In this article we list 10 unique ‘events’ since the Corona crash have never happened before in history of financial markets. The conclusion? Markets are going through a highly unusual period, we may call it the ‘New Normal in Markets’. Investors and traders have to adjust to this, and set their expectations low but also look for the truly effective methodologies that continue to work in this ‘New Normal in Markets’.

The scary list of 10 unique events since the Corona crash:

#1. The fastest crash ever

The Corona crash marked the fastest market crash in history of financial markets. Never before did leading stock market indexes lose 35 to 40% in 4 weeks time.

#2. A market goes negative

Never before, in history of markets, did a market go negative. Crude oil futures went below zero in April of 2020. Many traders got burned with millions of losses in a matter of hours, some committed suicide as a result.

#3. The fastest rise in VIX on a 3 day basis (resulting in a tiny retracement)

In the first week of February of 2021 VIX marked the fastest 3 day rise in the volatility index VIX. The results? Hardly any changes in the S&P 500. This is what we wrote to our premium members:

- Only 5 instances in the last few decades pushed VIX +70% higher in 3 trading days.

- In all those instances, the damage on SPX ranged from 9.7% to 19.5% in 3 to 4 trading days. The average drop was 12.5% in SPX.

- In all those instances the recovery was slow, and mostly indexes went lower for an extended period of time before moving higher.

- Even during the 2008/9 crash there wasn’t such a violent move in VIX.

- Last week, the SPX impact was a laughable 4.3%, and 4 days later SPX was trading higher than where it started ‘dropping’.

There is a structural shift going on in markets, and we better don’t ignore it.

#4. Nasdaq vs. Dow Jones divergence

The divergence between the Nasdaq (sharply down) and the Dow Jones (sharply up) in the first half of 2021 had never happened before in history of markets.

