President Trump may be very active on Twitter with his threats towards China. But it may backfire in a way that U.S. markets will be the victim, even a stock market crash may follow while emerging markets (EEM) may be the beneficiary. How is this possible? As simple as possible, with the most basic dynamic of markets: intermarket dynamics as per our investing tips. This is how capital markets worked for ages, currently still work and will continue to operate. It is by the flow of capital from one asset class to another one. President Trump’s actions are a great case study, so let’s look into this.

Let’s revisit the intermarket dynamics, and how they are currently working out:

- President Trump wants to attack China by rates, tariffs, and any other measure that a politician has in his control. This has economic effects, but also effects on markets.

- With his actions Mr Trump makes large investors uncomfortable. They prefer safe havens like Treasuries.

- Because of a continuous flight to Treasuries their yields fall.

- Falling rates tend to lead to a weaker U.S. Dollar, most of the time (though not always). The point is this: capital has to flow somewhere. If there is mega uncertainty it may happen that everyone wants to hold cash, in which case the U.S. Dollar may become the beneficiary. However, large investors clearly have shown their preference for real safe havens like Treasuries, not the U.S. Dollar. So that’s the trend that is currently in place.

- And here is the important point: a slightly rising or flat U.S. Dollar favors emerging stock markets.

- Moreover, fast falling rates tend to hurt U.S. stock markets.

There you have it: Mr Trump is about to help emerging stock markets and punish U.S. stock markets.

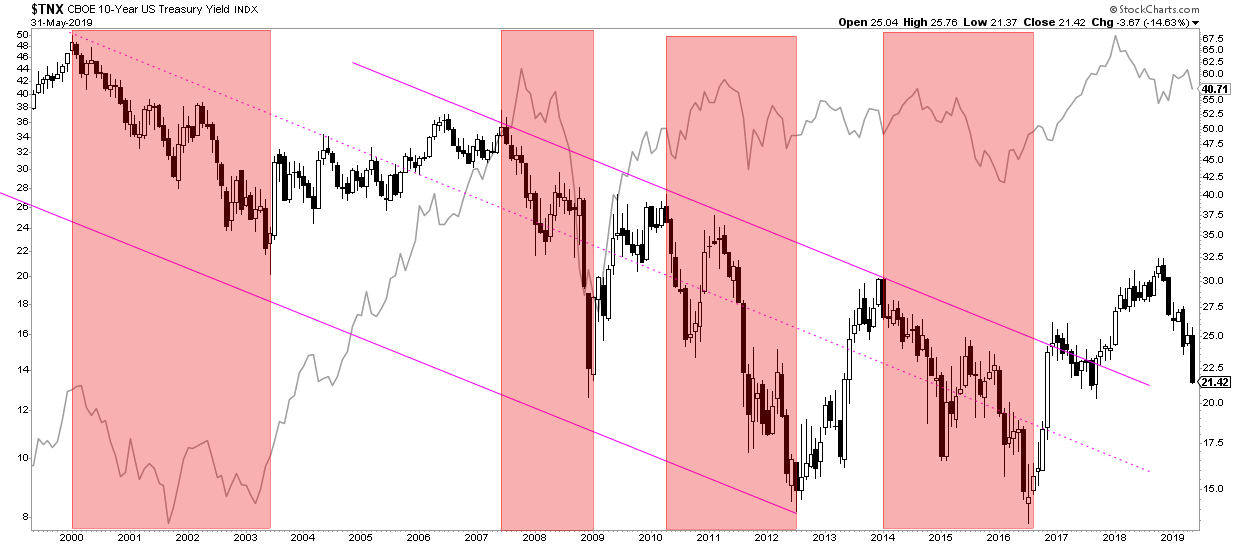

The following chart makes the point: it shows the correlation between Treasury yields and emerging markets. Fast falling rates do hurt U.S. stock markets (red boxes), but as this chart shows it does not really heavily impact emerging stock markets (light grey line). The only exception is extreme conditions like the 2008/2009 crash where essentially everything went under!

We hope we have helped Mr Trump with these insights.