One of the common questions top of mind of commodity investors is which commodities to buy for 2019. Commodities are typically volatile in nature. They can go up significantly, once they start rising. However, they also move in cycles, and they tend to be neutral or bearish most of the time. What about 2019, are commodities the place to be? Is our Commodities Outlook for 2019 valid, and if so which commodities to buy for 2019?

Not only on Quora (here for instance) is it a common question which commodities are worth buying in 2019 or any other year. More importantly, many investors tend to have a preference for some specific market(s) or asset(s). In the case of commodities this may be tricky because the last 10 years have proven to be pretty disastrous for commodity only investors.

The key take-away here is that investors better be very careful, and very cautious, when selecting a commodity to invest in.

More than anything else we see one of our 100 investing tips that applies to the question which commodities to buy in 2019:

‘Timing is not the most important thing, it is the only thing.’ This implies that timing an entry point as well as exit point is by far the most important thing for an investor to do well. ‘Timing is the only thing‘ means that it is more important than reading news, analyzing fundamentals, following gurus, and so on. Excellent charting skills are a prerequisite to apply this principle!

With this in mind let’s look at 6 of the most important commodities, and try to understand if they are worth buying in 2019.

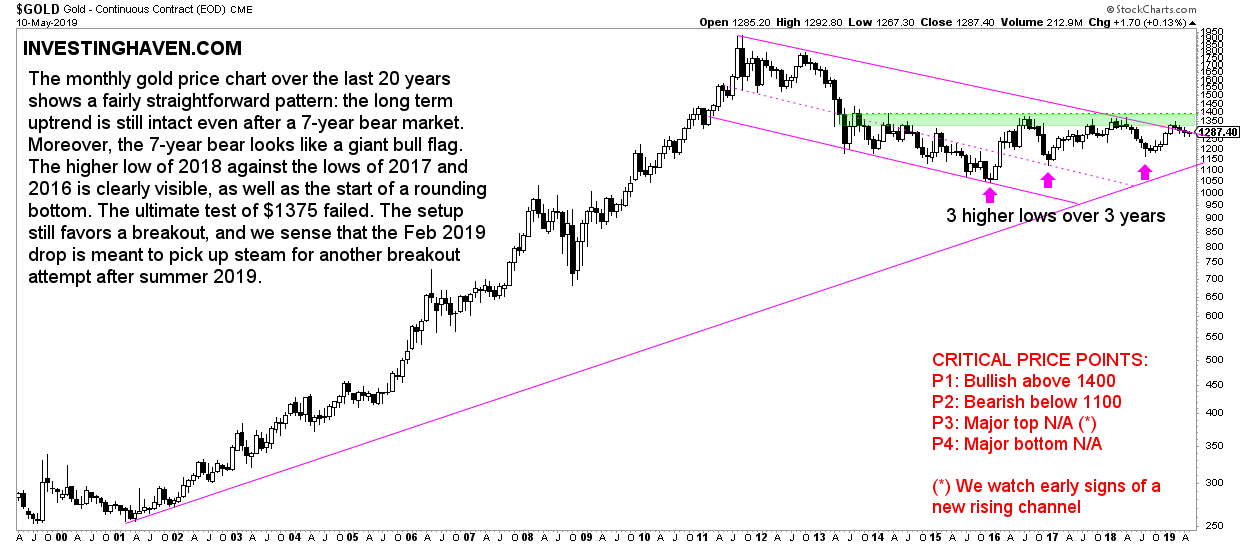

Gold: Commodities To Buy In 2019?

Gold is a commodity class on itself. As explained in great detail in our gold forecast gold tends to behave according to its own specific principles. It is inflation sensitive, but it is also currency sensitive. It may sometimes act as a fear trade, but sometimes it does not.

The price of gold (GOLD) has a clear sideways pattern. Moreover, it is still within its falling channel (bear market channel since 2011).

As long as gold does not cross $1375 it remains bearish to neutral.

We expect inflation expectations to pick up and a stronger Euro to lead to another attempt for gold to break above $1375 after summer. If this attempt succeeds we will see $1550 around year end. The condition is that gold crosses $1375.

