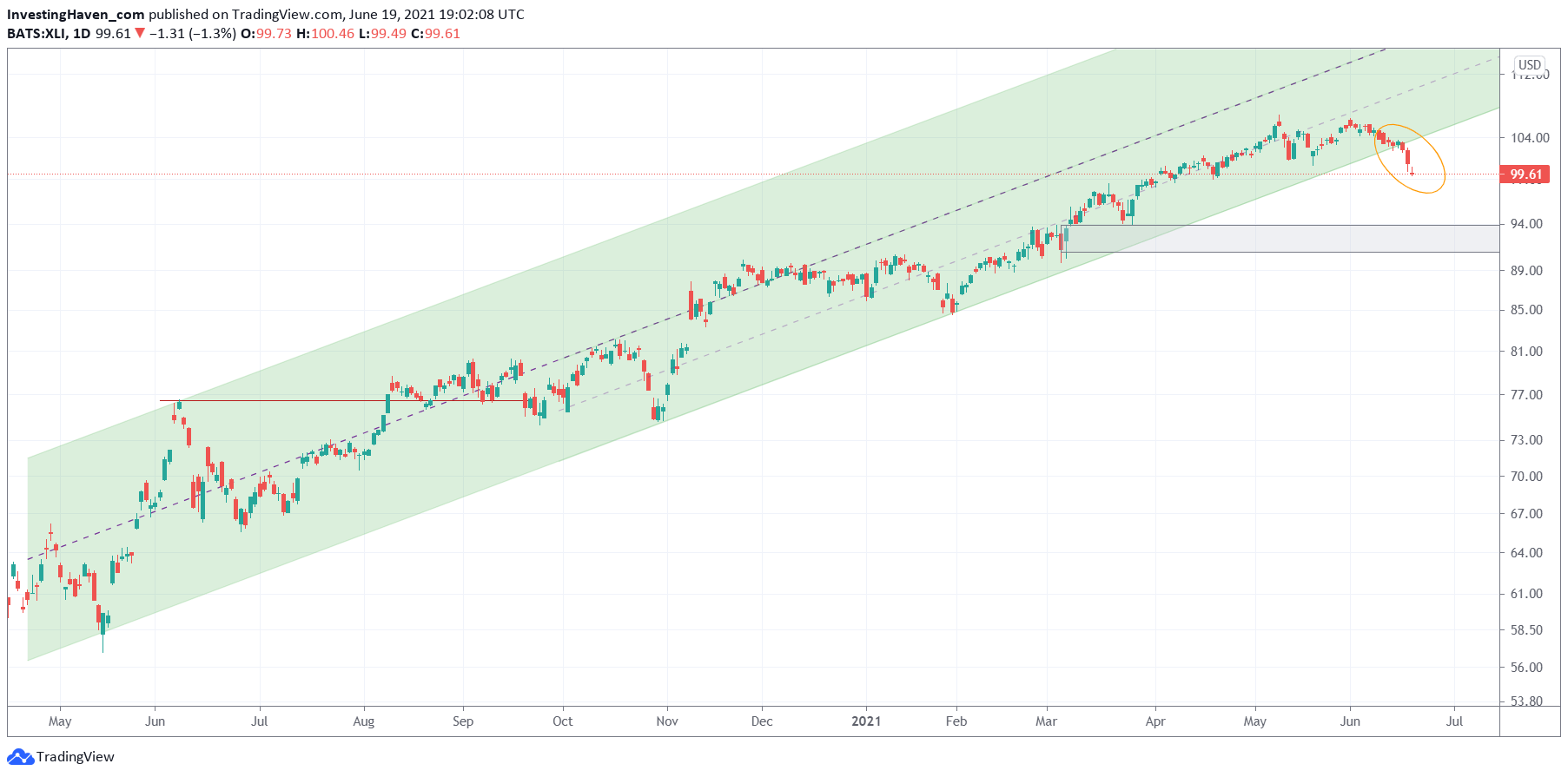

So far the monster rally in industrials and financials. They were the leaders in the bull run that started in November of last year. They are breaking down now. When we say ‘breakdown’ we really big breakdown patterns. We were very excited about both sectors, but we clearly have to change this stance now as we get confirmed sell signals in this sector. In the meantime sector rotation is sending capital to tech stocks and biotech stocks.

