Not many realize how influential the Euro is. We are on record with this statement: the Euro is THE most important asset, together with Treasury rates, influencing most, if not all, global markets. As part of our new series of annual forecast we use the Euro in most of them as an important leading indicator. We refer to our 2020 forecasts as well as 2021 forecasts for a list of all our predictions.

Let’s revise in this article what we see on the Euro chart, and how it might impact our forecasts.

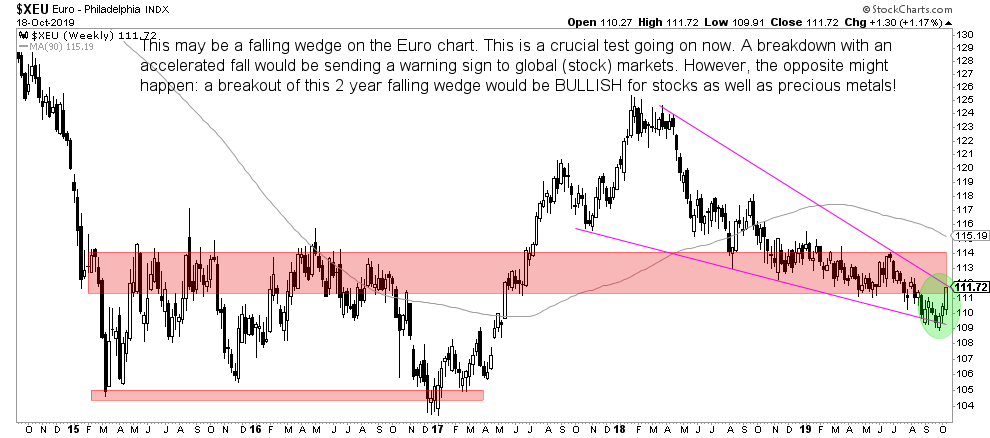

First of all the Euro chart embedded below has a text book chart setup. This is a falling wedge, which is bullish in nature. We expect the Euro to turn bullish anytime soon.

We do not care whether this is a Brexit thing, Mario Draghi announcement, or any other news item that drives this. In general we do know that news is a lagging indicator, but the market is leading the way.

So regardless of the question “why” this is happening we want to focus on the impact if and when the Euro breaks out.

A Silver Price Forecast For 2020 And 2021

The Euro will positively impact silver prices. As per our latest forecast we see a directional positive correlation between the Euro (inverse Dollar) and the silver price.

A Crude Oil Price Forecast For 2020 And 2021

Crude oil will benefit from a rising Euro. In the forecast above we show how strong the Euro breakdown in 2014 was, and how it triggered this epic crude oil crash of 75%.

A Copper Price Forecast For 2020 And 2021

Copper is directly influenced by the Euro. A positive Euro will help copper to trade in its range, or stated differently avoid a breakdown.

Our Emerging Markets Outlook For 2020 And 2021

Last but not least a rising Euro will be hugely bullish for emerging markets! We expect a strong move higher in emerging markets if the Euro’s falling wedge turns into a rising trend.