As fear about a recession to continues moves higher so do stock indexes as well. It is like the stock market is rising the wall of worry. We said it and will say it again: we forecast no stock market crash in 2023 but a few volatile periods will make the bears very vocal (temporarily though). Interestingly, although stock indexes are improving, the bears continue to shout loud how bad it’s going to be out there.

Here is some more recent evidence of experts shouting loud about a coming doomsday scenario:

Are Economic Experts Lying Or Confused Or Both? (January 12th)

2008 vs. 2022: Similarities and Differences (December 25th)

The Single Most Important Chart Of 2023 (January 8th)

It’s perfectly possible for the market to diverge from what experts are telling. Note that experts are lagging, they follow economic data and ‘events’. As said many times, that’s a lagging indicator.

Let’s turn it around: what were those experts saying in November of 2021?

Here is some proof about an epic divergence between the market and the Fed: This is What The Market Thinks About The Fed’s Policy.

That said, we already shared one chart from our research in our premium services: This Is When The Stocks Bear Market Will Be Over. The chart and commentary were featured in one of our recent premium research updates.

Here is another view that is going to answer the question when the bull market in stocks is going to be confirmed. Our view remains that the bull market already started on July 17th, 2022. The double bottom on Oct 13th, 2022 was a confirmation of the start of the bull market. We said so that very same day: The Market Will Not Move 50% Lower Contrary To What The Gurus Are Telling You.

If the bull market already started, then when will it be confirmed?

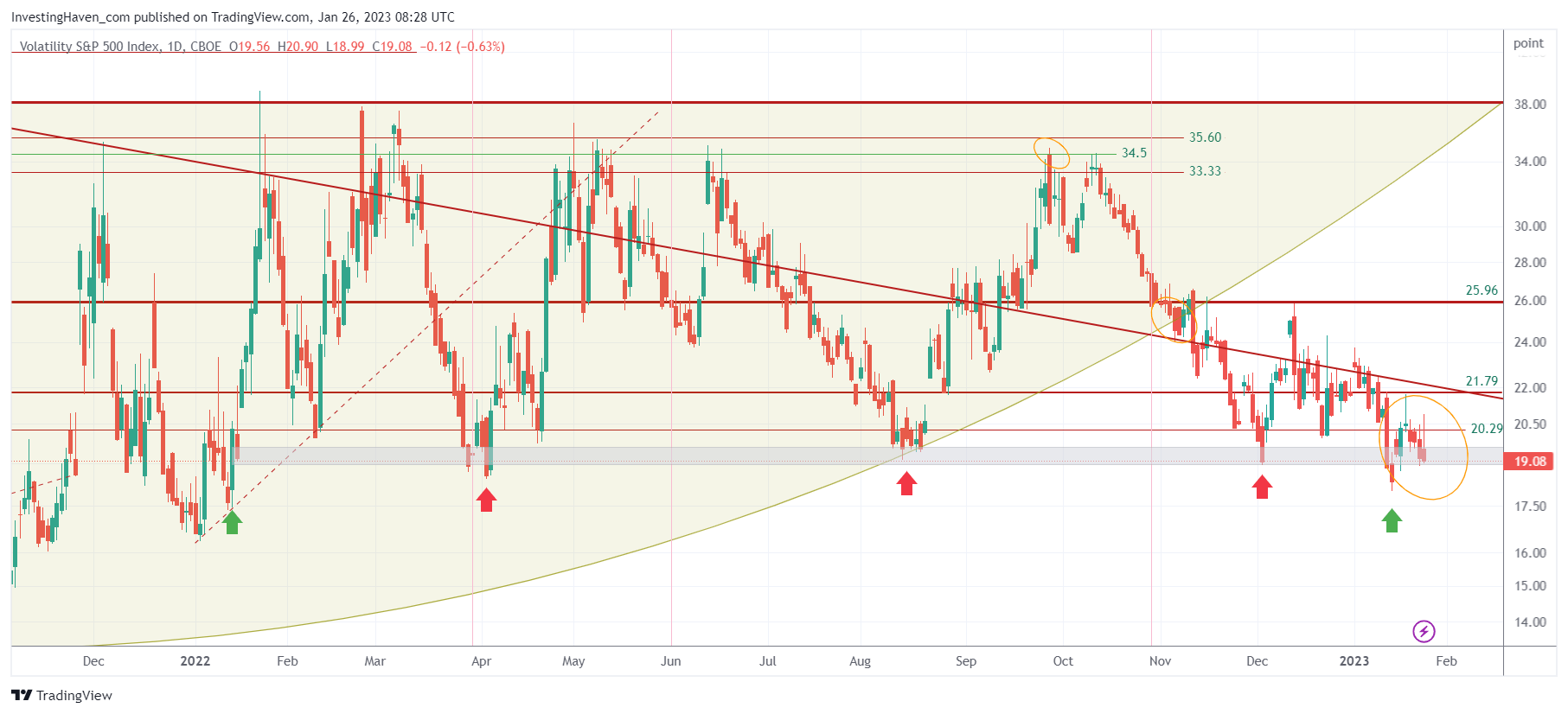

Here is another chart from our premium services that answers that question: when VIX falls for 5 days below 19.00 without touching 19.00. VIX tried to do so, in 2022, 3 times. It failed 3 times. We believe it is a matter of time until it is going to work. Between now and then, it might be volatile and a few failed attempts will occur, but long term investors will look at those volatile periods as ‘buy the dip’ opportunities as opposed to listen to the experts with the never-ending and easy to sell ‘doomsday message’.

In our premium services, we issue guidance even on X-mas eve: Must-See Charts: Q1/2023 Will Be Crucial, 7 Timing Conclusions, 2008 Comparisons.