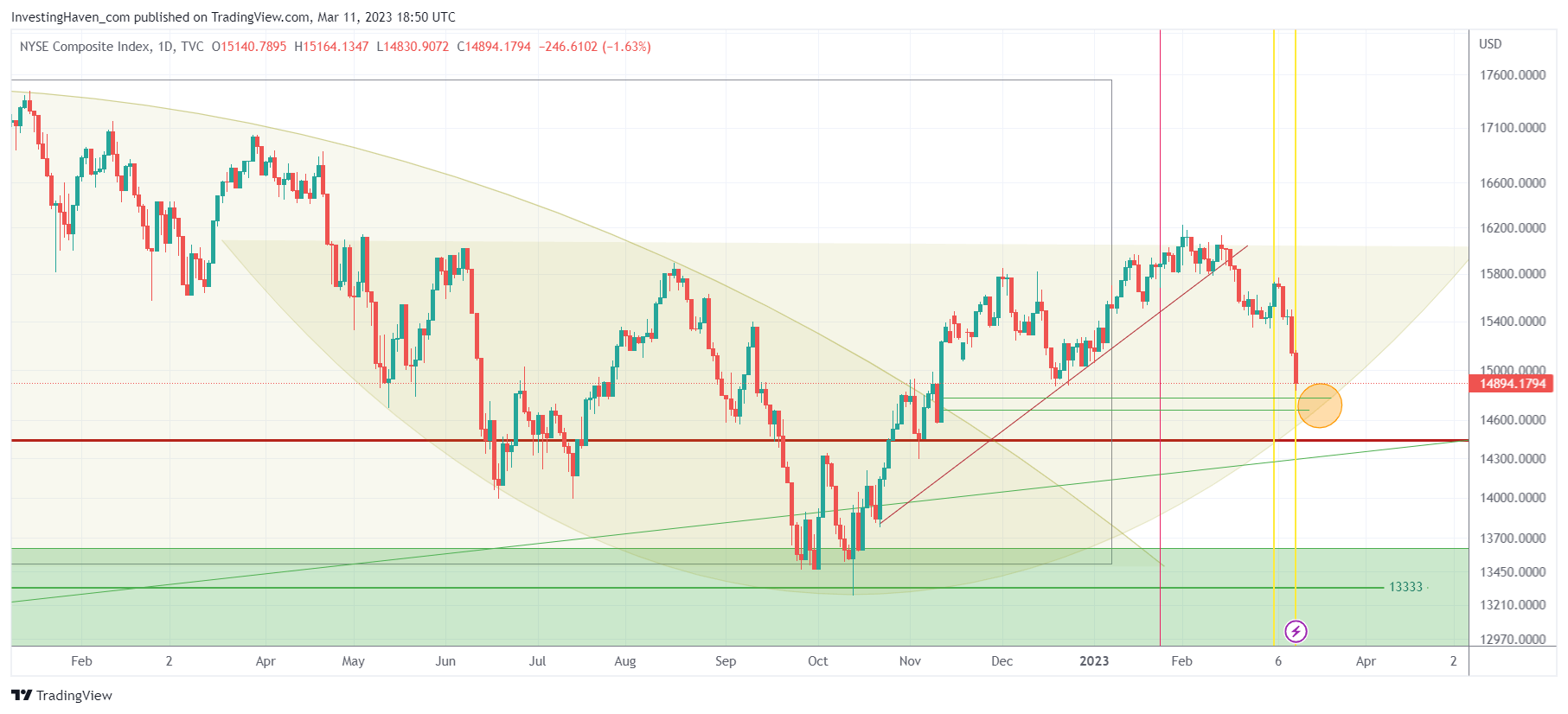

We covered the NYSE Composite Index multiple times in the last few months. We outlined a very specific price target, and predicted a time window in which it would move to that downside target. The NYSE Index is now inches away from our first bearish target, it is happening exactly in the week we forecasted!

As a refresher, this is what we have written about the NYSE Index in the last 4 weeks.

On February 11th, we wrote A Reasonable NYSE Target For March of 2023

Our expectation is that a pullback to 14700-14900 is a real possibility, in the next 2 to 4 weeks from now.

We believe it will be a ‘buy the dip’ opportunity.

On February 26th, we wrote How Concerning Is The Recent Breakdown In The NYSE?

It looks like our forecasted price target [14700 – 14900] is now underway, it is going to take a little longer is what we start concluding. We need another 3 weeks to get there, the price target remains valid.

IF the NYSE index will find support right at the orange circle on our chart, it would confirm the bullish rounded pattern. This means that it will be an EPIC buy the dip opportunity.

The up to date NYSE chart is embedded in this article. It has the same bullish rounded pattern, the same price target (orange circle), and the same timeframe in which we expected volatility to pick up (yellow lines).

We believe that the 14600 target will be reached next week. The market might overshoot this target, but selling should stop around 14400 in order qualify as an inverted head & shoulders pattern.

For now, we believe that the inverted head & shoulders pattern is a high probability outcome: left shoulder registered in June and July, the (inverted) head in October, the right shoulder should be created this month.

Invalidation: if 13400 is breached, it won’t be pretty!

In our Momentum Investing service we release today a new list of stock tips which we call ‘shortlist’. Based on our leading indicators, we’ll pick the stocks that hold strong in this volatility window. We are obviously closely tracking whether a ‘buy the dip’ opportunity is in the making.