Capital flows from market to market. Sector rotation is certainly more present than ever before.

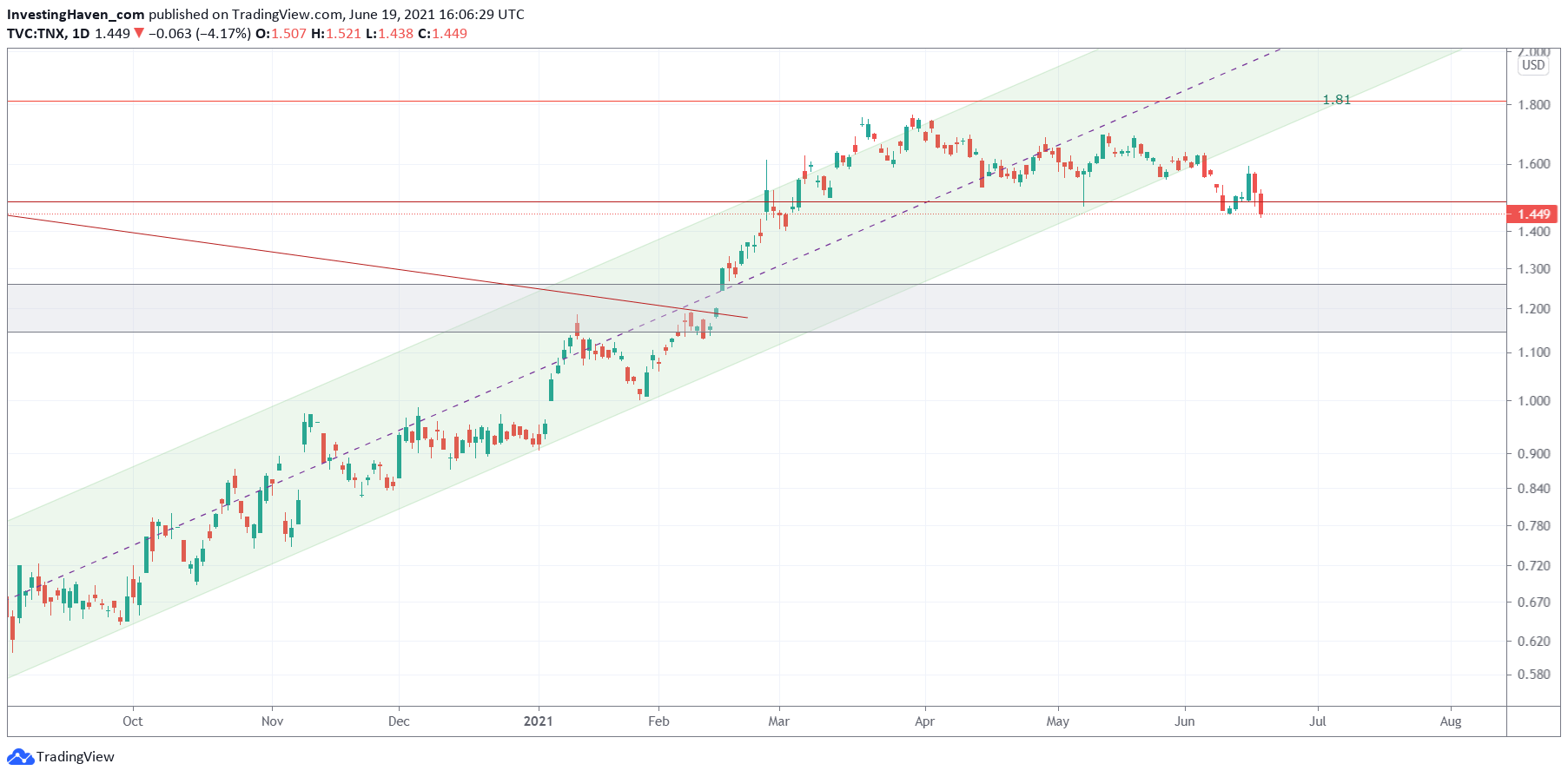

The Dow Jones is declining for 7 days in a row. Surprise surprise, bond yields started breaking down exactly 7 days ago.

Coincidence? Of course not, markets don’t operate in a vacuum. Capital flows in one and the same ecosystem. That’s what markets are, that’s how they operate.

