In our emerging markets forecast 2019 as well as published 4 months ago we identified current price levels as critical support. As 2019 kicks off we believe the emerging stock markets (EEM) have limited downside. Admittedly, this goes against the perception which is one of catastrophy in emerging markets as said in great detail in our 15 leading indicators and dominant market trends.. Not only the chart pattern but also the correlation with crude oil suggests that the downside is limited in emerging markets in 2019, and why a juicy entry opportunity may be shaping up especially in some of our top 4 emerging markets for 2019.

Emerging markets ‘feel’ bad

Especially in 2016 and 2017 emerging markets were on fire. However, 2018 was a small disaster, and if ‘felt’ worse largely because the U.S. stock market was going up for most part of the year.

It is this ‘feeling’ and ‘perception’ of a market that can be so misleading, and that’s where news headlines really come into play. Look at the following news items from the past few days:

Emerging Markets Seen Bringing More Pain to Investors in 2019 (Bloomberg)

Emerging markets are likely to bring much more pain to investors in 2019 (Economic Times)

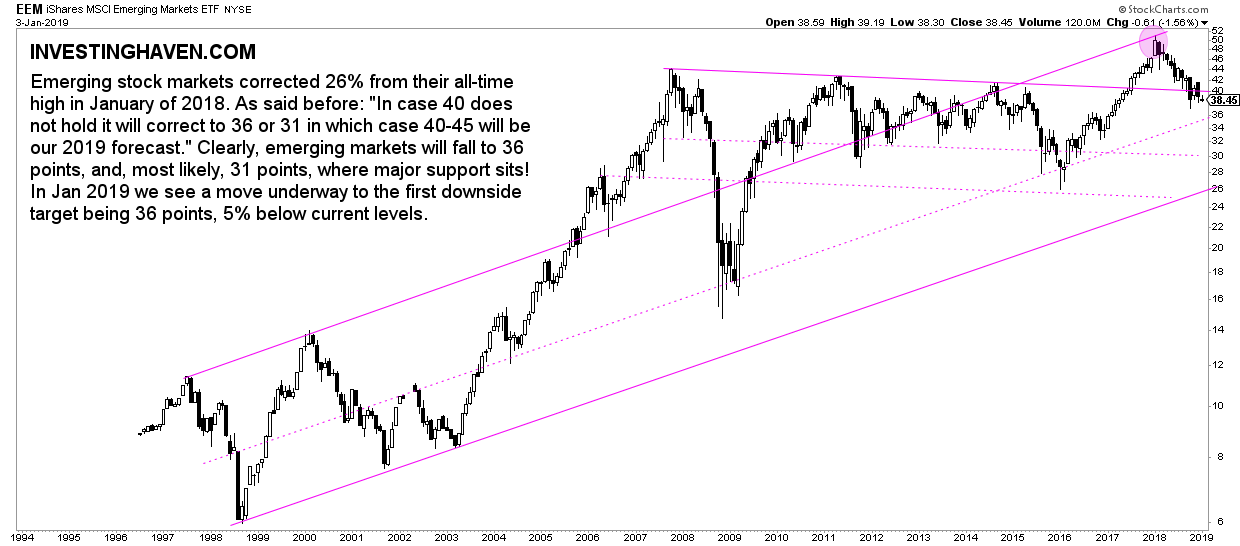

It becomes a different story once looking at the chart(s). As per our method charts are the only way to neutralize feelings, emotions, perceptions and opinions.

So let’s move on to the charts, and not only the emerging markets chart but also one maybe unexpected correlated asset: the chart of crude oil.

Emerging markets chart ‘looks’ good

Last year’s retracement brought the EEM ETF to its breakout level. We said:

This may be a normal retest of a breakout which was 9 years in the making. Note: the energy of a pattern that is in the making for 9 years is significant.

However, if the consolidation continues for a little longer then the 36 level followed by 30 will provide support. In that case emerging markets will hit 40 to 45 in 2019 as they need more time to recover.

More specifically, in terms of price analysis, we identified 40 points on the EEM ETF as the proverbial ‘line in the sand’ for our bullish forecast. We added to it: “Unless the Euro crashes this year we believe that emerging markets will consolidate only to move higher in 2019. If this happens as expected our price target for 2019 will be 52 and, ultimately, 60 in 2020 for EEM ETF.”

How is this playing out now, 4 months after we published our forecast?

The first chart says it all.

