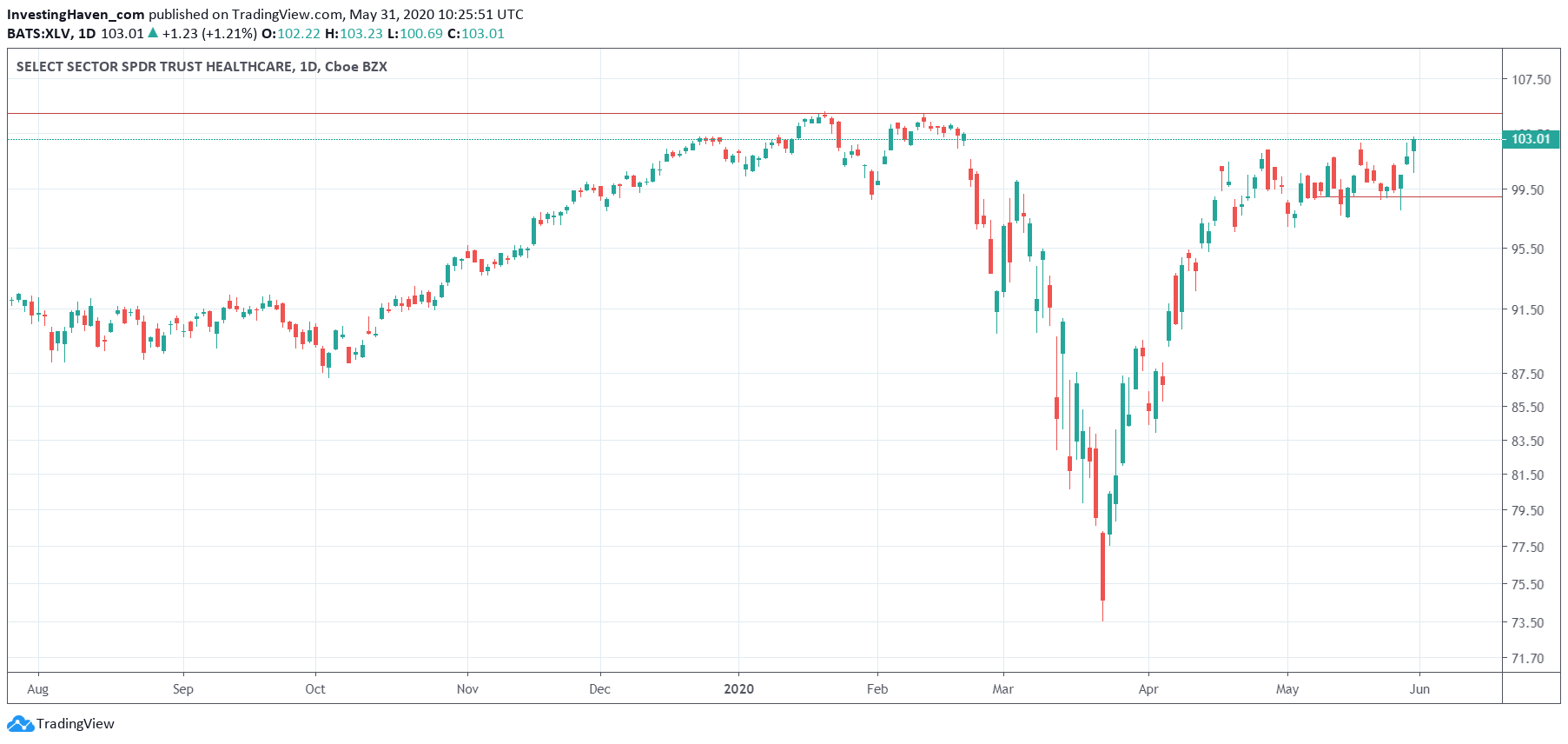

Many stock segments recovered from the Corona crash lows. Some specific segments recovered so fast that they are about to test all time highs. One of the two sectors in that position is the healthcare space. The healthcare stock index XLV is exactly 1.8% below its all time highs. Time to sell or buy this sector?

It is pretty obvious: the XLV ETF shown below (daily hcart) has a very bullish setu for 3 reasons:

- The bounce from its March lows was fast and furious.

- The subsequent short term consolidation has a very strong bullish bias with a series of higher lows in May.

- There is one specific bullish signal on this chart in May that confirms the bullish thesis. It’s a tiny detail, that 99% of chartists even don’t know about. But we know it’s there, and we know this is reliable.

XLV ETF is a very broad sector index. It includes biotech, medical devices, and so many other sub sectors.

We are particularly interested in a few sectors that will do well in 2020 and beyond, not the highflyers but the ‘value’ plays in the healthcare space.

In our Momentum Investing service we currently hold one healthcare stock, since last Monday. We might look to rotate profits into another healthcare stock at a later point in time. Healthcare is a sector we closely follow especially because of the upside potential we see in this sector.