Are gold mining stocks bullish now, is one of the most common questions we have heard in recent weeks. This question has become especially relevant since this week as gold miners index close for 3 consecutive weeks above a major bullish breakout level. This article answers the question when exactly gold mining stocks will be bullish. We do this based on our gold forecast 2019, and we conclude with our viewpoint on the top investing opportunities in the precious metals space (which has not changed in recent weeks).

The one, and only one important thing to watch in this phase of the gold market, is the price of gold.

What we are saying is that gold miners may be bullish, silver miners may be even more bullish, the price of silver may have broken out, gold to silver price ratios may have broken out, gold to miners ratios may have the most bullish outlook in many decades …. and gold news may be so bullish that you feel you did not invest all your investable assets in the gold market …. It all does not matter.

All that matters in this stage of the gold market is the price of gold, and its chart pattern.

Pretty simple, right? Too simple to be true?

This implies that followers do not have to look for gold related news, not have to search for gold fundamentals (supply/demand data, China gold imports/exports), economic news (jobs reports, economic data releases), and so on.

All that matters right now in the gold market is one, and only one, price chart: the gold price chart. We published earlier today the weekly gold price chart, and urge gold stock investors to carefully read this: Gold Has A Bullish Bias With Its 2nd Consecutive Weekly Close Above 1400 USD.

As seen on the weekly gold price chart we have a 2nd consecutive weekly close above this so utterly important price level of $1375 to $1400. For the gold market to be, and stay, bullish we want to see at a minimum 3 consecutive weekly closes above $1400. That’s why next week will be so important for the gold market.

Are Gold Mining Stocks Finally Bullish?

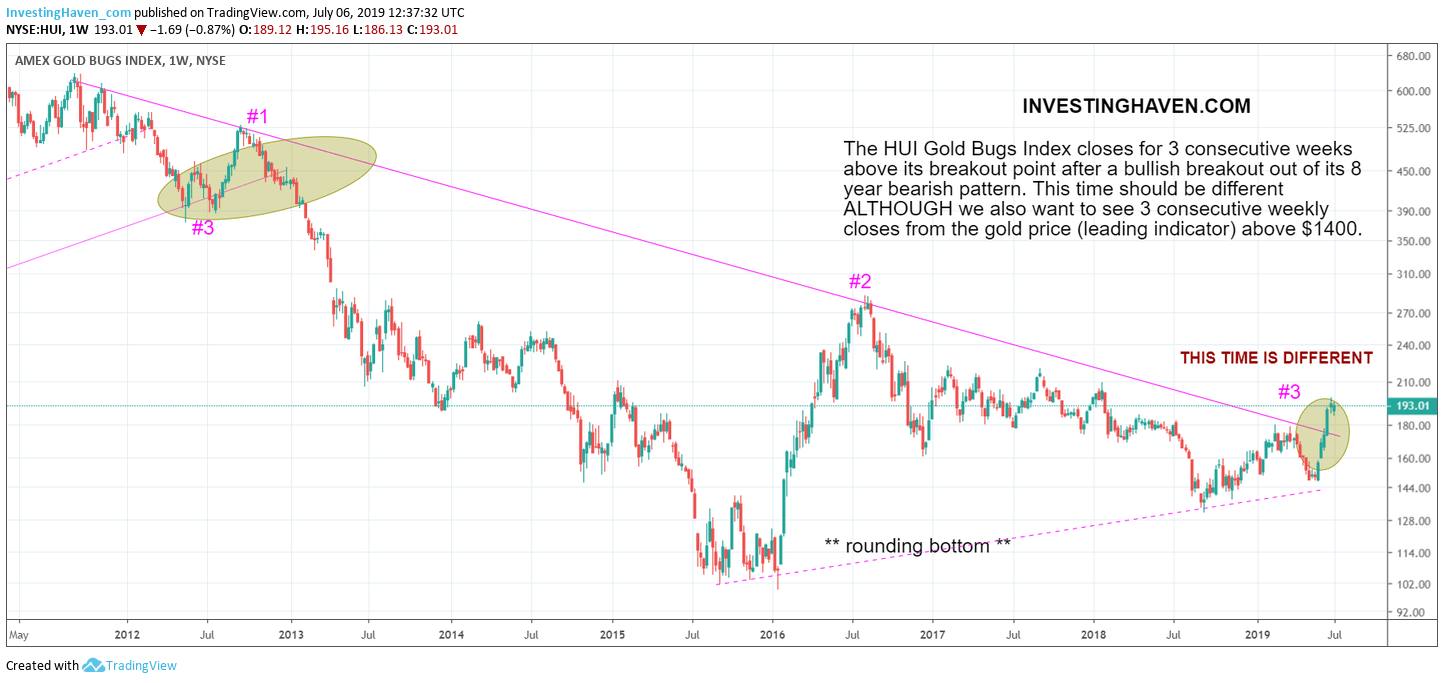

When it comes to the gold mining space we turn our attention to the gold mining stock index HUI.

The weekly gold stocks chart (HUI) we have a 3d consecutive weekly close above the breakout point.

So wait a second: gold miners closed 3 times (on the weekly timeframe) in bull market territory while the gold price closed only twice above its breakout point. What does this mean?

It means that gold miners got ahead of themselves, and may lead the gold price higher … or they may not.

We do not care, we stick to our principles. The price of gold must confirm its bullish breakout, period.

Going forward, what may happen?

The bearish outcome is a sell off below $1375. This will question the validity of the bullish breakout in the gold market, even the whole precious metals market.

The bullish outcome is a continuation of the rise in the gold price to above $1410, and ideally even another 2 weeks above that level would really confirm the breakout!

How to play this market?

Buying the breakout is an option, but you have to sell if the breakout fails. In case the breakout holds it is pretty simple. The best leveraged play is the silver market. As said in Silver Price Breakout: Why This Time Is Different silver is hugely undervalued. We stick to our favorite silver stock First Majestic Silver (AG) as our top pick, and re-iterated our viewpoint today in First Majestic Silver On Its Way To Double In 2019.

For investors that want to have exposure in the gold mining space we would not go into small miners. We prefer to stick to the best gold stocks out there. One of them is Royal Gold which is breaking out today, and we wrote about it in Royal Gold: Giant Breakout Out Of 15-Year Bullish Pattern.