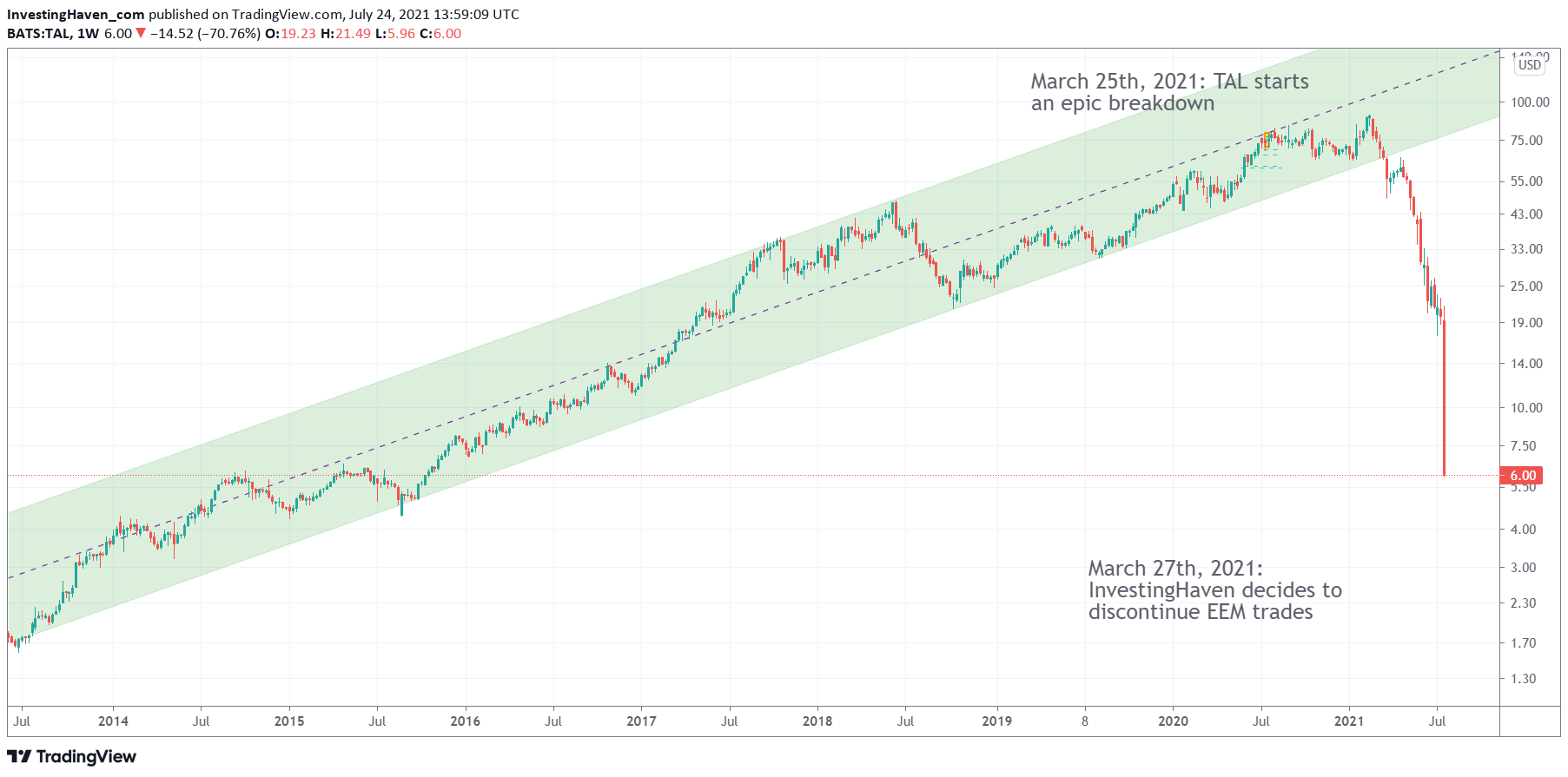

#5. Emerging markets crash

Since March of 2021 emerging markets entered into a highly unusual period of turbulence. In fact, our emerging markets algorithm which delivered 500% profits in 2019 suddenly stopped working.

The result? Charts like the ones below.

In a way, we knew that something big was underway when our proprietary algorithm ‘stopped working’. We discontinued our trade signals and focused on the S&P 500, rightfully so.

#6. Historic breadth divergence: stock indexes at ATH vs. the ‘average stock’ down

In 2021, stock indexes continued to make new ATH. But the ‘average stock’ was down approx. 30%.

An historic breadth divergence between indexes and the vast majority of stocks.

The result? Frustrated investors who don’t understand this divergence and ‘feel left behind’. They start over-trading, and enter the end of year selling period with a huge decline in their portfolio.

#7. Precious metals lower when the perfect intermarket setup suggests higher

For the first time we see gold and silver move lower, in the summer of 2021, while the USD was flat and bond yields declined 40%. In every other similar instance in the past precious metals moved higher.

#8. Short term trading losses highest ever on rising indexes

From Sentimentrader’s The worst year ever for trading:

So far in 2021, most trading systems using technical indicators have lost money. As a group, they have lagged the S&P 500’s buy-and-hold return by 16%, tied for the worst performance in 25 years.

Never happened before. In 2021 a lot of short term trading portfolios got burned, knock out, out of the game.

#9. The 3 week commodities boom

In February of 2022, commodities boomed. In a matter of 3 weeks they exploded to test their 2011-2012 ATH. Two decades ago, it took them several years to achieve the same percentage rise. What once required years now can be achieved in weeks.

#10. Inflation at multi-decade highs with a rising USD

In 2022, the rate of (consumer price) inflation is hitting multi-decade highs. But the USD is not falling (inflationary) but rising (deflationary).

So what?

You could say ‘so what’ to this list of historical anomalies.

We would say ‘be careful’ this market looks easy but it is an extremely dangerous market, in disguise. We might argue that this market is one of the toughest to ‘get right’ in history.