The US Dollar rose 22.33% between January 6th, 2021 and July 8th, 2022. That’s a really hefty rally for the world’s largest currency (in terms of daily trading volume). In doing so, it broke a lot of trends in metals and markets. Many commodities got destroyed in June of 2022 after setting a turning point either in May or in June. However, there is one and only commodity that is unimpressed by the USD strength. InvestingHaven’s loyal readers know exactly which commodity it is and premium members have enjoyed multi-fold rallies in our Momentum Investing stock selection. As said in our Lithium Forecast 2022, we expected lithium to stay strong. While many lithium stocks retraced, recently, the price of lithium trades some 5% below ATH.

At the risk of sounding like a broken record we will repeat a few quotes that really, really mattered when we wrote them a long time ago, way before the world was confronted with historic CPI readings:

Written back in December of last year:

We expect lithium stocks to outperform the market again in 2022 but they will move in a very cyclical way so buy the dip is the right approach

Another quote from the same article:

But the mega secular bull market in lithium stocks is not over yet, far from it, as explained in our green battery metals forecast for 2022. It is even not halfway according to us. It is rather clear from the charts that some lithium stocks might be taking a breather to recharge themselves but they will continue to perform well in 2022.

Very recently, we wrote this article in the public domain: Lithium Outlook 2022 And Sector Darling Lithium Americas. We concluded:

Lithium related stocks remain Bullish on the long term and therefore our Lithium price forecast for 2022 is still on track. The main risk we see for the sector is the social and environmental impact (pollution, water depletion, chemicals used in the process.). On the other hand, we believe that the extraction and treatment processes will hopefully become more environmentally friendly as the sector matures.

Why is this meaningful?

Because of the huge divergence between:

- The price of lithium and any other commodity.

- The price of lithium and the USD.

- The price of lithium and lithium stocks.

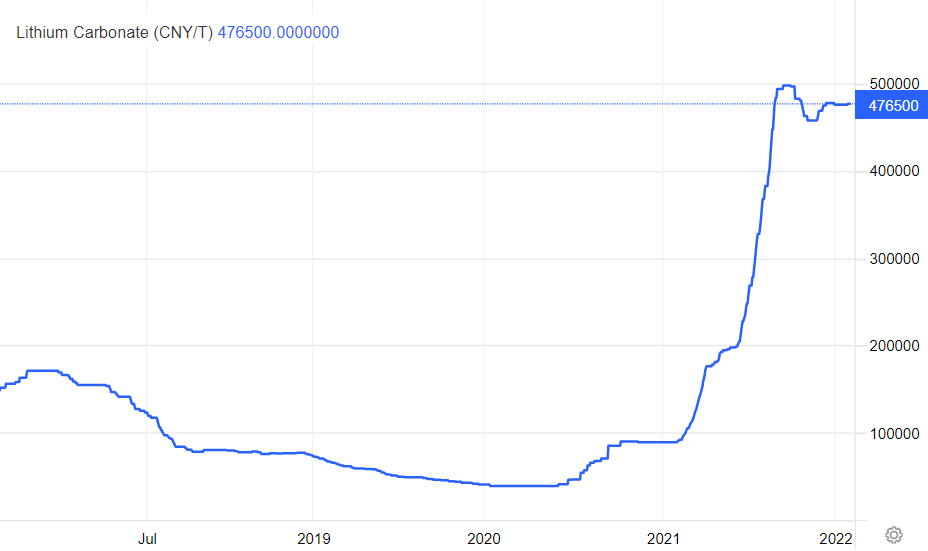

Below is the lithium price chart in the last 4 to 5 years.

Lithium stocks came down.

Lithium stocks came down.

They came down after they rose multi-fold.

Our top pick, Core Lithium, with a very strong buy recommendation in our Momentum Investing service back in June and July of 2022, went up more than 6-fold before coming down in April/May of this year. It is still up almost 5-fold since then.

Most lithium stocks have been consolidating lately after a strong retracement in April/May of this year and a wild rally since last summer.

The largest cap lithium stocks like Albemarle (ALB) and Sociedad Quimica y Minera de Chile (SQM) are already recovering. Although we like both companies, they are not the ones that will deliver the highest returns over time. They will do well, but not amazingly well.

Most, if not all, of our lithium stocks selection look really good as they confirm a long term basing pattern, setting the stage for a continued rally in the next 18 months.