Emerging stock markets corrected 26% from their all-time highs in January 2018: from 51 points to 38 points. The chart clearly shows that current levels mark critical support. We mark this as ‘critical’ support because of the fact that the 36 to 38 level is double support. Looking carefully at this chart makes clear how 2 distinct support trend lines coincide here: the horizontal support connecting all-time highs in recent 9 years as well as the median line of the multi-decade rising channel. This is very powerful.

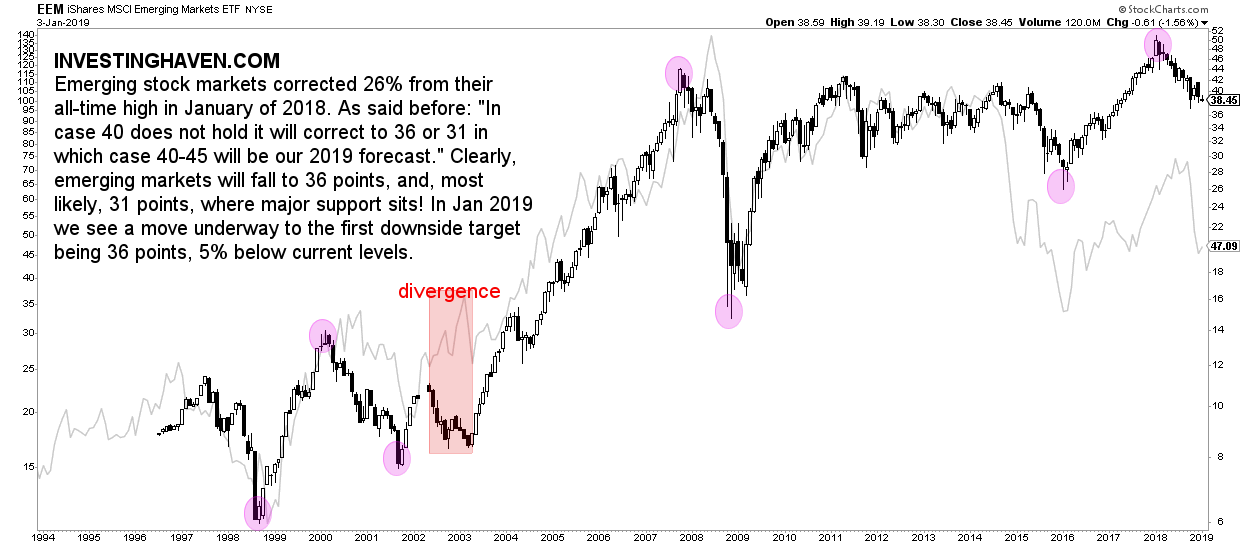

Emerging markets vs crude oil suggest selling may be over

Moreover, and maybe more importantly, emerging markets are strongly correlated to the price of crude oil.

The second chart visualizes our point. Look at this multi-decade time period in which both assets have risen and fallen in tandem.

The price of crude oil has fallen to $43 recently. Although the chart type shown below is not great in forecasting a top or bottom it is clear how much support there is in the lower 40ies on crude’s chart. Moreover, crude fell from $75 to $43 in a matter of weeks, a decline of 43%. Both data points suggest to us that the crude oil decline is largely over.

In other words the crude oil correlation confirms our finding on the emerging markets chart pattern. Both suggest the downside in emerging markets is limited to a couple of percentage points in 2019. This finding is invalidated if and once both assets fall through their critical support levels, with a vengeance, which we consider a probability of less than 5%.

The state of our top 4 emerging markets

Almost half a year ago we published our top 4 emerging markets to watch in 2019: India, Brazil, Thailand, China. Let’s quickly review how they are performing against our forecast:

- India: as said in India Stock Market At Major Decision Point As 2019 Kicks Off there is hardly any trend change in India. On the contrary, this market sits a major multi-decade support. We need another few weeks, ultimately, 2 to 3 months, before we will see a new trend.

- Brazil is the outperformer. It reached all-time highs this week. This looks very bullish for 2019.

- Thailand is setting a lower low in recent weeks. Only if all emerging markets rise will it provide support. It is the weakest of all 4 emerging markets.

- China has sold off heavily, but still against our forecast there was just a 10% decline. China as well sits at major support, a make-or-break level with a decision point is here!

All in all we believe there are major opportunities shaping up in emerging markets, but risk management suggests we must see current levels hold strong as the prerequisite before going long. We estimte the probability at a minimum 80% that current levels provide a juicy long term entry point for smart investors!

![[:en]emerging stock markets[:nl]groeimarkten[:]](https://investinghaven.com/wp-content/uploads/2017/05/emerging_stock_markets.jpg)