The U.S. Dollar has triggered a lot of volatility in markets in 2022. One thing is clear: 2023 will be very different compared to 2022 as explained in our 2023 forecasts. Yes, we predict more good things to happen in 2023 although volatility will not be entirely gone. Leading indicators will be crucial in understanding the direction of markets, first and foremost the U.S. Dollar. This is what we see on its long term chart. In sum, no stock market crash in 2023, no end of year crash underway, 2022 is not 2008.

It is 2 months ago since the USD topped. We were there when the USD printed a turning point, mid-October, with this article: When Oh When Will The US Dollar Stop Rising?

We mentioned that there were 2 potential turning points and the market reversed at the first one we mentioned.

No surprise, silver started moving higher since then as said in Is The U.S. Dollar About To Confirm An Epic Bullish Bottom In Silver?

With that said, what is going to come next? This is what we see on the long term USD chart:

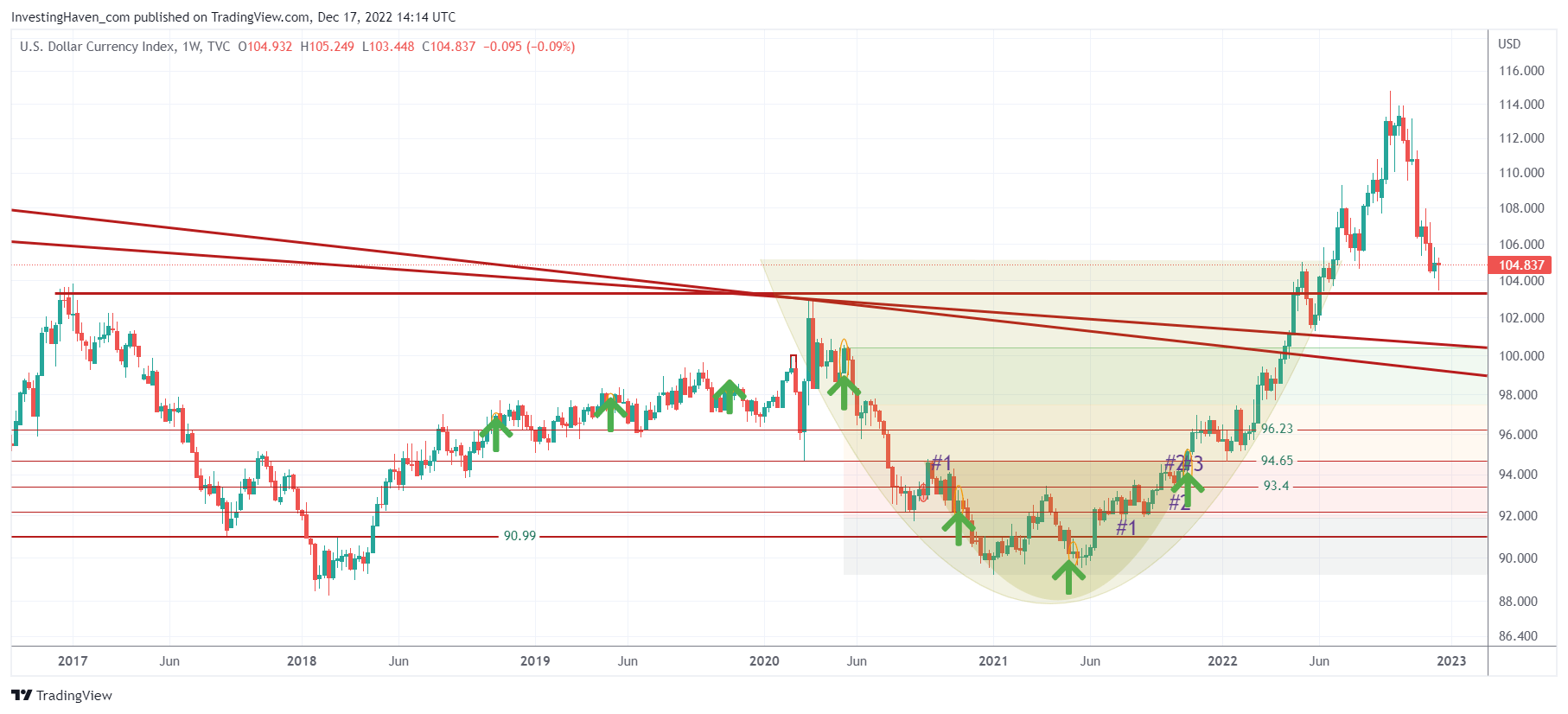

- A long term reversal which has the shape of a W pattern, between 2017 and 2022.

- A breakout in May/June of 2022, when markets and metals were falling apart.

- A turning point some 6 months later, at 114.4 points in DXY.

- A steep decline which came with a sharp turning point.

There are 2 aspects to be considered in this setup:

- The recent decline got back to 103 points which is the multi-year breakout level. It looks like the USD does not want go lower which suggests that these ‘elevated’ readings are here to stay. This does not tell anything about the future path other than saying that the USD is not likely to fall below 100 points any time soon.

- A sharp turning point which suggests that the USD won’t clear 110 points any time soon neither.

Are we in for a longer term consolidation above 100 points in the USD? If so, other than a few volatile periods in 2023, it would suggest there is no market crash due in 2023.