Our emerging markets forecast 2019 published 4 months ago identified critical price levels in order for emerging markets to be bullish in 2019. Our price levels were spot-on, and this week it seems that a breakout is taking place. This suggests that, per our forecast, emerging markets will be bullish in 2019. The right way to pick outperformers is to focus on the top 4 emerging markets we identified earlier.

Let’s recap what we said before:

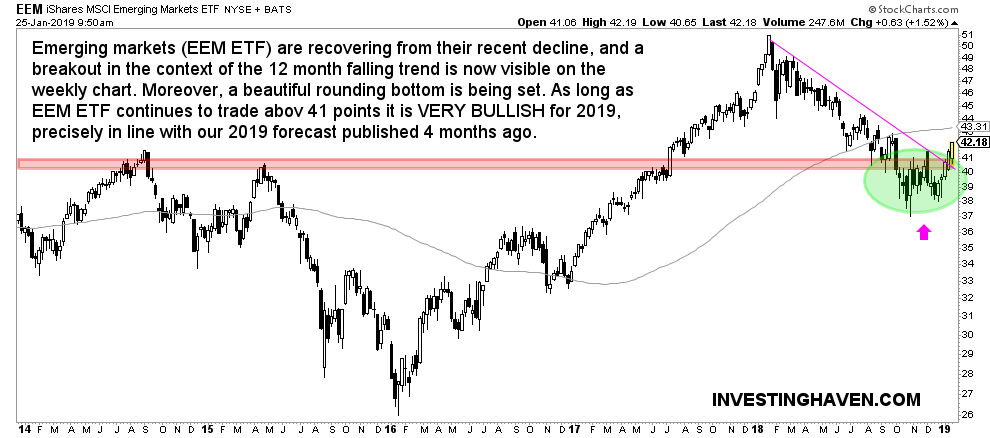

The 2018 retracement brought the EEM ETF to its secular breakout level. This may be a normal retest of a breakout which was 9 years in the making. Unless the Euro crashes this year we believe that emerging markets will consolidate only to move higher in 2019. If this happens as expected our price target for 2019 will be 52 and, ultimately, 60 in 2020 for EEM ETF. Where is the line in the sand for our bullish forecast: EEM ETF 40 points must hold, emerging markets currencies should trade above 17.60, the Euro should not crash.

The Euro did hold strong and emerging markets currencies as well. Readers are able to continuously track these key assets in our 15 leading indicators overview. There was strong support both for the Euro as well as emerging currencies.

What do we spot on the emerging markets chart right now?

Emerging markets (EEM ETF) are recovering from their recent decline, and a breakout in the context of the 12 month falling trend is now visible on the weekly chart. Moreover, a beautiful rounding bottom is being set.

As long as EEM ETF continues to trade abov 41 points it is VERY BULLISH for 2019, precisely in line with our 2019 forecast published 4 months ago.