We covered the dry bulk shipping market in recent updates. Two weeks ago we noticed that the Dry Bulk Market IS Heating Up, A Parabolic Rise Might Be Starting. There is nothing that makes us think that the dry bulk market is deviating from this extremely bullish path.

Some readers reached out asking why the dry bulk market is so bullish. In other words what are the drivers?

In terms of market dynamics it is not a demand driven uptrend.

The bullish dynamics are caused by COVID. In a way the dry bulk shipping market is a COVID play.

One really interesting article appeared a few days ago about the dry bulk market, and it is the only one you need in order to understand why this market is so hugely bullish:

Summer’s dog days see dry bulk market still playing the waiting game

The short version: congestion in ports all over the world because of COVID is driving freight rates much higher.

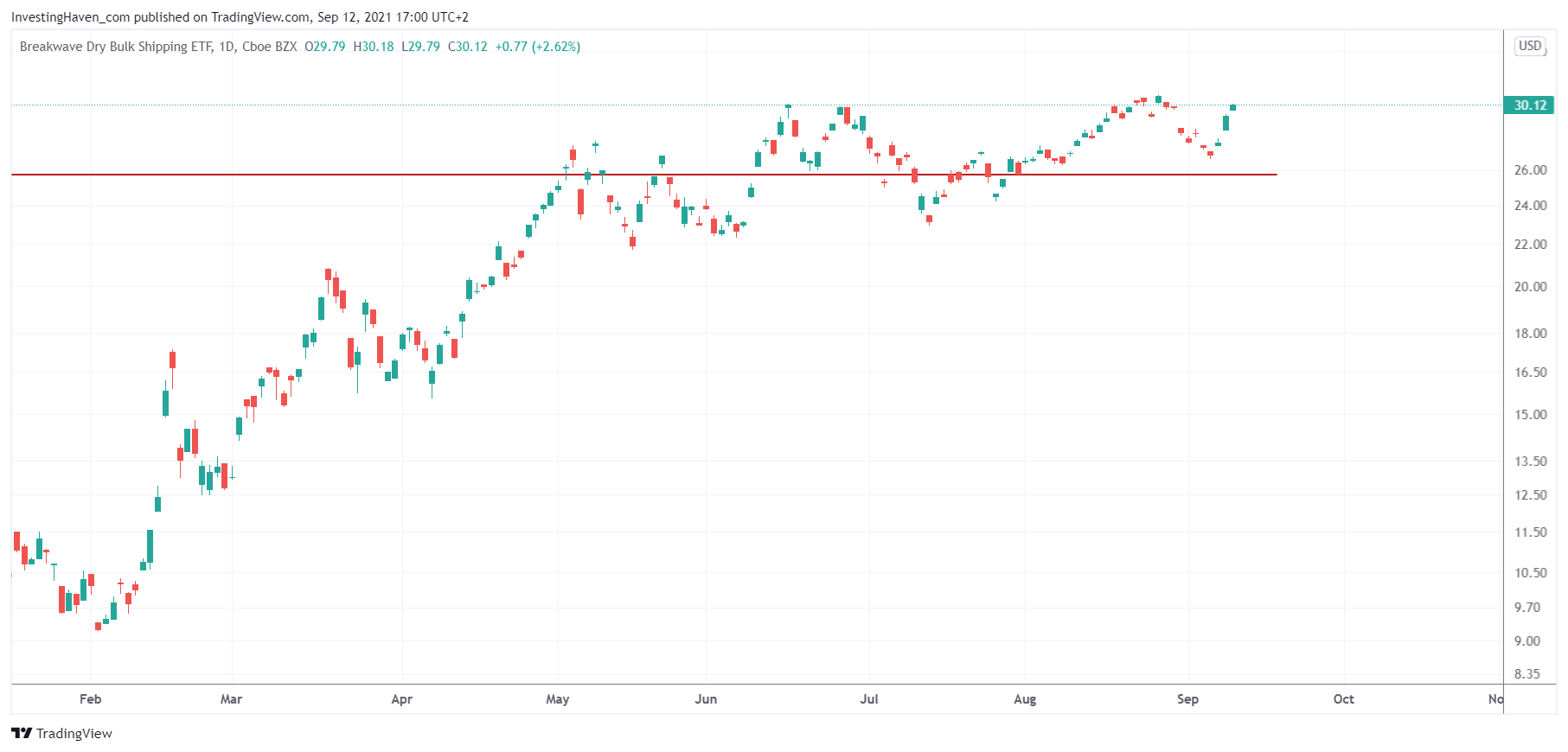

This is the dry bulk index in the last 12 months. What a phenomenal bull run.

Very short term there is typhoon Kiko which is about to make it even worse. We should see an uptick in the BDRY ETF early in the week. Remember, the BDRY ETF tracks the freight rates for several vessel types, and it is one of the 2 leading indicators for the dry bulk shipping sectors which has stocks that are ready to break out above 6 year resistance levels. It will be huge once the dry bulk sector breaks out, as our bullish targets are +100% above current levels.

All these dry bulk shipping stocks have phenomenal setups. And we have one specific stock in our Momentum Investing portfolio since Friday.