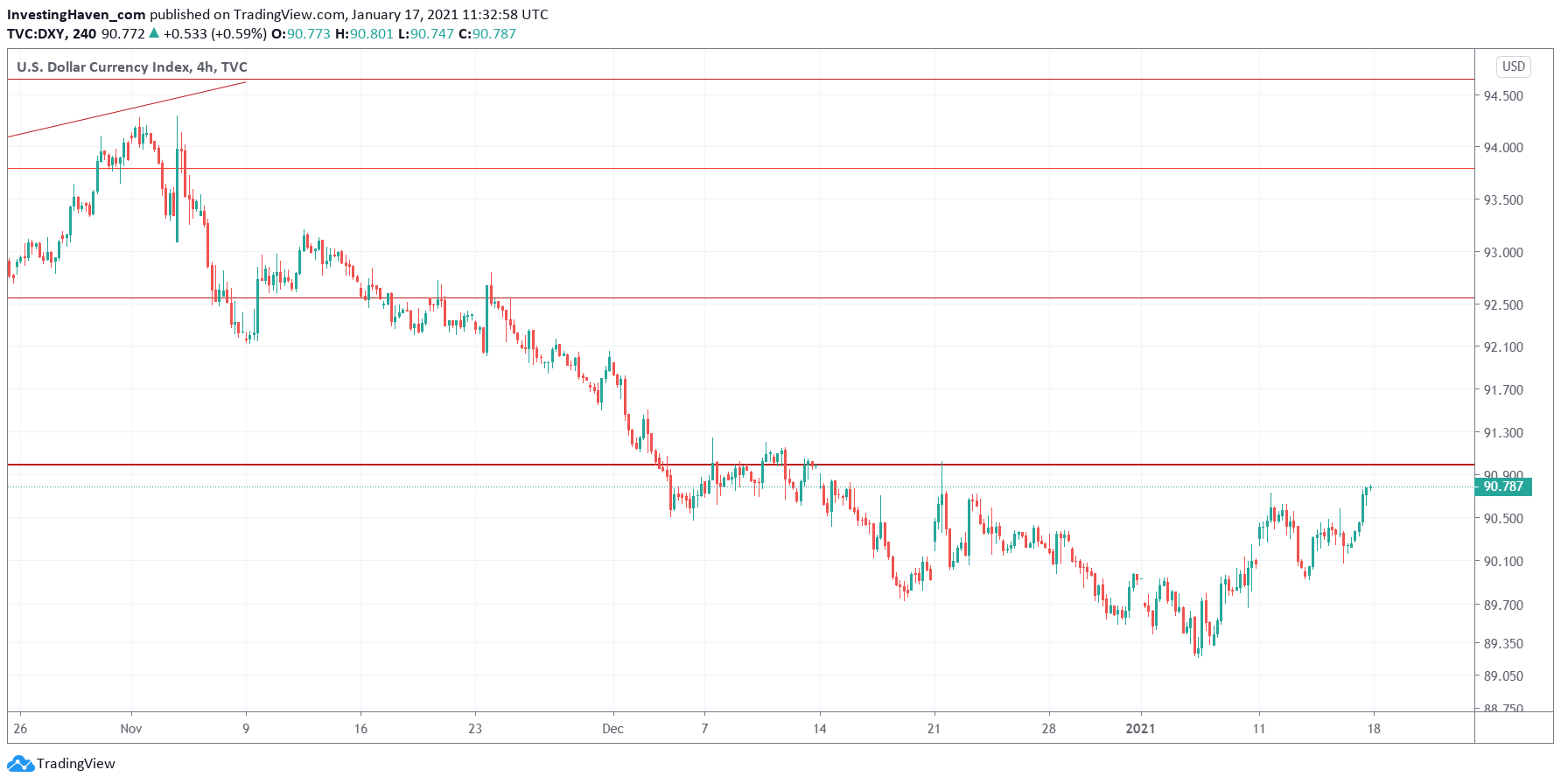

It is happening: the Dollar is back after it was beatend down by the Corona vaccination. After November 9th, the Dollar went in one, and only one direction: down. However, it looks like the Dollar did not give up, on the contrary. It created what we would call a potentially bullish reversal. Our medium term forecast is that the Dollar will bring volatility in February and March, but our longer term 2021 forecast for markets remains bullish. Yes, our Dow Jones bullish forecast may be hit, but we expect even higher stock prices later in 2021 as discussed in our 7 market forecasts for 2021.

From a chart perspective the US Dollar is certainly a beauty.

From a traders’ perspective this is promising as the Dollar about to create short term volatility.

From an investor perspective this is less promising as investors need to ensure (1) that their positions are resistant to a bullish Dollar (e.g., no or minimal precious metals positions) and (2) that they are able to time the market in case the Dollar breaks up (to protect their open positions, or start reducing some of them).

The Dollar chart is certainly eager to move higher, and a first reasonable target is the 92.5-93.0 area. Worst case, the Dollar goes back to 94 points which, if it happens will bring quite some volatility in February.

In terms of timing there is nothing on this chart that tells us it is about to start immediately. The Dollar may need a few more days, or a few more weeks, to do its magic. Timing this breakout, and the impact on stocks and metals, will be the challenge.