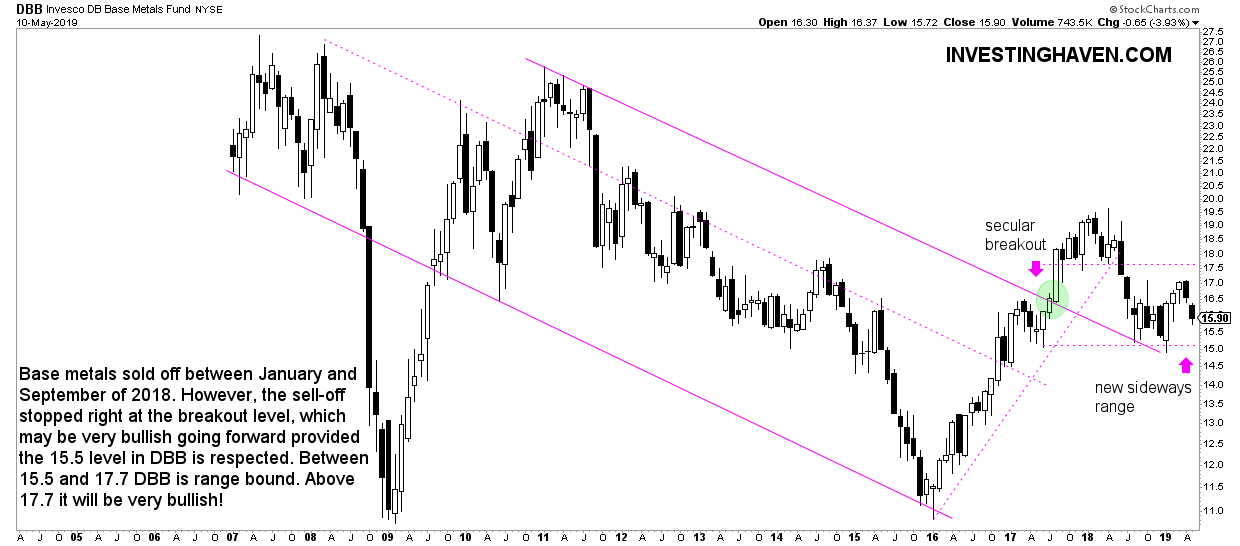

Base Metals: Commodities To Buy In 2019?

The base metals complex was strongly bullish 2 years ago, but is back to neutral.

This chart setup suggests that a new sideways trading range has started. It may also be a bull flag though we don’t think so.

For now, we believe this market to be neutral in 2019. It becomes bullish above 17.70 in DBB.

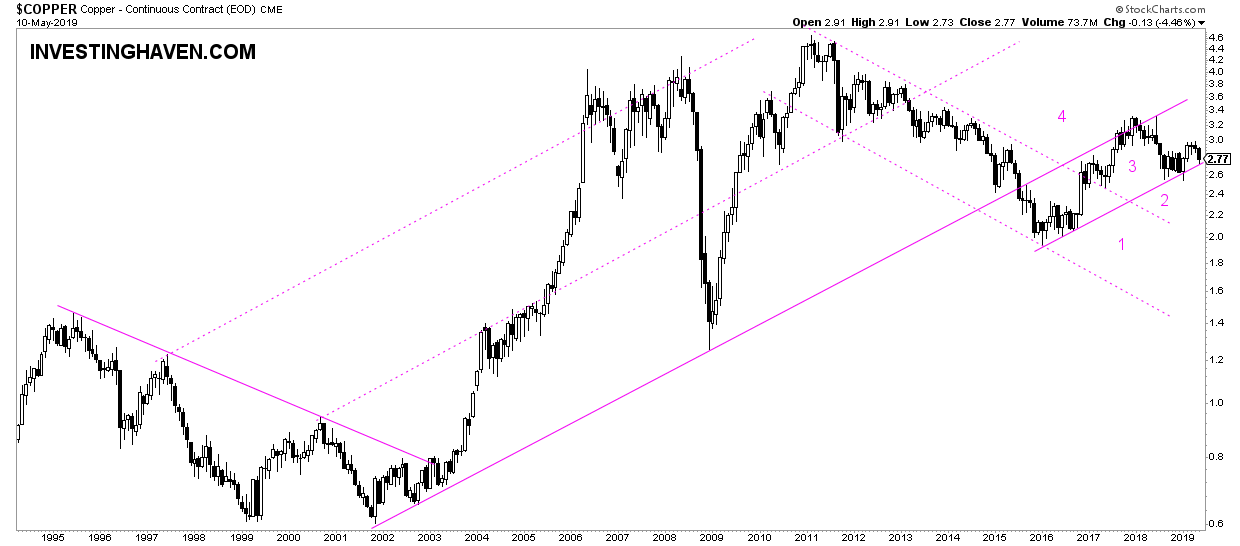

Copper A Buy In 2019?

The price of copper (COPPER) is certainly _not_ in bullish territory. It also is not really attempting to become bullish in 2019. This is in line with our copper forecast.

The only scenario in which copper might become very bullish is a combination of a strong Euro with copper respecting rising channel indicated with #3 on below chart, ideally a break above 3.00 anytime soon. Until then we see copper acting as a neutral commodity.

