Emerging stock markets (EEM) have sold off in recent days and weeks. In 2018 they lost 22% as a group in the emerging stock markets ETF EEM. Is this just the start or the end of the decline? What happened with the bull market breakout of emerging stock markets in 2018?

Let’s first go back to our thoughts earlier in 2018. This is not meant to pride ourselves but only to challenge our own thoughts and observations as they are all published in the public domain. It’s the ultimate challenge that an analyst team like the one behind InvestingHaven can subscribe to.

Early January of this year we published It’s Official: Emerging Markets New Major Bull Market In 2018 Is Now Confirmed. That’s when the EEM ETF cleared former all-time highs at 45 points.

Emerging stock markets continued to rise for a couple of weeks only to turn south since then. The question becomes: was this the worst market call that any analyst on earth could make? Or is this market call still relevant?

We argue the latter is the case, and we started writing about this in June of this year:

Emerging Markets Kissing Secular Support, Likely Bullish in 2018 (July 2018)

Emerging Markets Weak: Buy Or Sell In 2018? (June 2018)

Emerging stock markets: bull market breakout test of 2018 ongoing

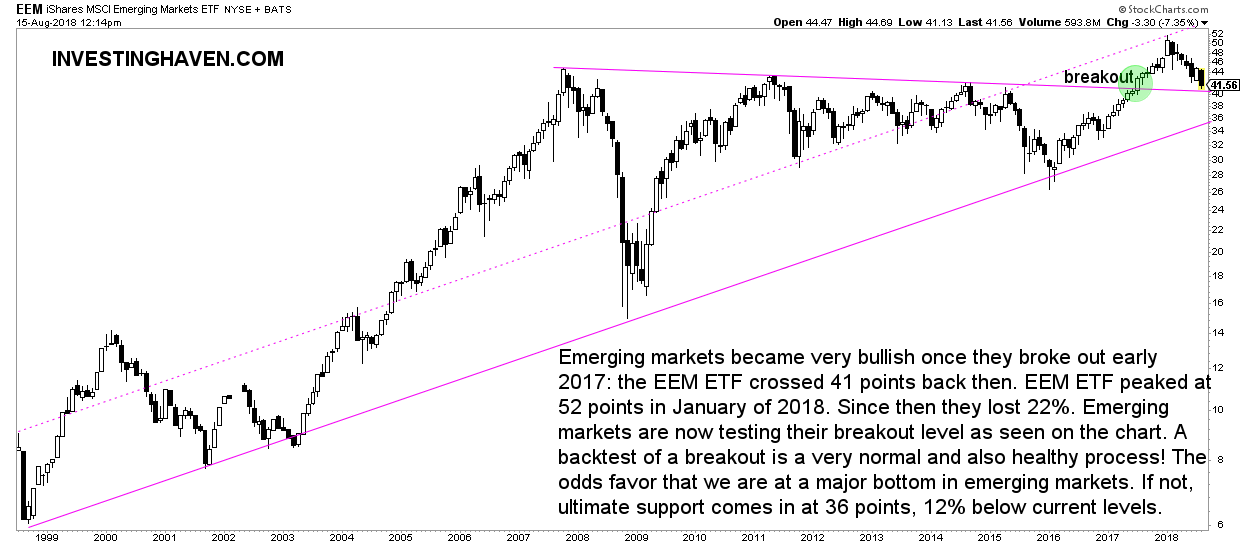

The point is that the EEM ETF was clearly in the process of testing its breakout point. What does this mean? Very simple, any breakout on a chart, for instance clearing previous all-time highs, is bullish in nature provided the long term trend is up. After this breakout there is a fair chance that the market falls back to the breakout point. If the decline stops at that point it is wildly bullish! In chart terms: the confirmation of the breakout!

We noticed a retest which is a process and not a moment in time was ongoing when we published our June and July articles.

While the whole world was talking about trade wars, China and US export tariffs, and the likes, we were looking at the breakout retest. The former is the news which is meant to sell advertising by mainstream media sites. The latter is the real world action of market participants visualized on a chart. The latter is the only thing that counts, as per our investing philosophy 99% of the news is noise for investors.

Right now, with the Turkey Stock Market Crash and China’s Stock Market Selloff testing the lowest and most extreme support levels, it is no coincidence that emerging stock markets as a group have reached secular support.

If the decline stops at this point it confirms our wildly bullish outlook and forecast for emerging stock markets in 2019. However, it is a mandatory condition.