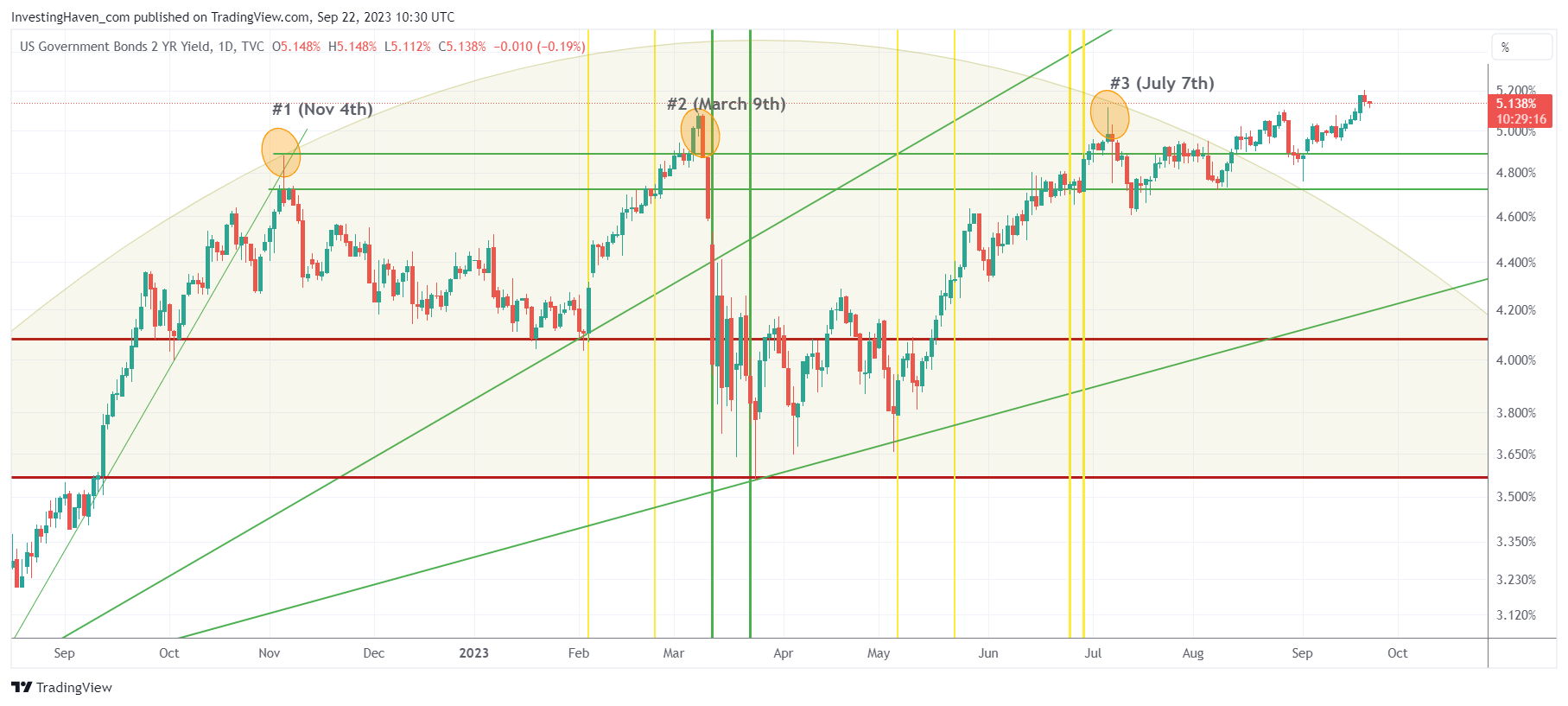

One question, top of mind of many investors, is whether rates will continue to rise to the point where they will break markets. While nobody can never be 100% about the occurrence of a stock market crash, we believe it is the lowest probability outcome to expect that markets will break because of a continued rise in rates. We believe that the upside potential is limited, particularly in 2-Year Yields.

There are several reasons why we believe that rates have limited upside potential from here. We don’t expect rates to break markets, on the contrary.

What we do expect, though, is that ‘higher for longer’, as per the Fed’s guidance, is going to cap broad based momentum. This implies, as said many times, that being selective is going to be crucial for success. Given the epic rotational dynamics that are dominant since 2022, sector rotation is also the name of the game.

In plain simple terms for the average investor: pick value + be patient.

We already covered this topic with TLT ETF when we wrote The Single Most Important Chart For The Month Of September 2023. While TNX moved higher, TLT is now thoroughly testing its harmonic price/time combination.

No market crash is visible on our timeline and cycle readings, certainly not in 2023, on the contrary.

Moreover, rising 2-Year Treasury (negatively correlated to Yields) seems to be an overcrowded trade as evidenced by the following statistic (courtesy of Bespoke Invest):

Traders are Short the Two-Year. Speculator positioning on the 2-Year Treasury as measured by the weekly Commitments of Traders Report (COT) hit its most net short level in the history of the series dating back to 1990 in the release as of 9/8/23. That means that futures traders are betting the yield on the 2-year will continue to go higher even after it has risen from 0.22% up to just under 5% in the last two years. (Source: CFTC)

What we do know, from history, is that the consensus trade mostly does not work out.

Fundamentally, the drivers for higher rates are macro-economic conditions. Consider the following:

- Inflation keeps on moderating. Invalidation? Crude oil & natgas explode in price (unlikely), and double from here.

- The U.S. economy remains strong. Invalidation? High mortgage rates will crash the housing market, not likely to happen even though the housing market is going through a recession.

- Consumers continue to spend. Invalidation? Consumers are hit by a credit crunch, and stop spending which is the lower probability outcome.

Never say “never.”

Inflation might continue to rise, the Fed might go in overdrive even though they clearly said they tend to lower the FFR in the latter part of 2024, they might overrule themselves.

From our perspective, being laser focused on the chart, this is what we see:

- The inability of 2-Year Yields to truly break out, and move above their March 9th and July 7th highs.

- The recent touch of 5.2% was somehow to be expected. Why? Because 2-Year Yields represent the FFR in one year from now. This is how the FOMC guided last week: “The 2024 forecast was raised to 5.1% from 4.6%.” Obviously, 2-Year Yields must temporarily move to 5.1%, stay there for a little while, to reflect the future situation.

While yields may continue to move higher, we believe it will not get out of hand which is the overarching sentiment currently.

In sum, will rates continue to move higher and break markets? We don’t see that happening, certainly not in 2023 which is how far our current cycle & chart readings go.