It seems time to go long Iqiyi, China’s version of Netflix. It was the market darling of April and May but had to undergo a serious correction in July and August. Exactly 2 months ago one of the InvestingHaven analysts wrote this piece IQIYI: New Market Darling But Investors May Wait-And-See For Now. As the previous price targets were hit, and as China’s stock market seems to have bottomed, we believe Iqiyi is in a buy area now for 2018 and 2019, but likely not for long!

In the last week of June, when IQIYI was trading at $33, one of InvestingHaven’s analysts Ralf Lai published his viewpoint on this stock. He clearly said there is no point in trying to chase this stock higher, but a wait-and-see was the best approach. He was spot-on. It was not the best time of 2018 to buy Iqiyi but much better entry points would shape up, a very sharp forecast in hindsight.

This is a quote from that article:

If the channel on my chart is correctly identified, the price of Iqiyi could retrace back to 29 and consolidate longer around this area. In case it goes lower we may see a price of 23 which comes close to the IPO price.

There is no point trying to bottom fish in this stock because what is going down can always go lower.

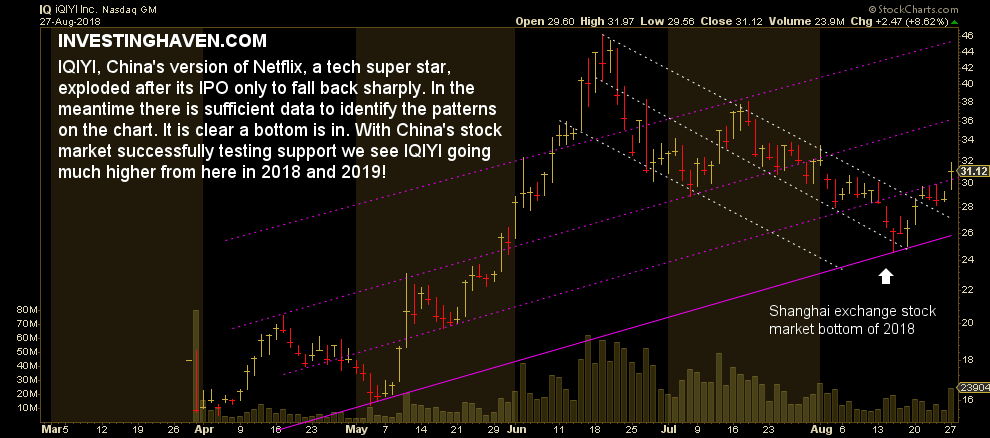

Astute readers will notice on below, up-to-date chart, that the price of Iqiyi fell to almost exactly the bearish price target (23-ish).

So going forward what can we expect from IQIYI? Is this a stock to buy in 2018 and 2019 or not?

IQIYI is a buy for 2018 and 2019

We strongly believe that IQIYI is a stock to buy for 2018 and 2019, with breath taking returns. This is why.

First, as per our ‘start with the chart‘ principle, we see a very bullish chart setup. The point is that the daily chart of IQIYI finally has sufficient data to see a pattern. Note this stock was IPO’ed on the last day of March of 2018.

The pattern on the chart below shows this rising channel which has been fully respected. It is a pixel-perfect trend which suggests it is highly reliable.

Iqiyi is now moving from its lower channel to a higher band. Clearly, this is a breakout from a 2 month bearish cycle.

Second, from a fundamental perspective, Iqiyi has reported amazing results. As shown here quarterly results exploded for the quarter ending June 30th 2018. The outlook of the company is great, so is its chart setup.

Third, from an intermarket perspective, China’s stock market outlook is amazing according to InvestingHaven. As detailed in 3 Must See Charts On China’s Stock Market Selloff in 2018 we believe that China has bottomed right at secular support. In July and August China has been struggling because of the so-called ‘trade wars’ which was nothing more or nothing less than a financial media stream of headlines which shaked ‘weak China stock holders’ from their positions. Smart investors picked up undervalued Chinese stocks at reduced prices. This is proven by yesterday’s price action: a big boom right above secular support in the Shanghai index but also great stocks like Iqiyi that sold off were hitting a bid.

Moreover, emerging markets confirmed their breakout with a successful backtest, how much more bullish can the environment be for a quality stock like Iqiyi?

All in all, we believe that all indicators are green for Iqiyi to qualify as a stock to buy for 2018 and 2019! Its chart is right, its financials and fundamentals are great, China’s stock market looks gorgeous after a sell off.

Because of this Iqiyi may test its June highs at 46 USD late in 2018, and, ultimately, the top of its rising channel at 60 USD somewhere in 2019. On the flipside, never lose sight of the bearish scenario: in case of whatever reason the channel gives away, and Iqiyi falls below rising support which currently sits at $26, it will invalidate any bullish outlook for this year. Conditions suggest the probability of this bearish scenario to play is really (really) low.