Broad stock markets were down more than 2 pct yesterday, gold stocks were up more than 3 pct yesterday. The price of gold (GOLD) crossed $1300 again, after some 6 weeks. We stick to our bullish gold forecast, and we closely watch gold stocks (GDX) as well because they are now back 10 pct removed from their secular breakout point.

After yesterday one would conclude that gold goes up on fear, and it often does. However, it does not always and not only go up on fear.

That’s the trick with gold investing.

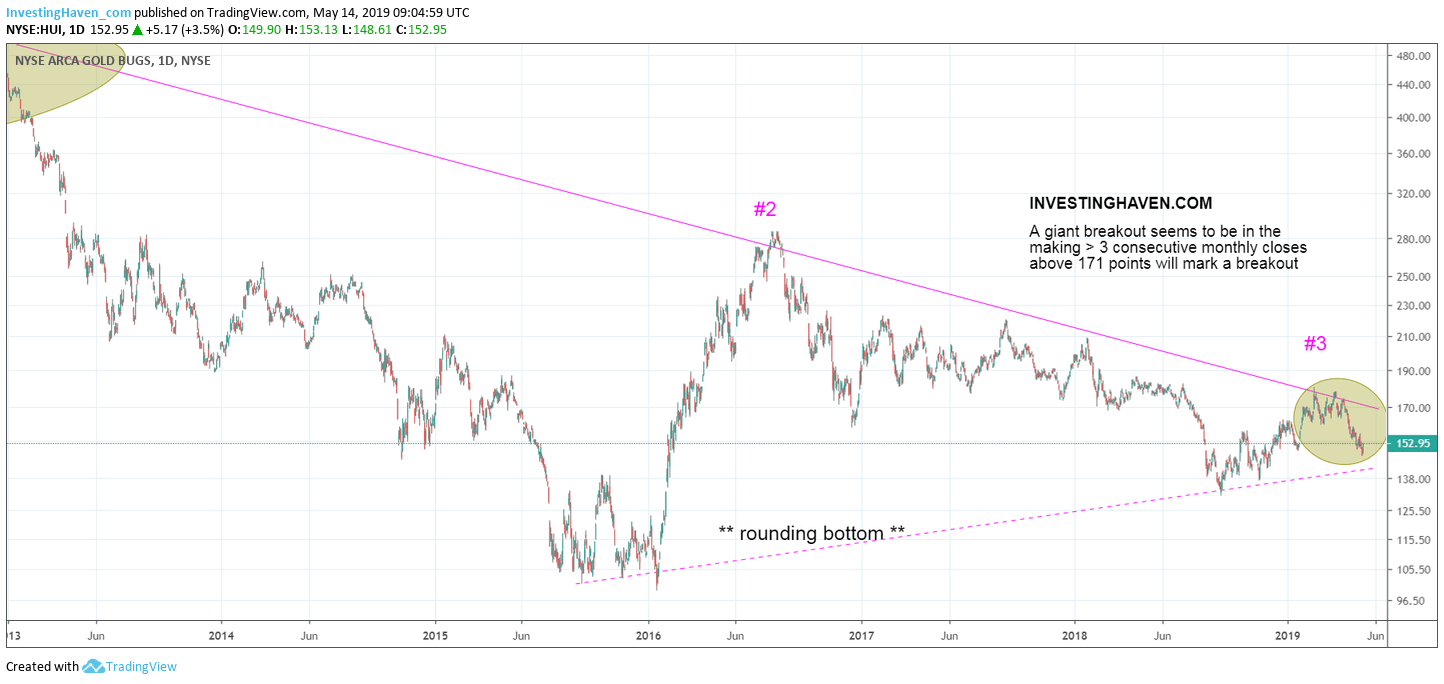

We keep focused on two, and only two, important price levels. First, gold’s price at $1375 is of the highest importance! Second, the gold bugs index HUI at 170 points.

Below is the HUI gold stocks index which, after yesterday’s nice rise of 3 pct, now trades at 152 point. This is 10-ish percent from its crucial 170 point level.

Moreover, the apex of this huge triangle is coming to resolution!

For all of these reasons we want to catch any breakout in gold stocks because they are known to rise ultra-fast once they break out.

This is a classic case where fundamentals do not matter. Investors better do not spend their precious time on checking gold supply/demand statistics, China’s gold reserves, the U.S. Fed’s gold reserves, gold/silver ratio, and so on and so forth. This is all useless against the importance of a coming breakout (or breakdown).

In this type of scenario as we see the gold market in this year there is only one thing that matters: the trend. Once trend changes from a bear market (after 8 years) to a new bull market we expect a first sudden strong rise. That’s what we don’t want to miss, that’s why we spend so many articles on following the gold market.

We still believe the gold market, especially silver stocks, might shape up for one of the top investing opportunities of 2019.