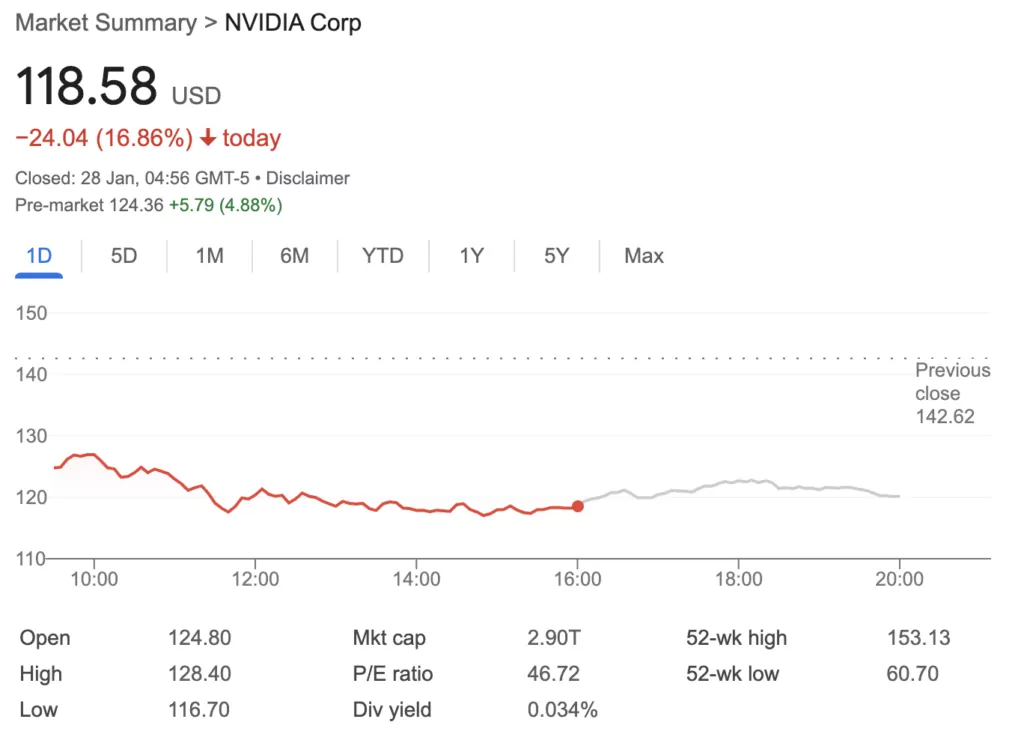

Nvidia shares saw a significant drop in yesterdays trading, the key factors that fuelled this drop was the emergence of significant competition in the AI space.

What is Nvidia?

Why Are Nvidia Shares Down? Is It Time to Buy This AI Stock?

Nvidia, a market leader in artificial intelligence (AI) and semiconductor technology, recently experienced a dramatic decline in its stock value, shedding nearly $600 billion in market capitalization. This loss raises questions about the reasons behind the drop and whether this moment presents a buying opportunity for investors.

Never Miss the Best Stock Opportunities

Stay ahead of the market with our Premium Stock Trading Newsletter. Here’s what you’ll get:

- Top stock opportunities identified through a proven methodology.

- Actionable insights to make informed decisions.

- Expert guidance to help you navigate volatile markets.

- Access to exclusive research and analysis.

Key Points

- Nvidia’s stock has faced significant losses, wiping out $600 billion in market value.

- Concerns surrounding AI-related investments and market competition have fueled the decline.

- Nvidia’s dominance in the AI and semiconductor space remains unchallenged despite short-term turbulence.

What Caused Nvidia’s Massive Stock Decline?

The sharp downturn in Nvidia’s valuation is linked to market jitters about AI’s long-term growth. Nvidia has seen tremendous gains from its role in generative AI models, but recent developments, including increased competition, have shaken investor confidence. According to Forbes, Nvidia’s market value dropped dramatically following the announcement of DeepSeek, a rival AI platform promising lower costs and greater efficiency.

Geopolitical and economic headwinds also contributed to Nvidia’s decline. As reported by the BBC, rising interest rates and increased market volatility have made investors cautious about high-growth stocks like Nvidia, which previously thrived on speculative enthusiasm in the AI boom.

DeepSeek’s launch has sparked concerns over whether Nvidia can sustain its dominance in AI hardware. The timing of this announcement coincided with a broader sell-off in tech stocks, amplifying Nvidia’s market losses.

Is This the End of Nvidia’s AI Dominance?

Despite recent losses, Nvidia remains a leader in AI technology. Its GPUs are essential for machine learning and AI infrastructure. Demand spans industries such as healthcare, gaming, and autonomous vehicles, securing Nvidia’s role as a critical player in the AI and semiconductor space.

Some analysts believe Nvidia’s valuation had grown unsustainable, driven more by hype than fundamentals. The Financial Times suggests that the current correction could represent a necessary recalibration, providing an opportunity to reassess Nvidia’s true value amid evolving competition and market dynamics.

Is It Time to Buy Nvidia Stock?

For investors, the key question is whether this slump presents a buying opportunity. While the decline is significant, Nvidia’s robust fundamentals, industry leadership, and continued investment in AI technologies make it a promising long-term growth prospect.

Investors considering Nvidia should monitor its response to competitors like DeepSeek, its earnings performance, and broader market conditions. While speculative enthusiasm has cooled, long-term conviction in AI’s transformative potential may make this a great time to consider Nvidia at a lower price.

You may also like to read: A Bullish Nasdaq Prediction 2025 Based On The 20-Year Nasdaq Chart

Premium Stock Market Investing Newsletter

Looking to uncover winning opportunities before the market does? Subscribe to our premium stock market investing newsletter for proprietary research, momentum investing strategies, and expert stock trend analysis.

Sign up now to gain the tools and insights needed to stay ahead of market trends. Let us help you build lasting wealth with data-driven strategies and actionable recommendations.

Nvidia’s stock decline reflects high-growth sector volatility, but its AI dominance remains intact. For informed investors, this could be an ideal time to take a closer look at this market leader’s long-term potential.