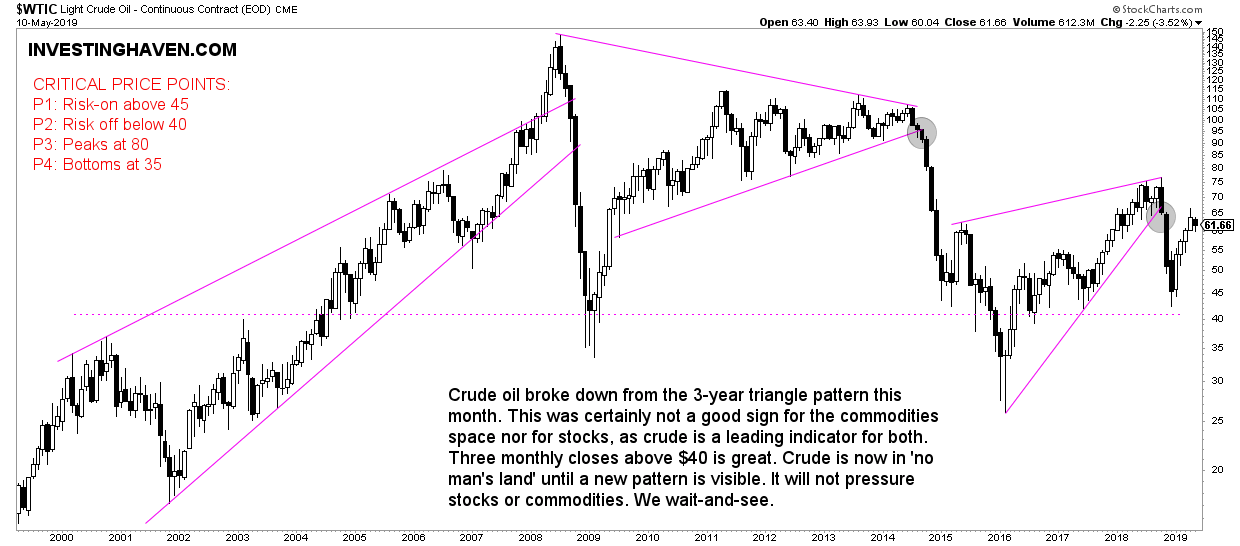

Crude Oil A Buy In 2019?

The crude oil (OIL) chart is one of the most complex charts in the world to read. It mostly has a variety of chart patterns, in random order.

Our crude oil forecast was mildly bullish with a price target around 75 USD per barrel. This would be, if materialized, a rise of 30%. On the downside we see room to fall to the 45 area, a downside potential of 25%.

The crude oil market may remain bullish, but it certainly can fast become bearish if it falls below 52 USD.

In other words it stands out as the prime candidate for a tactical bull market, which means a bull market still in 2019 (medium term timeframe).

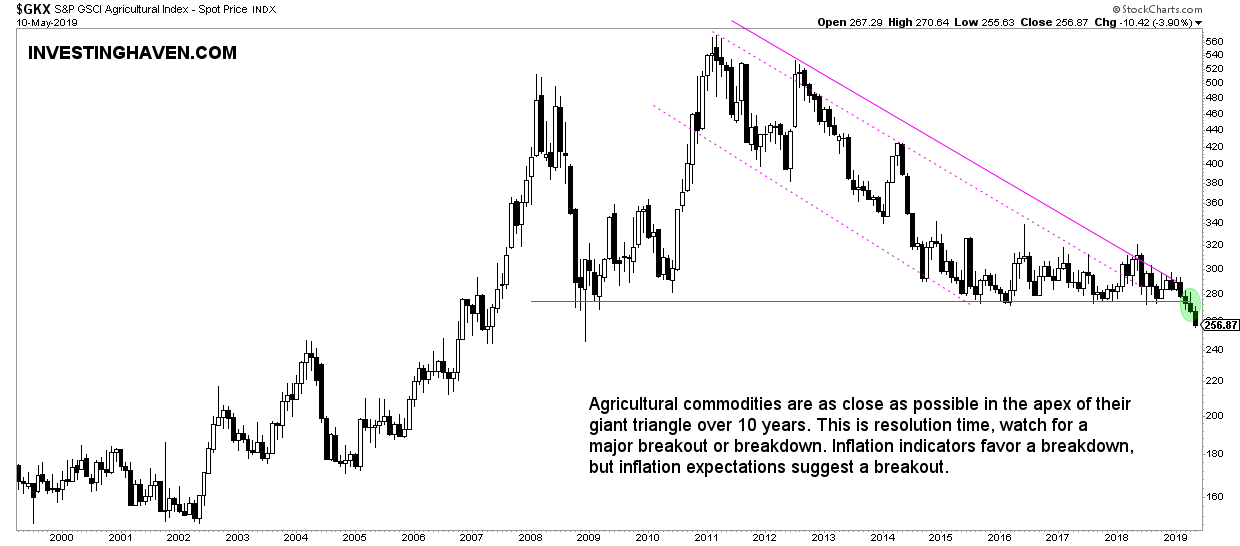

Agricultural Commodities: Buy In 2019?

