Agricultural Stocks are set up for a major breakout in 2018 as indicated by the performance of the S&P Agricultural Index GKX. We have written previously about the performance of the sector and maintained a positive outlook for Agricultural stocks in general:

Are Potash Stocks Back In Vogue? Potash Corp Still A Darling?

Agriculture Stocks: Buy In 2018 Or Avoid?

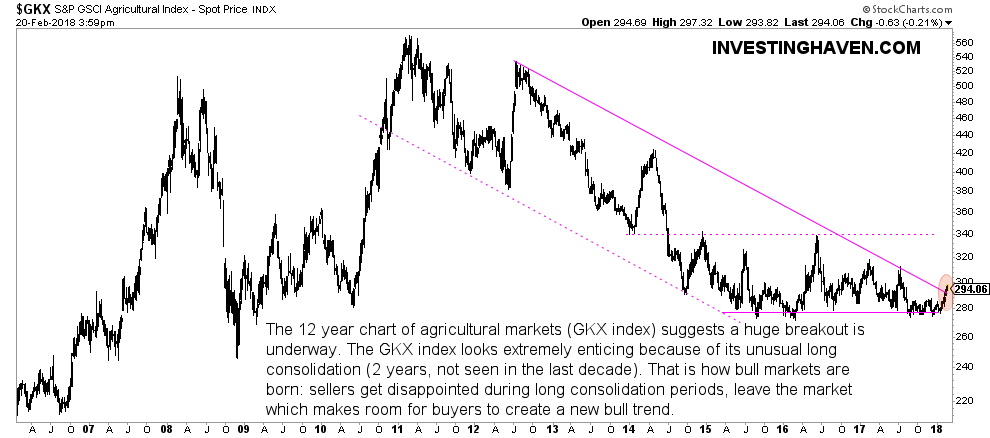

As seen on the chart below, the GKX index and the sector in general tested investors nerves. The long consolidation that lasted 2 years will definitely lead to a major move and we believe it will be a huge Breakout. As you probably know, the longer the consolidation is, the stronger the move is going to be. And that’s what the next move will probably look like.

The chart below, covering a period of 11 years, shows what could be the beginning of an impressive Bull Market in Agricultural Stocks.

3 reasons why the Agricultural’s long term chart looks bullish

We derive the following bullish observations from the chart:

- The Agricultural Index is breaking out of the long term bear market shown by the descending channel. The Breakout is happening as we write this article and annotated with the purple circle at the right.

- The Agricultural Index built a Mega support in the 280 area as it has a bottom formation of almost 3 years which is not a pattern you will find in many charts.

- The bottoms of 2015 and 2016 didn’t fall as low as the 2009 low.

The easiest way to get exposure to this sector is through a liquid high volume ETF that could be selected here.