As the whole world believes that China’s economy and China’s stock market (SSEC) is due for a really bad year we see the opposite happening on the charts. In line with our China stock market outlook 2019 China is moving higher. It is now almost back in its bullish area. This is good news for China stock market investors.

Articles like this one “You thought 2018 was bad for China’s stock market? Profit warnings suggest worse may be yet to come.” published on South China Morning Post are the ones that we see all over the place! It creates a perception, and most investors believe China is a bad place to invest in.

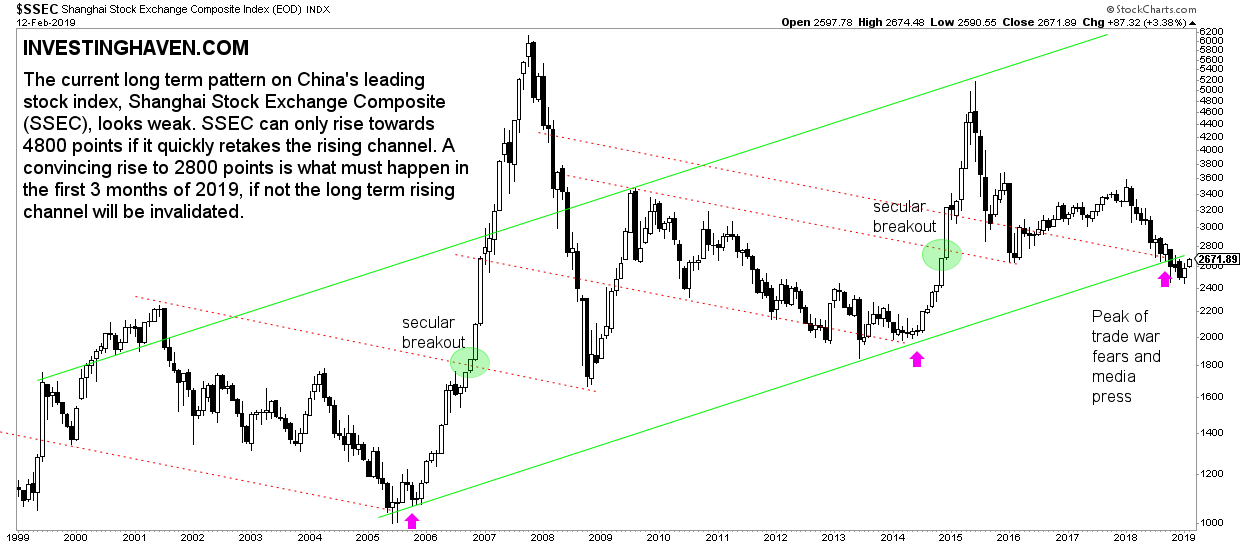

The chart now suggests the opposite is true.

As per our 100 investing tips:

The biggest caveat with new bull markets is that nobody talks about them. They are only visible on monthly and weekly timeframes. That’s where the ‘real market news’ is created. At the time bull markets appear in financial news and media it is already close to the end of the bull market.

Moreover, this investing tip is really relevant as well:

News is a lagging indicator, charts patterns are leading indicators!

As a refresher this is what we wrote 5 (!) months ago:

The Euro, leading indicator, will be a catalyst for China’s stock market and that bad press as a lagging indicator has probably peaked. This implies that hardly anyone believes that China’s stock market can go higher, a great environment for the bull to resume.

That said, with the SSEC chart setup, we are on record with our China stock market outlook of 4800 points in the SSEC for 2019 or 2020, a 73% rise against current levels.

Obviously, this forecast assumes the bearish story does not develop. Stated differently, the SSEC cannot close the coming months below 2600 points. If so, the bearish scenario will play out, though we deem the probability lower than 10 percent.

Indeed, at a time everyone thought it was the end of China’s economy and stock market we said we were close to a major bottom. It now appears we were spot on with our forecast!

The monthly chart of the Shanghai Stock Exchange Composite shows that its price is almost back in its bullish area (rising channel). We have seen a similar situation in 2005 when prices dipped below the bullish channel for a couple of months.

With 2 to 3 monthly closes within the rising channel we have a confirmation that our 4800 target is underway, likely not in 2019 but one or two years later.