Nasdaq chart.

What we are saying is that Bitcoin has been moving strongly up and down during times of high risk-on vs risk-off in the Nasdaq index.

And with the evolution outlined before (intermarket connection between crypto and broad markets) this correlation is set to accelerate because there will be direct capital flows between these markets.

As seen below the first next trend as part of the cycle is … Nasdaq up. This is also confirmed by our intermarket analysis, and we expect a new risk-on cycle in stock markets to start somewhere NOW. Today’s articles on intermarket analysis feature our viewpoint in great detail with awesome charts:

Euro: Leading Indicator For Global Markets Turning Bullish

Green Light For Global Stock Markets Going Into 2020

If we are proven right this will not only drive but also accelerate Bitcoin’s crypto bull market going into 2020!

Note that we highlight the big picture trend in this chart with below chart. However, we discuss insights and tips on a much shorter timeframe in our premium crypto service in the First Blockchain & Crypto Investing Service In The World. For investors that are looking for exposure in the crypto market but did not get positions in February / March (when we flashed our buy alerts) we have now a series of secondary entry points. By signing up you will discover those secondary entry points in last week’s crypto alert.

Ed. note: the chart below is the type of chart we publish for crypto and blockchain investors. They receive on a weekly basis (at a minimum one) crypto alert with this type of chart. You too can receive them by signing up here, and you will get instant access to all our crypto alerts and unique charts.