The agricultural space is a disaster. We tipped this as the Bear Market Of 2019: Agricultural Commodities.

The chart below says it all, no comment needed.

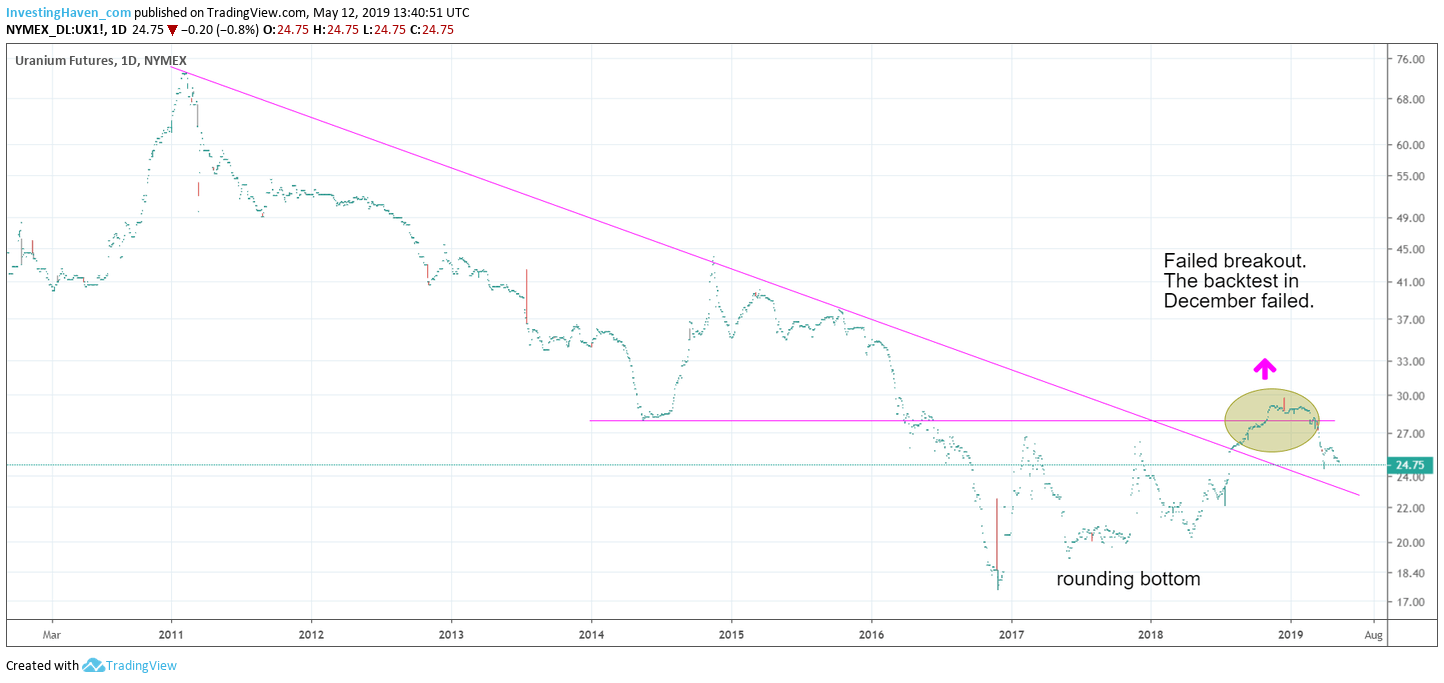

Uranium: Commodities To Buy In 2019?

Last but not least uranium is known to be a very volatile asset. Many have made big money on uranium in the previous decade, but many have lost big money as well in the current decade.

Even though we saw breakout attempts some 4 to 6 months ago by uranium they all failed. Our uranium stocks forecast was accurate in pointing out that the uranium price breakout should hold if the uranium market (especially uranium stocks) would become bullish in 2019.

Right now the uranium price keeps on falling after a failed breakout end of last year.

Until there is a bullish sign on this chart we expect the uranium market to be neutral to bearish in 2019, not worth buying yet.