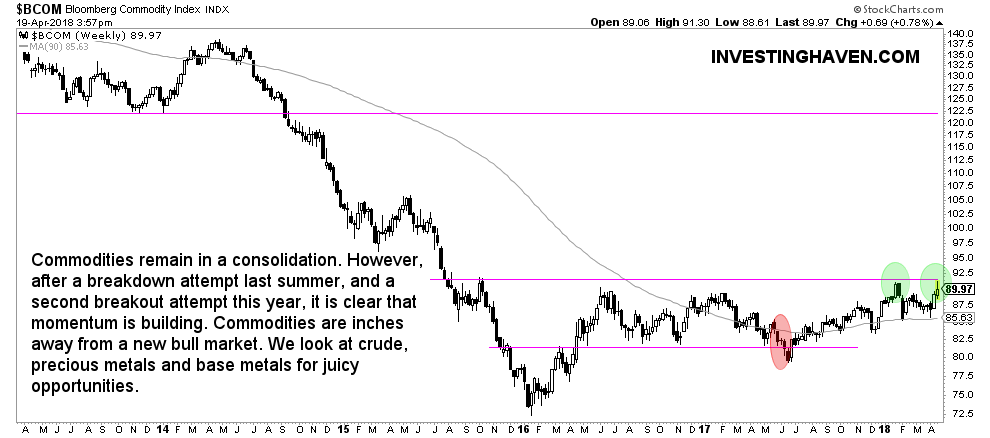

A strong breakout is brewing in commodities. There is even more: commodities are inches away from a new and strong bull market to start in 2018. This is why, and what investors should watch.

Commodities may be strong right now, they were extremely weak last summer when we wrote Commodities Facing Huge Breakdown Risk. This is a quote from that article “The most up-to-date commodities chart simply confirms the viewpoint from 3 months ago. Worse, commodities are breaking down now, on their weekly chart (5 years), which is certainly a significant event.”

Interestingly, it was a false breakdown. We clearly indicated which levels to watch, and commodities eventually did not go lower from there. As we saw this happening, we did interpret it as a consolidation trend when we wrote early this year Top 3 Commodities To Watch In Spring 2018 particularly crude oil, gold and silver, agriculture. All of them did amazingly well since then.

Commodities as an asset class are now on the verge of a secular breakout. In other words, as soon as commodities go slightly higher they would be in a new bull market starting in 2018.

We are quite sure this there is a fair chance the new bull market of 2018 in commodities is about to start anytime soon. Why? Because several commodities like crude oil as well as gold and silver are breaking out. So momentum is bullish in the commodities space.

Moreover, treasury yields are on the rise favoring inflation and, consequently, higher commodity prices.

We also see sector rotation in stock markets: XLE ETF as well as XLB ETF see inflows of money. Fresh capital is flowing into commodities stocks.

All in all, we see sufficient indicators flashing green for commodities. That is also why InvestingHaven’s Top 12 Stocks For Q2 2018 features several commodities stocks.