Rising bond yields typically create momentum in stocks. They certainly are strongly correlated with financial stocks.

Industrials confirmed their breakdown on Friday. They are eyeing the 89 to 94 area now.

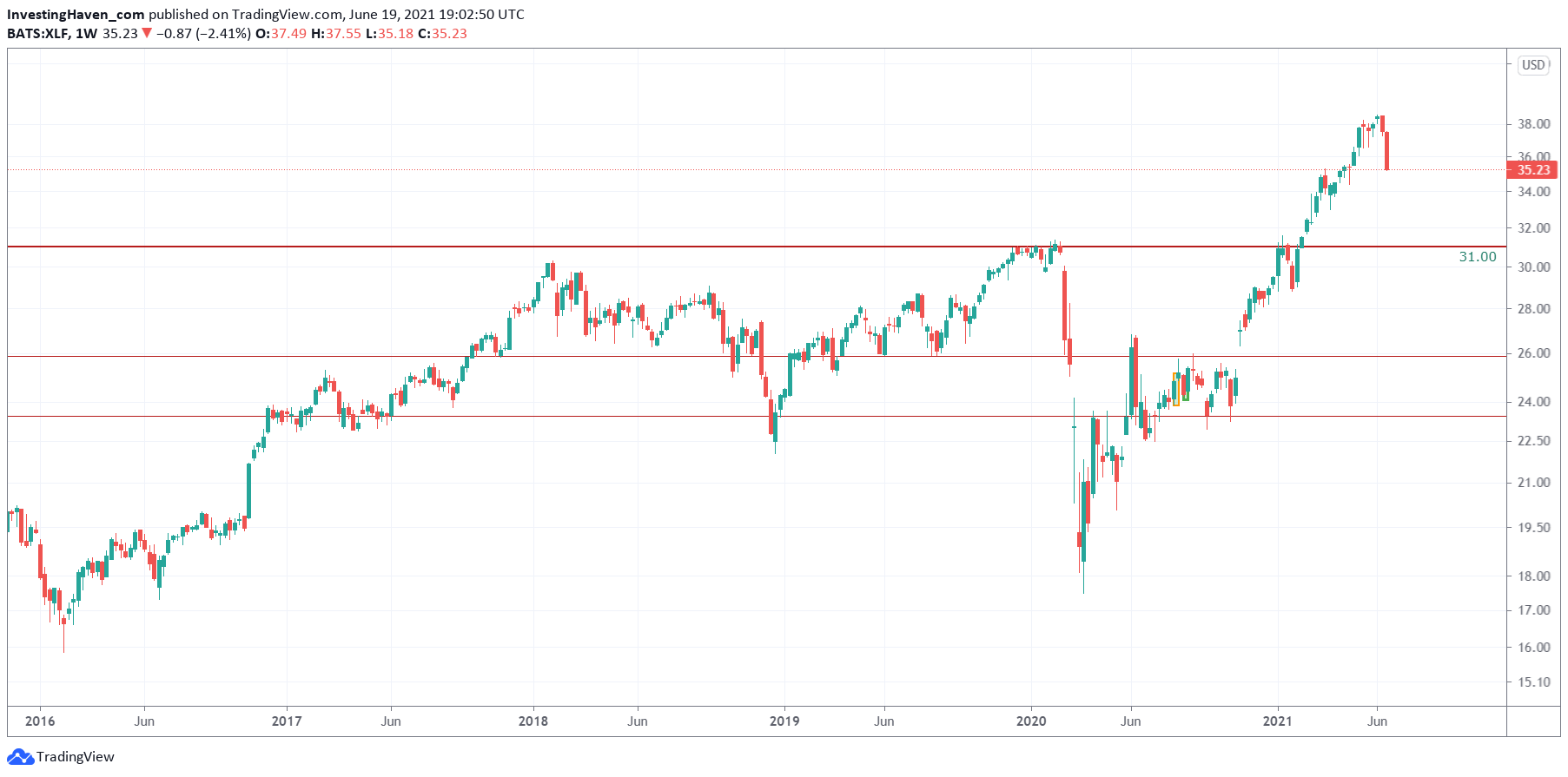

Financials can expect a decline to 31 points, probably even 29, which can qualify as a secular breakout test. This test will be a process, and it will take time to create a solid reversal pattern in that area before financials can become leaders again.