[UPDATE ON 22 AUGUST 2018: At the bottom of this article we add an update of this stock as well as a new chart on 22 August 2018. It really shows that Rapid7 is still a strong buy, and our price target of 42 USD wil be met easily, if not crushed!]

The cloud sector is in an amazing shape. Although many cloud stock have risen dramatically, some are lagging and only recently starting to rise. We have found one specific cloud stocks, still a mid-cap, with very strong results and an amazing outlook. It has always focused on analytics, but is now taking this one step further with machine learning as a first step towards artificial intelligence. Its fundamentals are great, its financials are very solid, its market continues to grow considerably, all you need for a good investment.

The company we are talking about is Rapid7. It provides security services, cloud based. Not only is it solving a big problem with basic security services, also did it focus much more on analytics in order to pro-actively signal security holes in the system landscape of a company. It started taking this service to the next level, last year, with machine learning and artificial intelligence.

These security services in the cloud, aka SecOps (security operations) are not only protecting companies, but also is it saving headcount because the service is a managed service. So Rapid7 solves two problems concurrently. See the solutions https://www.rapid7.com/solutions/

The following data pieces stand out after investigation of the company’s financials (based on data from the investor deck as well as financial results):

- Revenue: year on year growth of 30%

- Recurring revenue over 30% and growing customer base, a growing average revenue per customer, a great recipe to future success

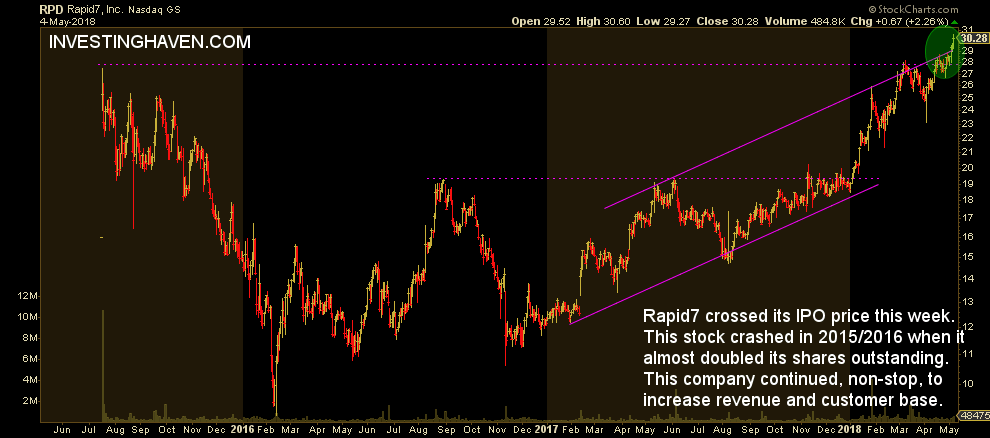

- Shares outstanding: from 24M in 2015 to 41M in 2016 which likely contributed to the collapse after the IPO in the summer of 2015

- Losses accumulated until last year after which an improvement started, clear path of the company to improve losses

What makes us so excited? The product/market combination, the value proposition and the problems this company solves, the growing need for security as a market trend and the financials. That is all you need.

Moreover, from a chart perspective, the company broke out from an 18 month basing pattern when it crossed $20 in January of this year. Admittedly, it has already risen 50 pct this year, which is a big rise, but still we like their story because it is now crossing past its post-IPO peak of $27 (it topped at $27.45 the day of its IPO). As mostly happens, buying the IPO is not a great idea, but only buy after the company is recovering post-IPO-correction.

Our price target is $42 for the end of this year. How did we derive this? Based on the price-to-sales ratio, our favorite ratio to forecast fast growing technology stocks, of 7.5x for the second half of 2018. We assume that the company’s 2018 revenue will be $265M, less than 10 pct higher than expected, and with a small increase of their outstanding shares to 46M, we calculate a price target of $43. That is a 40 percent increase against Friday’s closing price!

Its market cap is currently $1.3B. If our price target of $43 materializes, at 46M shares, Rapid7 will have a market cap of $1.9B, on the verge of a large cap stock, certainly realistic in the next 12 months.

Note, Rapid7 will publish quarterly results after market close on Tuesday May 8th. If the company comes with deceptive results this stock will plunge. That’s why you should not trade this stock, overall, somewhere over the course of the next 12 months from now, it will do very well, regardless of short term volatility. Be prepared for a serious jump higher or flash-crash lower on Wed May 9th.

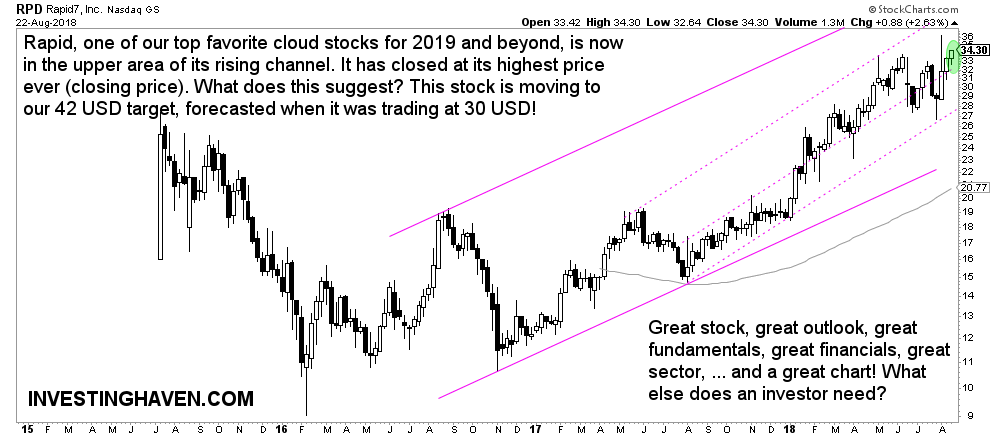

UPDATE ON 22 AUGUST 2018: At the bottom of this article we add an update of this stock as well as a new chart on 22 August 2018. It really shows that Rapid7 is still a strong buy, and our price target of 42 USD wil be met easily, if not crushed!

Rapid7 published quarterly results on August 6h 2018. The results were great, really. They were also fully in line with our expectations when we wrote back in May the above article with our 42 USD forecast.

This is a very important quote from the earnings call:

With our new bookings generating more recurring revenue, we saw strong growth in ARR per customer, increasing 31% year-over-year to over $27,000 per customer. This increase is being driven by higher quality, new customer addition, as well as ongoing growth in both upsells and cross-sells. This has resulted in a higher mix shift of subscription bookings, away from services, further increasing our confidence in our mid- and long-term outlook.

Moreover, during earnings, they clearly announced that their outlook for next quarters will be better than expected, especially when it comes to the ARR per customer! That’s the improved outlook that we see on the chart now!

In sum, we expect, even from this point on, to see another 40% increase in Rapid7’s price. So we raise our target to 50 USD. It is not too late to buy, on the contrary.

The chart is gorgeous. Note how Rapid7 has closed today at its highest closing price ever. It also is now in the upper part of its rising channel, after it spend some time in the lower channel last month.

What does all this suggest? Higher prices are coming, our 42 USD will get crushed, we are looking at a 50 USD price target!