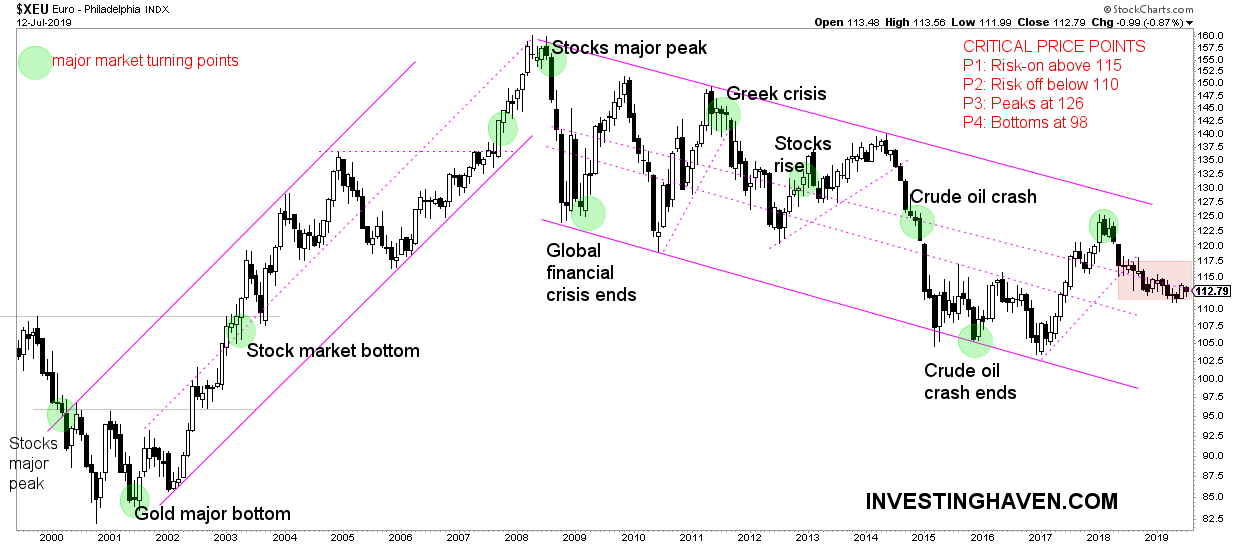

As per our investing method, especially our leading indicators, the Euro has the most important significance for global markets. What this really means is that fast moves in the Euro, especially in the context of its long term chart patterns (mostly long term channels) influence other markets globally. When we did spot the end of Euro’s tactical bear market a few months ago we concluded that it suggests that the Euro, Leading Indicator For Global Markets, Turns Bullish. On top of that insight we now see something remarkable: the Euro is flat for 12 full months. This has not happened before. The otherwise ultra-volatile currency market is now writing history! What does this really mean, and how does it influence our 2019 forecasts as well as our 2020 forecasts?

Because this has never happened before we have to be cautious with our interpretation.

One thing is clear: the monthly Euro chart below has a track record of being ultra volatile. As indicated in light red the last 12 months were as flat as can be. The Euro has been trading in a range of just 5%. Very remarkable.

Why do we care? Because of the following investing principle which is one of our 100 investing tips.

All major moves in markets, especially market crashes, start with major turning points in credit and currency markets. That’s why 10 and 20 year rates, as well as leading currency pairs, have the most influence on all other markets, including stock markets around the globe.

On the question why this is happening we believe we can be very brief. Central banks all over the world, in the first place Europe, are working extremely hard to stimulate economic growth which they do through easing monetary policies.

We can talk about this for hours, and go into the specifics of monetary policies, but why should we care? Why should be try to understand the specifics? All that matters is what impact it creates on markets, and more specifically our portfolios. Along the same lines we are only interested to understand which investing opportunities this creates!

On the question which market trend this will influence going forward we believe we can be very brief.

A flat Euro means there is no downside pressure on risk assets. In other words a flat Euro is supportive of rising stock markets. No coincide that U.S. stocks indexes are moving to all-time highs.

Moreover, over the last 7 years a rising Euro has been strongly correlated to a rising gold price.

A flat Euro is even supportive of rising commodities, or at least it will not put pressure on falling commodity prices.

We believe we are at an important juncture in global markets. We also believe the next trend is clear: stocks strongly up (end of the 18 month flat stock market), gold and silver mildly up (end of the 7 year bear market), mildly bullish commodity market (some commodities might do well, some others flat to bearish).

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 to 6 months. Subscribe to our free newsletter and get premium investing insights in 2019 for free.]