The NASDAQ keeps on rising. Bellwether stocks like Apple and Amazon continue to set new all-time highs in the last few weeks, almost non stop. Meantime, however, it is very quiet on emerging markets. From time to time we find a bullish emerging markets forecast like this bullish emerging markets view on CNBC or this one on NASDAQ.com. But, in general, there is not much fuzz about emerging markets.

We emphasized several times recently that we see decent opportunities in India and China, but also South Korea and Taiwan.

Especially in China, we see the Chinese stock market acting bullish as it is in a long term silent uptrend.

We expect technology stocks in China to perform very well.

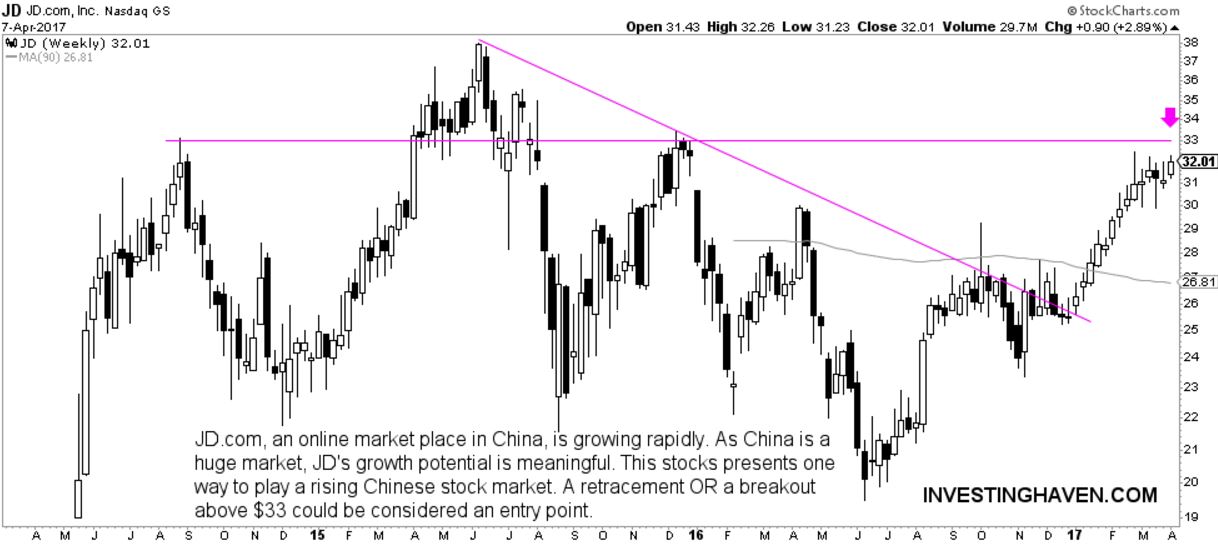

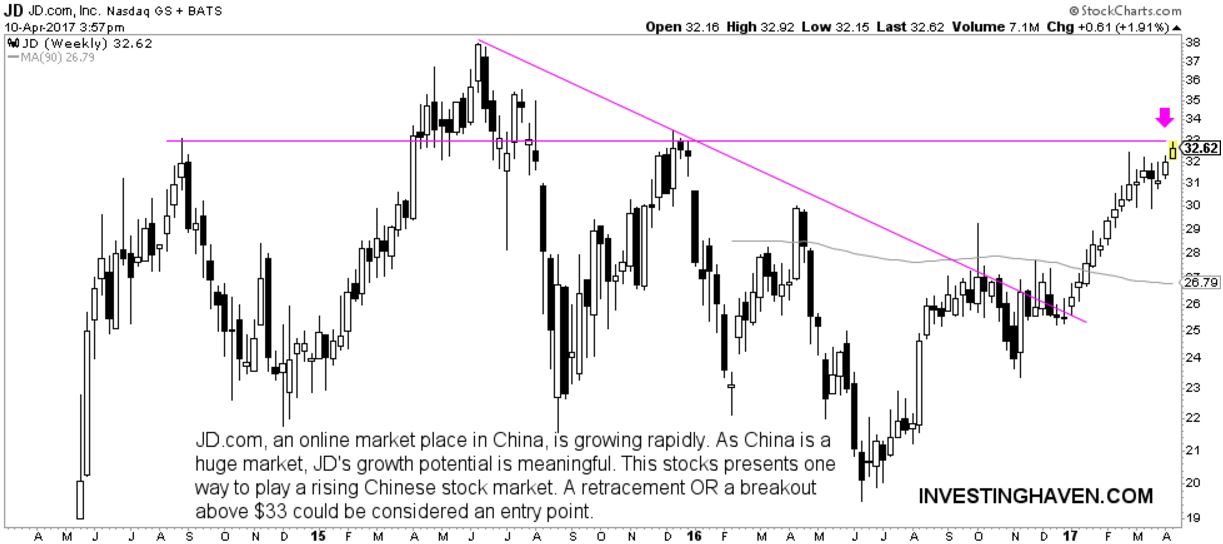

One such stock is JD.com, a giant internet company with a market cap of $45B. Visibly, there is lots of interest in this stock which is undergoing a fourth attempt to break out of $33. Two times were unsuccessful, one was a false breakout. What will this time bring?

Financials of the company look great from a growth perspective, with a 30% rise in revenue over the last quarter. Profits have come down, but that is acceptable as long as the revenue keeps on growing and profits are ‘contained’. There is lots of cash on the balance of JD.com and the forward P/E looks promising for such a fast grower.

Chinese technology stock JD.com has a great chart setup. Recent growth figures combined with a rising Chinese stock market are a recipe for success, so we see a breakout coming in this stock.